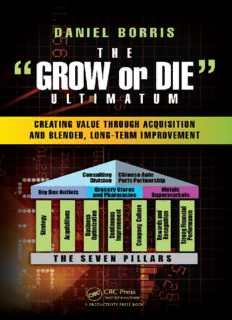

The Grow or Die Ultimatum - Creating Value Through Acquisition and Blended, Long-Term Improvement Formulas PDF

Preview The Grow or Die Ultimatum - Creating Value Through Acquisition and Blended, Long-Term Improvement Formulas

THE “GROW or DIE” ULTIMATUM DANIEL BORRIS THE “GROW or DIE” ULTIMATUM CREATING VALUE THROUGH ACQUISITION AND BLENDED, LONG-TERM IMPROVEMENT CRC Press Taylor & Francis Group 6000 Broken Sound Parkway NW, Suite 300 Boca Raton, FL 33487-2742 © 2017 by Taylor & Francis Group, LLC CRC Press is an imprint of Taylor & Francis Group, an Informa business No claim to original U.S. Government works Printed on acid-free paper Version Date: 20160524 International Standard Book Number-13: 978-1-49875683-9 (Hardback) This book contains information obtained from authentic and highly regarded sources. Reasonable efforts have been made to publish reliable data and information, but the author and publisher cannot assume responsibility for the validity of all materials or the consequences of their use. The authors and publishers have attempted to trace the copyright holders of all material reproduced in this publication and apologize to copyright holders if permission to publish in this form has not been obtained. If any copyright material has not been acknowledged please write and let us know so we may rectify in any future reprint. Except as permitted under U.S. Copyright Law, no part of this book may be reprinted, reproduced, transmitted, or utilized in any form by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying, microfilming, and recording, or in any information storage or retrieval system, without written permission from the publishers. For permission to photocopy or use material electronically from this work, please access www.copyright.com (http://www.copyright.com/) or contact the Copyright Clearance Center, Inc. (CCC), 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400. CCC is a not-for-profit organization that provides licenses and registration for a variety of users. For organizations that have been granted a photocopy license by the CCC, a separate system of payment has been arranged. Trademark Notice: Product or corporate names may be trademarks or registered trademarks, and are used only for identification and explanation without intent to infringe. Library of Congress Cataloging-in-Publication Data Names: Borris, Daniel, author. Title: The “grow or die” ultimatum : creating value through acquisition and blended, long-term improvement formulas / Daniel Borris. Description: Boca Raton, FL : Taylor & Francis, 2016. Identifiers: LCCN 2016001965 | ISBN 9781498756839 (hardcover) Subjects: LCSH: Consolidation and merger of corporations. Classification: LCC HD2746.5 .B67 2016 | DDC 658.1/62--dc23 LC record available at https://lccn.loc.gov/2016001965 Visit the Taylor & Francis Web site at http://www.taylorandfrancis.com and the CRC Press Web site at http://www.crcpress.com Contents Preface Acknowledgments Introduction Chapter 1 To Acquire or to Be Acquired Chapter 2 M&A in the Full Light of Day Chapter 3 Preparing the Message for the Board Chapter 4 Expectations Are Reset on M&A Valuations Chapter 5 Getting Your Own House in Order…The Division President’s Performance Update Chapter 6 Summary Update for the Chairman of the Board Strategic Logic Chapter 7 The Help Arrives Chapter 8 Establishing the Mandate and Gated Approach Chapter 9 John and Rory Get Reacquainted Chapter 10 The Search for Our M&A Broker Chapter 11 Expect Resistance: Doing the Rounds with the Division Presidents Chapter 12 The Strategy Review Strategic Time Frame Mission Statement Values and Beliefs Primary Business Driver Key Capabilities Product Market Matrix Profit/Return Guidelines Critical Issues Chapter 13 Defining the M&A Targets Chapter 14 The Business Analysis Training…Think…Think…Think Chapter 15 Selecting the Right Broker Chapter 16 Initial Internal Analysis Findings Chapter 17 Four-Point Planning Chapter 18 At the Heart of Every Problem There Is a Nut to Crack Chapter 19 Corporate Culture Chapter 20 The Project Plan Chapter 21 Communication and Final Broker Selection Chapter 22 Due Diligence…Don’t Fall in Love Too Soon Chapter 23 Due Diligence 2…What Was That Again? Chapter 24 Due Diligence 3…Look Before You Leap Chapter 25 Due Diligence 4 Chapter 26 The Communications Strategy Chapter 27 Rory McGregor Chapter 28 Status Update to the Chairman of the Board Chapter 29 A High Performance Culture A High Performance Culture Characteristics Chapter 30 Spreading the Message…Train the Trainer Skills Chapter 31 The M&A Shortlist Chapter 32 What We Are Working with Is Time and Space.Synchronous Chapter 33 Preliminary Meetings with the Owners and Presidents…The Faces behind the Deals Chapter 34 And More Preliminary Meetings Chapter 35 Go/No Go…Do These Ones Fit Chapter 36 Planning for the Coming Due Diligence Chapter 37 Details for the Due Diligence… Questions…Questions…Questions Chapter 38 The Due Diligence Is Launched Chapter 39 In the Final Analysis Chapter 40 The Numbers Are In Chapter 41 An Integrated Approach Chapter 42 Two Years In Chapter 43 Three Years In Chapter 44 Four Years In Chapter 45 Five Years In Index About the Author Preface It seems to me that given the oft-quoted statistics regarding the high failure rate of acquired companies that achieve the targeted synergy savings, the synergies that triggered the acquisitions in the first place with some quotes as high as 95%, there is a need for a book on the topic that is largely aimed at medium-sized companies. The main reasons for failure are often cited as including poor strategic fit, a failed cultural marriage, failure to identify crucial issues in the due diligence process, and failures resulting from any business integration. This book therefore is focused on this end of the M&A process. In addition, it highlights the need to ensure the current business is in optimum shape before adding a new one to the mix. Mergers and acquisitions are bloody hard work! It is unlikely that you would automate a production line before you had it working properly in a manual state. The same truth holds when grafting a new business onto an existing one. Although the information in this book will prove of value to any company, I believe it is medium-sized businesses that likely need the most help. It is harder for them to recover from adverse financial surprises than it is for their larger sister companies, and yet often they are faced with the need to do an acquisition. They are unlikely to have a permanent M&A department or the financial resources to hire the top gun experts in the field and so they must make do with what they have. I sincerely hope the information in this book helps to fill that gap. My brother Steven and I just had our book The Success or Die Ultimatum published by CRC Press, a publisher who is truly dedicated to supporting productivity across the globe. For me, this was my first book and for Steven his third. The Success or Die Ultimatum makes a very clear statement of how we feel about spreading our know-how and sharing what we believe works best. This follow-up book is intended to achieve those same goals with an expanded view on mergers and acquisitions. Looking back at my life, it seems I remember almost everything; sometimes a casual statement can become a guiding principle. One guy told me that everything you ever learn in any job during your life goes into your briefcase