Trend Following Mindset PDF

Preview Trend Following Mindset

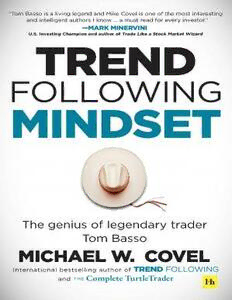

Trend Following Mindset The Genius of Legendary Trader Tom Basso Michael W. Covel Contents Living with “Mr. Serenity”— Foreword by Brenda Russell-Basso Preface Part 1: Interviews Enjoy the Ride Episode 10: April 25, 2012 Q&A with Mr. Serenity Episode 83: November 28, 2012 Brain Teasers Episode 200: January 10, 2014 Travel, Politics and Catastrophic Events Episode 306: January 1, 2015 Tools That Make or Break Us Episode 700: October 8, 2018 Part 2: Collected Research and Publications Adding Low Sharpe Ratio Investments Can Increase Your Sharpe Ratio Background on the study Results of the study Using the research Algorithmic Trading Is Getting a Bad Rap Currency Investing—Increasing Net Worth While Protecting Net Wealth Net Worth versus Net Wealth Currency values—the score of the game we’re all playing Good Trading Is Not Rocket Science Some Leverage Is Good, Too Much Is Dangerous Purpose of the study Defining leverage Leverage varies by markets Good use of leverage Leverage varies with strategy Where leverage becomes dangerous Study of Time Spent in Trending and Sideways Markets Purpose of the study Markets move up, down and sideways How to measure the trend of a market The theory of timing in an up stock market Timing a down stock market Timing a sideways stock market Time spent in up, down and sideways markets Study of market direction 10 Rules to Consider When Investing Your Money The ETR Comfort Ratio Issues with measuring return-to-risk using these approaches A better way to calculate return-to-risk: the ETR Comfort Ratio A simple example: T-Bills Another example: S&P 500 Index How do you calculate the ETR Comfort Ratio? Spreadsheet example Conclusions and suggestions The Value Added of Asset Allocation Combined with Rebalancing Background on the study Results of the study What does this show us? Thoughts on Good Investing Psychology in the Midst of Turmoil Time Stocks Spent in Up, Down and Sideways Markets (2018 Update) Purpose of the study How the study was done Exponential moving averages Conclusions Timing the Market Revisited Constructing a reasonable study of timing What is the potential objective of perfect timing? Performance of a simple timing strategy More results of the study They were the best of days, the worst of days … Annual returns Sorting the monthly returns The real reason that timing helps the investor Math used in creating an exponential moving average (EMA) Risk Control System New position risk Ongoing risk exposure Measuring Futures Volatility Daily volatility The Logic of Trend Following and How to Improve Your Trader Psychology with Market Wizard Tom Basso Interview with Tom Basso by Aaron Fifield, July 22, 2015 About the Author About Tom Basso Bibliography Appendix: Trend Following Podcast—Selected Interviews with Michael Covel Publishing details Also by Michael W. Covel Trend Following: How to Make a Fortune in Bull, Bear, and Black Swan Markets The Complete TurtleTrader: How 23 Novice Investors Became Overnight Millionaires The Little Book of Trading: Trend Following Strategy for Big Winnings Trend Commandments: Trading for Exceptional Returns Living with “Mr. Serenity”— Foreword by Brenda Russell- Basso I��� Tom one week after he had retired, when we both attended a two-step dance lesson in Scottsdale, AZ. This was not in some upscale venue; it was in a cowboy dive bar. Upon leaving, I noticed that Tom drove a rather unremarkable SUV, which he later described as a utilitarian, 12-year-old vehicle. After seeing each other intermittently over a few months of lessons, the two of us had more conversations. I soon learned that Tom was avidly putting together, with dedication and energy, a retirement life to include all his many interests. I later realized this dedication and energy was a carry-over from his long career. The interests are many. Besides dancing there is golf, singing, cooking, painting, fishing, landscaping, reading, and wine-making. Such a combination of time use may put a question mark on any type of serenity, but as I got to know Tom, I began to understand. Fast forward to one of Tom’s recent seminars on trading, where I was the moderator. At a break, one of the participants casually asked me what it was like to live with “Mr. Serenity,” that famous moniker bestowed on Tom by Jack Schwager. After a couple of comments, we had drawn a small crowd. Apparently, this topic is of more interest than I would have thought. If you read interviews with Tom and study his methodology and long success in trading, you would probably accurately think, “I don’t want to be in that head.” Retirement could be hectic and stressful, trying to conscientiously include all the elements. Delving further, though, you would understand that he applies that same focused but non-stressed attitude in retirement that he applied in his work life. He constructs his “movie of life” to suit himself, and each interest is compartmentalized and enjoyed in a relaxed fashion. There is, however, evidence of his analytical, engineer mind that he applied so meticulously to designing trading strategies with detailed execution. When Tom was 12, he bought a book on hypnotizing oneself to sleep. I am a witness: he can put himself to sleep in about six seconds. Once when working on his golf swing, he remarked, “I think I need to get 30% more weight on my left side.” And when people ask about the kind of dog we have, our chill rescue Banjo, Tom answers every time: “25% miniature poodle, 25% miniature schnauzer, and 50% terrier mix with probably a lot of wheaten due to his color.” (Mixed breed, rescue might suffice.) A recipe he invents has a pinch of this, a dash of that, and some varied and unexpected components that usually result in a tasty concoction most could not imagine. (I am the lucky sampler.) He is a compendium of information on 70s rock and roll, and can recognize most hits and the artists in the first few seconds. (I prefer Beethoven myself.) And imagine my surprise when I found out he had a detailed list of 20 traits he would look for in a possible mate. (Luckily, I somehow hit 19.5 of those. The other half point? I will never be 5’9” tall.) His mind does focus on details. A friend of ours is fond of saying, “Don’t ask Tom what time it is, because he will tell you how to build a watch!” But let’s go back to the serenity topic. I don’t often ask how our portfolios are doing. I handle our real estate investments and don’t cross over into trading. On occasion though, I will say, “Did we make any money today?” A response could be, “No. We lost ____ dollars.” I feel I need to choke and pound my chest, but the news is delivered in a matter-of-fact, non-emotional manner. Likewise, if the answer is that we made a rather large profit, I feel like applauding and perhaps clicking heels. However, again the response from Tom is the same— matter of fact with no discernible reaction. I have learned that he truly lives one of his favorite sayings: “The market will do what the market will do.” The answer to that student’s question is that living with Mr. Serenity is serene indeed in every aspect. I get to see up close how Tom moves through his “to-do lists” with calm purpose. We don’t have volatility in our life together. Basically, we just “enjoy the ride” every day. Brenda Russell-Basso