View/Open - AgEcon Search PDF

Preview View/Open - AgEcon Search

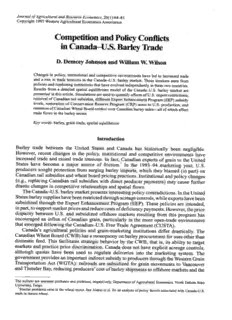

The World’s Largest Open Access Agricultural & Applied Economics Digital Library This document is discoverable and free to researchers across the globe due to the work of AgEcon Search. Help ensure our sustainability. Give to AgE con Search AgEcon Search http://ageconsearch.umn.edu [email protected] Papers downloaded from AgEcon Search may be used for non-commercial purposes and personal study only. No other use, including posting to another Internet site, is permitted without permission from the copyright owner (not AgEcon Search), or as allowed under the provisions of Fair Use, U.S. Copyright Act, Title 17 U.S.C. Journalo fAgricultural and Resource Economics, 20(1):64-81 Copyright 1995 Western Agricultural Economics Association Competition and Policy Conflicts in Canada-U.S. Barley Trade D. Demcey Johnson and William W. Wilson Changes in policy, institutional and competitive environments have led to increased trade and a rise in trade tensions in the Canada-U.S. barley market. These tensions stem from policies and marketing institutions that have evolved independently in these two countries. Results from a detailed spatial equilibrium model of the Canada-U.S. barley market are presented in this article. Simulations are used to quantify effects of U.S. import restrictions; removal of Canadian rail subsidies, different Export Enhancement Program (EEP) subsidy levels, restoration of Conservation Reserve Program (CRP) acres to U.S. production, and retention of Canadian Wheat Board control over Canadian barley sales-all of which affect trade flows in the barley sector. Key words: barley, grain trade, spatial eqiulibrium Introduction Barley trade between the United States and Canada has historically been negligible. However, recent changes in the policy, institutional and competitive environments have increased trade and raised trade tensions. In fact, Canadian exports of grain to the United States have become a major source of friction.' In the 1993-94 marketing year, U.S. producers sought protection from surging barley imports, which they blamed (in part) on Canadian rail subsidies and wheat board pricing practices. Institutional and policy changes (e.g., replacing Canadian rail subsidies with direct producer payments) may cause further drastic changes in competitive relationships and spatial flows. The Canada-U.S. barley market presents interesting policy contradictions. In the United States barley supplies have been restricted through acreage controls, while exports have been subsidized through the Export Enhancement Program (EEP). These policies are intended, in part, to support market prices and reduce costs of deficiency payments. However, the price disparity between U.S. and subsidized offshore markets resulting from this program has encouraged an influx of Canadian grain, particularly in the more open-trade environment that emerged following the Canadian-U.S. Free Trade Agreement (CUSTA). Canada's agricultural policies and grain-marketing institutions differ drastically. The Canadian Wheat Board (CWB) has a monopsony on barley procurement for uses other than domestic feed. This facilitates strategic behavior by the CWB, that is, its ability to target markets and practice price discrimination. Canada does not have explicit acreage controls, although quotas have been used to regulate deliveries into the marketing system. The government provides an important indirect subsidy to producers through the Western Grain Transportation Act (WGTA): railroads are subsidized for grain movements to Vancouver and Thunder Bay, reducing producers' cost of barley shipments to offshore markets and the The authors are assistant professor and professor, respectively, Department of Agricultural Economics, North Dakota State University, Fargo. Similar problems exist in the wheat sector. See Alston et al. for an analysis of policy factors associated with Canada-U.S. trade in durum wheat. Johnson and Wilson Competition and Policy Conflicts in Canada-U.S. Barley Trade 65 eastern United States. Under terms of the CUSTA, WGTA subsidies do not apply to shipments to western states. Grain handling costs are high relative to those in the United States, creating incentives to circumvent Canadian elevators through cross-border truck shipments to U.S. elevators for shipment beyond.2 Opportunities for North American barley trade have inspired much debate in Canada (Carter 1993b; Gray, Ulrich, and Schmitz; Brooks; Veeman). Alberta Agriculture (Alberta) first proposed liberalized barley trade in North America, citing the cost-price squeeze for prairie producers and the need to seek new market outlets. A major liberalization of barley marketing in Canada was implemented in August 1993. The move toward a "Continental Barley Market" allowed Canadian producers or traders to sell directly to U.S. buyers, bypassing the CWB, which retained control over offshore sales. This was reversed through a September 1993 court decision. The purpose of this article is to analyze effects of selected trade and marketing policies on barley and malt trade flows, prices and price differentials, and economic welfare. There are important policy tradeoffs for the United States, such as whether the United States should pursue a policy of increasing exports through EEP, or a policy of protecting its domestic market. Canada confronts equally difficult issues, including whether to remove the CWB's monopoly over U.S. sales. In addressing effects of policy changes, numerous complexities have to be recognized. First, the Canada-U.S. barley market comprises many distinct regional markets. Prices are connected spatially through transport and handling costs, but also reflect impacts of trade policies (i.e., U.S. tariffs and export subsidies, and Canadian export permits). Second, quality factors are an important determinant of regional flows, especially for malting barley. Third, published data on feed barley demand at the state or province level do not exist. Feed demand ultimately depends on the size and composition of livestock herds and on prices of substitute feedstuffs, which vary drastically by region. Our results are based on a detailed, spatial equilibrium model of the North American barley market. Several policy simulations are reported. The base case corresponds to a freer trade regime in Canada. Other simulations show effects of U.S. import restrictions, removal of Canadian rail subsidies, different EEP subsidy levels, restoration of the Conservation Reserve Program (CRP) acres to U.S. barley production, and retention of CWB control over Canadian barley sales. The next section provides a brief review of related studies. The spatial model is described in the third section. Simulation results are presented in the fourth section, and the article concludes with a discussion of policy implications. Related Studies Recent studies have reached sharply different conclusions about whether the CWB has been underselling barley (in volume) into the U.S. market, and whether the board should retain a monopoly over Canadian exports.4Magnusson and Lerohl suggested that Alberta could sell 1-1.4 mil. MT of barley into the northwestern region of the United States. Agriculture Canada reaffirmed that the CWB should remain as the sole exporter of barley to offshore 2See Johnson and Wilson for a detailed explanation of these mechanisms and effects. 3See Johnson and Wilson for a discussion of the institutional differences affecting barley quality in these two countries. 4Several articles are devoted to this topic in the November 1993 issue of the CanadianJ ournal of AgriculturalE conomics. Veeman provides a useful summary. 66 July 1995 Journal ofAgricultural and Resource Economics markets, but recommended that an intensive analysis be undertaken on alternative marketing arrangements for North American trade. The CWB argued that liberalized trade (i.e., the proposed Continental Barley Market) would result in: (a) increased exports to the United States and a lower U.S. barley price; (b) reduced returns in offshore markets; (c) a loss in malting barley premiums; (d) possible U.S. retaliation; and (e) transhipment of Canadian barley through the U.S. marketing system. There have been two comprehensive analyses of the Canada-U.S. barley market. Carter (1993a) concluded that the CWB does not exert market power in either the United States or the world market, and that there are significant opportunities for expanded sales of Canadian barley to the United States. He suggested that an additional 500,000 MT of feed barley and 400,000 MT of malting barley could be sold to the United States. Producer revenues from barley could increase by up to 17% under a liberalized marketing system, with no restrictions on trade flows within North America. These results were based on Agriculture Canada's Canadian Regional Agricultural Model (CRAM). Schmitz, Gray, and Ulrich used a trade model for feed barley comprising four markets: Canada, the United States, Japan, and other importers (EEP recipients). Demand elasticities, evaluated at representative trade volumes, were - 0.7, -1.3, - 0.2, and -1.2, respectively. Critical assumptions were made on intermarket price spreads. In particular, the U.S.-Canada price spread was specified as a linear function of bilateral trade volume, while the spread between Japan and other importers was set equal to the U.S. EEP subsidy. Results indicated that a continental barley market would lead to a modest increase in equilibrium trade flow (from 620,000 MT to 740,000 MT), but a net reduction in Canadian producer welfare due to the elimination of premiums for sales to Canadian maltsters. The approaches used in these studies have several limitations, all of which are improved upon in our analysis. First, neither Carter nor Schmitz, Gray, and Ulrich explicitly modeled regional demands for feed barley, as distinct from feed grain use. Second, they did not incorporate details on regional malt plant capacity or characteristics of malting barley supply and demand (by region). Third, a very important component of trade is the transportation and logistical channels linking barley producing regions to malt plants and malt plants to breweries. These features are incorporated in our spatial equilibrium model, which forces all barley to be allocated among competing demands. Empirical Procedures A mathematical programming model was developed to explain barley trade flows and price relationships. Components of the model are described first, followed by a section presenting mathematical specifications and data sources. Overview of the SpatialE quilibrium Model The United States ad Canada are divided into different producing and consuming regions; there are also several export markets for barley and malt. The objective is to maximize the sum of producer and consumer surplus in feed barley markets less the cost of satisfying fixed regional demands for malt. This formulation treats malt demand as perfectly inelastic, while allowing feed barley prices and quantities fed (by region) to vary. The model is static and determines barley flows within a marketing year with supplies fixed. Available supplies are based on average annual production during 1989-92. Johnson and Wilson Competition and Policy Conflicts in Canada-U.S.B arley Trade 67 The model includes 30 barley supply regions (23 in the United States and seven in Canada). Barley supplies include four distinct types: feed barley (varieties not suitable for malting), six-rowed white malting, six-rowed blue malting, and two-rowed malting. For each producing region, supplies are divided among the four types based on recent production history and quality factors. Quality differences are important because demand requirements vary across brewers, as discussed below. There are 21 feed demand regions (13 in the United States, six in Canada, and two offshore markets). State- and province-level demand functions were synthesized with an optimization model. Specifically, we used a least-cost feed model developed by Johnson and Varghese, which combines diet formulations for several classes of livestock in a single linear programming problem. Using 1992 livestock inventories as scaling factors, the least-cost feed model was adapted for individual states and provinces. Demand schedules were derived by varying the price of barley incrementally, holding other prices constant, and solving for barley quantity. For the spatial model, demand schedules were linearized by fitting regres- sions to these synthetic data points.5 An important institutional relationship exists in some prairie provinces. In particular, the Province of Alberta has subsidized local barley feeding under the Crow Benefit Offset Program. In Saskatchewan, the Feed Grain Market Adjustment Program is used to offset the competitive disadvantage of Saskatchewan livestock producers vis-a-vis other provinces. In the model simulations, effects of these programs are captured by adjusting the transportation and handling costs for intraprovincial barley flows. Specifically, we reduce the transportation and handling costs by U.S. $7.90/MT. This adjustment encourages feed use within these provinces in the base case. In alternative model simulations, when compensatory rail rates are assumed, we eliminate these local feed subsidies. Data on barley use and trade flows do not exist on a regional basis, making it impossible to compare results with actual observations. For purposes of base-case simulations, the model was calibrated to be consistent with bilateral Canada-U.S. trade flows observed in the 1993-94 marketing year. Specifically, we adjusted the intercepts of Canadian provincial feed demand schedules so that model "predictions" of net cross-border trade matched USDA 6 projections. Demand schedules for offshore markets (EEP and non-EEP) are based on econometric estimates.7 Both countries export from their Pacific ports (i.e., Portland and Vancouver). EEP subsidies ($32/MT in the base case) apply to U.S. export shipments. Canada's export price to the non-EEP market is constrained to be no greater than the Portland price. This mimics strategic pricing by the CWB in its offshore sales. There are 19 malt plant locations in the model (13 in the United States and six in Canada) with different capacity constraints. Vertical integration constraints are imposed at selected locations, reflecting brewer-owned malt plants. Malt demand regions are identified with states or provinces with significant beer production (16 in the United States, six in Canada); there are also two export markets. For each malt demand region, quality requirements 51n the least-cost feed model, barley demand is conditional on prices of substitute feedstuffs (e.g., corn and feed wheat), which vary substantially by region. The least-cost model is formulated as an LP problem, so that the demand for feed barley in each region is derived as a stepwise schedule. This was linearized for inclusion in the spatial model. Implied price elasticities vary with quantity demanded and hence are difficult to summarize. However, results repeated by Johnson and Wilson indicate that barley demand is generally price elastic and sensitive to the price of corn, a close substitute. 6Original feed demand parameters, reported in Johnson and Wilson (p. 41), were derived using market data (prices of substitutes and U.S./Canada exchange rate) from the spring of 1993. Using these parameters, the model projects a much larger volume of Canadian exports to the United States than was actually observed in 1993-94. Accordingly, intercepts forprovincial feed demand were adjusted upward by U.S. $16/MT. Details are in Johnson and Wilson, pp. 42--3. 68 July 1995 Journal of Agricultural and Resource Economics (percentages of six-rowed white, blue, and two-rowed malt) reflect market shares of major brewers with known variety requirements. Transportation and handling costs are based on recent truck and rail rates, and handling margins at U.S. and Canadian elevators. For individual origins and destinations, several alternative movements were identified (e.g., truck, rail, or combination); least-cost move- ments were identified and incorporated in the analysis. In particular, the model allows prairie-border-crossing trade, an alternative to traditional Canadian east-west movements. MathematicalS pecification The model is specified as a quadratic programming problem (Takayama and Judge). The objective is to maximize the sum of producer and consumer surplus in feed barley markets minus the costs of satisfying fixed regional demands for malt. Let Xik denote a shipment ('000 MT) from producing region i to feed demand regionj. The index k denotes barley type. There are four types of barley: feed, six-rowed white malting, six-rowed blue malting, and two-rowed malting. The four types are perfect substitutes in feed demand; however, only malting types are shipped to malt plants. For notational convenience, we use the index h to refer to the subset of malting types. Shipments from producing regions to malt plants ('000 MT) are denoted Ymh, where m identifies the malt plant location. Shipments of malt ('000 MT) to beer production regions are denoted Zmnh, where n identifies the malt destination and h the malt type. The objective function is defined as: QJ W=JE (I - P Qf)dQj -ZZZXijkTx (1) i o i j k - ZZ YimhTYim E Z mnh Tmn, i m h m n h where Qj is total barley feed use in regionj; (2) Q = Z XX k Vi; i k aj and pj are regional feed demand parameters; and Txi, Tyim, and Tzmn are transportation cost parameters ($/MT). The latter include freight costs and handling margins, as well as applicable import tariffs and export subsidies. Because barley supplies are fixed, total producer and consumer surplus is represented by the area under regional demand schedules less transportation costs. The objective function (1) is maximized subject to constraints on regional feed use, barley supplies, malt plant capacities, brewer ownership of selected malt plants, and malt requirements in beer production regions. Regional barley feed use, Q,, is constrained to be less than estimated total consumption of feed grains: (3) Qj <Q j . Johnson and Wilson Competition and Policy Conflicts in Canada-U.S. Barley Trade 69 Maximum feed use parameters were taken from Carter (1 993a, pp. 51-5), or derived by the authors using 1992 livestock inventories for individual states and provinces. No quantity limits were applied to offshore feed barley markets. Barley prices in feed markets are given by ((44)) P.i. =:a( j. --P~ .,i Qj Van, In general, the North American demand schedules are highly elastic. Evaluated at base-case quantities, demand elasticities in western states range from -3.8 in Montana to -7.4 in Idaho and -17.6 in California (the largest barley feeding state). For comparison, demand elasticities in the prairie provinces average - 4.0 in the base case. Highly elastic demand schedules are consistent with expectations, given the close substitutability of barley for corn and other feed grains in livestock rations. However, these regional elasticities are substantially greater than those used in Schmitz, Gray, and Ulrich. Offshore prices are measured at Pacific ports, Portland and Vancouver. To mimic strategic pricing by the wheat board, offshore prices are constrained as follows: (5) Inon-EEP < PEEP +EEP, where PnonEEp is the price in non-EEP markets ($/MT), PEE is the price in EEP markets ($/MT), and EEP is the U.S. export bonus ($/MT). This discourages U.S. exports to non-EEP markets. For each barley producing region, supply constraints are specified as follows: (6) X4i/,feed < Ai.fed Vi ./ and (7) ZXijh + Yil < Ail Edi, h, .I itn where A, fid denotes availability of feed-quality barley ('000 MT); and Ah denotes avail- ability of malting-quality barley (type h) in region i. The latter constraint reflects the alternative destinations for malting-quality barley, that is, feed markets (indexed byj) and malt plants (indexed by m). Material-balance and capacity constraints apply to all malt plants. These have the form: (8) 0.75a Yh > Z,,,,,h Vm, h, i n and 8Carter (1 993a, p. 59) estimated the price elasticity of U.S. demand (aggregated across barley types and regions) for Canadian barley at -19. 70 July 1995 Journalo fAgricultural and Resource Economics (9) EE2 EZ Yimi/h ,<(cid:143)CC,m VVm, , i hI where 0.75 is a barley-malt conversion factor, and Cm is the plant capacity ('000 MT barley/annum). Additional restrictions apply to selected brewer-owned malt plants; by assumption, these plants operate at full capacity and supply malt exclusively to breweries owned by the same parent (i.e., Anheuser-Busch or Coors). For beer production regions (indexed by n), total malt requirements (TMR) are specified. These are based on 1991 beer production by region and different conversion factors for U.S. and Canadian breweries: (10) - Zmh2 TMR Vn. m h For U.S. beer production, the conversion rate is 24 Ibs. of malt per barrel; for Canadian production, the rate is 36 Ibs. per barrel. Minimum and maximum allowable percentages are also specified for each malt type, as follows: Zmnh MINPC,,, m MAXP ( 11) MNC,,^ < MAXPC,Ih Vn, h. 100 ZZZ,,,,,h 100 m h The allowable percentages, MINPCh,a nd MAXPC,,h, are based on known requirements of major brewers, weighted by company shares of regional production capacity. U.S. and Canadian exports of malting barley and malt to third markets (offshore and Mexico) are fixed exogenously. The model does not include producer prices per se; producer prices can be computed as a weighted average of the shadow prices associated with supply constraints in barley producing regions. Similarly, there are no malt prices in the model other than the shadow prices associated with demand constraints at different points in the marketing system. These reflect the opportunity cost of malting barley (i.e., in terms of its alternative feed use) in addition to transportation and handling costs. The solution satisfies the usual assumptions of spatial equilibrium, no excess demand in consuming regions and absence of profitable arbitrage opportunities. However, the United States discriminates between offshore markets through its use of EEP subsidies, while the constraint on price spreads allows Canada to dominate the nonsubsidized offshore market. Data Sources Production data used in this study were derived from several sources. Data on U.S. area planted, harvested, and yields were taken from the U.S. Department of Agriculture, National Agricultural Statistics Service (USDA/NASS). For Canada, the same data were from Agriculture Canada sources. Data on barley quality were developed from Know Your Barley Varieties (American Malting Barley Association) and Barley Briefs (Brewing and Malting Barley Research Institute) for the United States and Canada, respectively. Grade factor data in the United States were from state-level quality reports, and Canadian acceptance rates are from Carter (1993a, p. 10). Johnson and Wilson Competition and Policy Conflicts in Canada-U.S.B arley Trade 71 Data for the United States brewing industry are from Brewers Almanac 1992, published by the Beer Institute and Brewer s Digest. 1991 Buyers Guide and Brewery Directory. Data for Canada are from the 1992 statistical bulletin of the Brewers Association of Canada, Ottawa (Brewers). U.S. beer production capacities at the state level were derived from the Brewers Almanac and company sources. U.S. and Canadian malt plant locations, ownership, and capacities are those listed in the Canadian Wheat Board report and were valid in 1992. Exports of malting barley and malt to third countries were taken from Canadian Wheat Board sources and were set equal to the five-year average ending 1991. Transport and handling costs are from a number of sources. U.S. rail rates were taken from Burlington Northern and CP/Soo Line Tariffs. Missing rail rates were estimated using data in the 1991 Waybill Data Tape (Interstate Commerce Commission). Canadian rates were taken from Canadian Pacific (CP) and Canadian National (CN) Rail Tariffs. Trucking costs and formulas and handling costs were from industry sources in each country. Simulation Results Base-Case: ContinentalB arley Market Our base-case assumptions reflect a freer marketing regime in Canada. Specifically, we assume the following: (a) quantitative restrictions do not apply to cross-border flows of barley or malt; (b) Canada does not regulate imports through the granting of permits; (c) current U.S. tariffs apply to imports of barley and malt from Canada; (d) Canadian rail rates reflect current WGTA subsidies; and (e) cross-border truck/rail shipments are allowed to U.S. barley destinations. These assumptions deviate from past marketing practices. Most important, perhaps, is that barley is allowed to move directly across the border by truck, bypassing the Canadian handling sector (but still incurring U.S. handling costs), if that is optimal. The model projects 1.4 mil. MT of Canadian barley exports to the United States, including 0.9 mil. MT of feed barley, in the base case (table 1). This is approximately the trade level observed in 1993-94. U.S. domestic feed use (5.4 mil. MT)9and Canadian feed use (5.5 mil. MT) are similar to levels observed in recent years. Canada also exports about 0.5 mil. MT of malting barley to the United States. Two-row malting barley accounts for over 90% of these malting barley exports. Average producer prices are higher in the United States than in Canada. U.S. producer prices are $1.82/bushel (averaged over all U.S. producing regions and barley types), while Canadian producer prices are $1.61/bushel. Among other factors, this difference reflects the proximity of U.S. producing regions to high-priced feed markets and malting capacity. Results confirm the importance of West Coast feed markets. California and Nevada represent the highest-priced feed barley markets due to transportation costs and expensive feed substitutes. U.S. prices are lowest in midwestern barley-producing states. Prices in the prairie provinces are the lowest of all regions. These results are consistent with recent observations. California represents the largest U.S. feed demand region, with barley feed use of 1.8 mil. MT (fig. 1). The northwestern states (Oregon, Washington, and Idaho) account for an 9This is close to the actual level of U.S. barley feed use in 1993-94. For perspective, in recent years barley has accounted for no more than 3-4% of total U.S. feed use of coarse grains. 72 July 1995 Journal of Agriculturala nd Resource Economics Table 1. Base-Case Simulation Results: Trade, Domestic Use, and Prices United States Canada Bilateral Trade Flows (TMT) Exports Feed barley 0 883 Malting barley 97 504 Malt 0 188 Net Bilateral Trade (exports -imports) Feed barley -883 883 Malting barley -407 407 Malt -188 188 Offshore Feed Exports Subsidized markets 1,903 0 Nonsubsidized markets 0 2,695 Domestic Use (thsd. MT) Feed use 5,356 5,539 Malting use 2,759 871 Average Producer Price (US $/MT) 83.46 73.81 Feed Market Non-EEP Offshore 1I IMg ;~~~~~~II'~~~~~~~~~~~~~ BritiEsEhP CM oMQaOlunaunmriettkbaobeerbtiicaosa, IBs(cid:3)88(cid:3)88PS8(cid:3)888(cid:3) III HBIBBBBBBBI'IIIII1IIIIIIIIII B BBB-B (I(III Alberta (cid:3)ess(cid:3)ss(cid:3)8ss(cid:3)8sss(cid:3) (cid:3)88(cid:3)88881 SasWkaaCWSCstMac.hAyoNO lhoDoiilrernfnoeIiamoevdzgwtrUkgaraoaaitontannodohdnatngianaaonhoaa...... 1(cid:3)8MB(cid:3)BIIRB8 (cid:3)s(cid:3)8rBa8mlWs 8Bsa8aBu8aWusB8au81su8aBBa8uBa8 IBIIIIIIIIIII,IIIIIB 8(cid:3) B 888(cid:3)B8888(cid:3)t888B888 8(cid:3)tBl(cid:3)BtI(III,III,IIIIIi,BIIII(cid:3)B(cid:3) IIIIIIIIIIII rIrIrIIIIIIIIIIIIIIIIIIIIIIrIIrIII IIIIIII1IIIIII1IIIIIIIIIIIIIIIIIIIIIIIII Minnesota II N. Dakota W-WI- I-BBBBW-W-I BB-IB BBBBIB, - I~~~-i~-~~~~~~~~~~~~~i.~-~~~~~ 0 500 1000 1500 2000 2500 3000 3500 Thousand Metric Tons Figure 1. Feed barley quantity sold by market, base-case solution

Description: