Gompers Park PDF

Preview Gompers Park

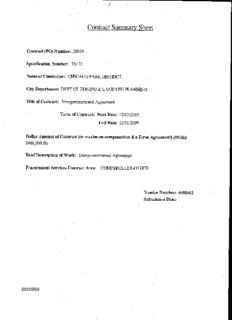

Contract Summary Sheet Contract (PO) Number: 20059 Specification Number: 75172 Name of Contractor: CHICAGO PARK DISTRICT City Department: DEPT OF ZONING & LAND-USE PLANNING Title of Contract: Intergovernmental Agreement Term of Contract: Start Date: 12/22/2005 End Date: 12/31/2009 Dollar Amount of Contract (or maximum compensation if a Term Agreement) (DUR): $400,000.00 Brief Description of Work: Intergovernmental Agreement Procurement Services Contract Area: COMPTROLLER-OTHER Vendor Number: 1050662 Submission Date: 8800958 11/6/2002 REPORTS OF COMMITTEES 95949 COMMITTEE ON HOUSING AND REAL ESTATE. AUTHORIZATION FOR EXECUTION OF INTERGOVERNMENTAL AGREEMENT WITH CHICAGO PARK DISTRICT TO PROVIDE TAX INCREMENT FINANCING ASSISTANCE FOR EXPANSION OF GOMPERS PARK. The Committee on Housing and Real Estate submitted the following report: CHICAGO, October 29, 2002. To the President and Members of the City Council: Your Committee on Housing and Real Estate, to which was referred an ordinance by the Department of Planning and Development authorizing the execution of an intergovernmental agreement with the Chicago Park District concerning expansion of Gompers Park, having had the same under advisement, begs leave to report and recommend that Your Honorable Body Pass the proposed ordinance transmitted herewith. This recommendation was concurred in by a vote of the members of the Committee present, with no dissenting votes. Respectfully submitted, (Signed) RAY SUAREZ,. Chairman. On motion of Alderman Suarez, the said proposed ordinance transmitted with the foregoing committee report was Passed by yeas and nays as follows: 95950 JOURNAL--CITY COUNCIL--CHICAGO . 11/6/2002 Yeas--Aldermen Granato, Tillman, Preckwinkle, Hairston, Beavers, Stroger, Beale_, Pope, Balcer, Frias, Olivo, Burke, T. Thomas, Coleman, L. Thomas, Murphy, Rugai, Troutman, DeVille, Munoz, Zalewski, Chandler, Solis, Ocasio, Burnett, E. Smith, Carothers, Wojcik, Suarez, Matlak, Austin, Colom, Banks, Mitts, Allen, Laurino, O'Connor, Doherty, Natarus, Daley, Hansen, Levar, Shiller, Schulter, M. Smith, Moore, Stone -- 47. Nays-- None. Alderman Beavers moved to reconsider the foregoing vote. The motion was lost. The following is said ordinance as passed: WHEREAS, The City of Chicago (the "City"), is a home rule unit of government under Article VII, Section 6(a) of the 1970 Constitution of the State of Illinois and, as such, may exercise any power and perform any function pertaining to its government and affairs; and WHEREAS, The Chicago Park District (the "Park District") is an Illinois municipal corporation and a unit of local government under Article VII, Section 1 of the 1970 Constitution of the State of Illinois and, as such, is authorized to exercise control over and supervise the operation of all parks within the corporate limits of the City; and WHEREAS, The Park District has proposed the acquisition of a parcel of land commonly known as 5145 -- 5159 North Pulaski Road and legally described in Exhibit A (the "Property"), to build and maintain a park on the Property (the "Project"); and WHEREAS, The Property lies wholly within the boundaries of the Lawrence/Pulaski Redevelopment Area (as hereinafter defined); and WHEREAS, The. City is authorized under the provisions of the Tax Increment Allocation Redevelopment Act, 65 ILCS 5/ 11-74.4-1, et seq., as amended from time to time (the "Act"), to finance projects that eradicate blight conditions and conservation factors that could lead to blight through the use of tax increment allocation financing for redevelopment projects; and . WHEREAS, In accordance with the provisions of the Act and pursuant to ordinances adopted on February 27, 2002 and published in the Journal of the Proceedings of the City Council (the "Journal of Proceedings'') for said date at pages 79687 -- 79793, the City Council: (i) approved and adopted a redevelopment plan and project (the "Plan") for a portion -of the City known as the "Lawrence/Pulaski Redevelopment Project Area" (the "Lawrence/Pulaski Redevelopment Area"); (ii) 11/6/2002 REPORTS OF COMMITTEES 95951 designated the Lawrence/Pulaski Redevelopment Area as a "redevelopment project area"; and (iii) adopted tax increment allocation financing for the Lawrence/Pulaski Redevelopment Area; and WHEREAS, In accordance with the provisions of the Act, pursuant to ordinances adopted on February 16, 2000 and published in the Journal ofP roceedings for said date at pages 24802 -- 24918, the City Council: (i) approved and adopted a redevelopment plan and project (the "LawrencejKedzie Plan") for a portion of the City known as the "Lawrence/Kedzie Redevelopment Project Area" (the "Lawrence/K~dzie Redevelopment Area"); (ii) designated the Lawrence/Kedzie Redevelopment Area as a "redevelopment project area"; and (iii) adopted tax increment allocation financing for the LawrencejKedzie Redevelopment Area (collectively, the "LawrencejKedzie Ordinance"); and WHEREAS, Under 65 ILCS 5/ ll-74.4-3(q)(7), such incremental ad valorem taxes which pursuant to the Act have been collected and are allocated to pay redevelopment project costs and obligations incurred in the payment thereof ("Increment") may be used to pay all or a portion of a taxing district's capital costs resulting from a redevelopment project necessarily incurred or to be incurred in furtherance of the objectives of the redevelopment plan and project, to the extent the municipality by written agreement accepts and approves such costs (Increment collected from the Lawrence/Pulaski Redevelopment Area shall be known as the "Lawrence/Pulaski Increment"; Increment collected from the Lawrence/Kedzie Redevelopment Area shall be known as the "LawrencefKedzie Increment"; and together, the Lawrence/Pulaski Increment and the Lawrence/Kedzie Increment shall be known as the "City Increment"); and WHEREAS, Pursuant to 65 ILCS 5/11-74.4-4(q), the City can use Increment from one redevelopment project area for eligible redevelopment project costs in another redevelopment project area that is either contiguous to, or is separated only by a · public right-of -way from, the redevelopment project area from which the Increment is received (the "Transfer Rights"); and WHEREAS, The Lawrence/Pulaski Redevelopment Area is either contiguous tO', or is separated only by a public right-of-way from, the LawrencefKedzie Redevelopment Area; and WHEREAS, D.P.D. wishes to make available to the Park District a portion of the City Increment in an amount not :to exceed Four Hundred Thousand Dollars ($400,000) for the purpose of partially funding the acquisition of the Property (the "T.I.F.-Funded Improvements") in the Lawrence/Pulaski Redevelopment Area to the extent and in the manner provided in the Agreement (as hereinafter defined); and 95952 JOURNAL--CITY COUNCIL--CHICAGO ll/6/2002 WHEREAS, The City will agree and contract to exercise its Transfer Rights pursuant to the Act, the Lawrence I Kedzie Ordinance and the LawrenceI Kedzie Plan in order to pay for certain T.I.F.-Funded Improvements in the Lawrence/Pulaski Redevelopment Area, to the extent and in the manner provided in the Agreement; and WHEREAS, The Plan contemplates that tax increment financing assistance would be provided for public improvements, such as the Project, within the boundaries of the Lawrence/Pulaski Redevelopment Area; and WHEREAS, The Park District is a taxing district under the Act; and WHEREAS, In· accordance with the Act, the T.I.F.-Funded Improvements shall include such of the Park District's capital costs necessarily incurred or to be incurred in furtherance of the objectives of the Plan, and the City has found that the T.I.F.-Funded Improvements consist of the cost of the Park District's capital improvements that are necessary and directly result from the redevelopment project constituting the Project and, therefore, constitute "taxing districts' capital costs" as 51 defined in Section ll-74.4-3(u) of the Act; and WHEREAS,The City and the Park District wish to enter into an intergovernmental agreement in substantially the form attached as Exhibit B (the "Agreement") whereby the City shall pay for or reimburse the Park District for a portion of the T.I.F.-Funded Improvements; now, therefore, Be It Ordained by the City Council of the City of Chicago: SECTION 1. The above recitals are expressly incorporated in and made a part of this ordinance as though fully set forth herein. SECTION 2. The City hereby finds that the T.I.F.-Funded Improv~ments, among other eligible redevelopment project costs under the Act approved by the City, consist of the cost of the Park District's capital improvements that are necessary and directly result from the redevelopment project constituting the Project and, therefore, constitute "taxing districts' capital costs" as defined in Section 5 I 11-74 .4- 3 (u) of the Act. SECTION 3. Subject to the approval of the Corporation Counsel of the City of Chicago as to form and legality, and to the approval of the City Comptroller, the Commissioner of D.P.D. is authorized to execute and deliver the Agreement, and such other documents as are necessary, between the City of Chicago and the Park District, which Agreement may contain such other terms as are deemed necessary or appropriate by the parties executing the same.on the part of the City. I SECTION 4. To the extent that any ordinance, resolution, rule, order or provision Of the Municipal Code of Chicago, or part thereof, is in conflict with the provisions ll/6/2002 REPORTS OF COMMITTEES 95953 of this ordinance, the provtswns of this ordinance shall control. If any section, paragraph, clause or provision of this ordinance shall be held invalid, the invalidity of such section, paragraph, clause or provision shall not affect any other provisions of this ordinance. SECTION 5. This ordinance shall be in full force and effect from and after the date of its passage. Exhibits "A" and "B" referred to in this ordinance read as follows: Exhibit "A". Common Address: 5 145 -- 5 159 North Pulaski Road. Permanent Index Number: 13-11-300-001-0000. Parcel 1: The part north of centerline of river of the west half of the southwest quarter of Section 11, Township 40 North, Range 13 East of the Third Principal Meridian, except that part taken for Foster Avenue and also that part taken for 40th Avenue, now Pulaski Road, in Cook County, Illinois. Exhibit "B". Intergovernmental Agreement. This agreement is made this _ day of , (the "Closing Date"), under authority granted by Article VII, Section 10 of the 1970 Constitution of the State of Illinois and the Intergovernmental Cooperation Act, 5 ILcs' 220/1, et seq., by and between the City of Chicago (the "City"), an Illinois municipal corporation, 95954 JOURNAL--CITY COUNCIL--CHICAGO 11/6/2002 by and through its Department of Planning and Development ("D.P.D.") and the Chicago Park District (the "Park District"), an Illinois municipal corporation. The Park District and the City are sometimes referred to herein as the "Parties". Recitals. A. The City is a home rule unit of government under Article VII, Section 6(a) of the 1970 Constitution of the State of Illinois and, as such, may exercise any power and perform any function pertaining to its government and affairs. B. The Park District is a unit of local government under Article VII, Section 1 of the 1970 Constitution of the State of Illinois and, as such, has the authority to exercise control over and supervise the operation of all parks within the corporate limits of the City. C. The Park District has proposed the acquisition of a parcel of land commonly known as 5 145 -- 5 159 North Pulaski Road and legally described in (Sub)Exhibit A (the "Property"), to build and maintain a park on the Property (the "Project"). D. ------------(the "Owner") owns the Property E. The Property lies wholly within. the boundaries of the Lawrence/Pulaski Redevelopment Area (as hereinafter defined). F. The City is authorized under the provisions of the Tax Increment Allocation Redevelopment Act, 65 ILCS 5/ 1 1-74.4-1, et seq., as amended from time to time (the "Act"), to finance projects that eradicate blight conditions and conservation factors that could lead to blight through the use of tax increment allocation financing for redevelopment projects. G. In accordance with the provisions of the Act, and pursuant to ordinances adopted on February 27, 2002 and published in the Journal of the Proceedings of the City Council (the "Journal ofP roceedings") for said date at pages 79687 -- 79793, the City Council: (i) approved and adopted a redevelopment plan and project (the "Plan", a copy of which is attached hereto as (Sub)Exhibit B) for a portion of the City known as the "Lawrence/Pulaski Redevelopment Project Area" (the "Lawrence/Pulaski Redevelopment Area"); (ii) designated the .Lawrence/Pulaski Redevelopment Area as a "redevelopment project area"; and (iii) adopted tax increment allocation financing for the Lawrence/Pulaski Redevelopment Area. H. In accordance with the provisions of the Act, pursuant to ordinances adopted on February 16, 2000 and published in the Journal of Proceedings for said date at pages 24802 -- 24918, the City Council: (i) approved and adopted a redevelopment 11/6/2002 REPORTS OF COMMITTEES 95955 plan and project (the "Lawrence /Kedzie Plan") for a portion of the City known as the "LawrencejKedzie Redev-elopment Project. Area" (the "LawrencejKedzie Redevelopment Area"); (ii) designated the LawrencejKedzie Redevelopment Area as a "redevelopment project area"; and (iii) adopted tax increment allocation financing for the LawrencejKedzie Redevelopment Area (collectively, the "Lawrence/Kedzie Ordinance"). I. Under 65 ILCS 5/ 11-74.4-3(q)(7), such incremental ad valorem taxes which pursuant to the Act have been collected and are allocated to pay redevelopment project costs and obligations incurred in the payment thereof ("Increment") may be used to pay all or a portion of a taxing district's capital costs resulting from a redevelopment project necessarily incurred or to be incurred in furtherance of the objectives of the redevelopment plan and project, to the extent the municipality by written agreement accepts and approves such costs (Increment collected from the Lawrence/Pulaski Redevelopment Area shall be known as the "Lawrence/Pulaski Increment"; Increment collected from the Lawrence/Kedzie Redevelopment Area shall be known as the "LawrencejKedzie Increment"; and together, the Lawrence/Pulaski Increment and the Lawrence Kedzie Increment shall be known as the "City Increment"). J. Pursuant to 65 ILCS 5/ll-74.4-4(q), the City can use Increment from one (1) redevelopment project area for eligible redevelopment project costs in another redevelopment project area that is either contiguous to, or is separated only by a public right-of-way from, the redevelopment project area from which the Increment is received (the "Transfer Rights"). K. The Lawrence/Pulaski Redevelopment Area is either contiguous to, or is separated only by a public right-of-way from, the Lawrence/Kedzie Redevelopment Area. L. D.P.D. wishes to make available to the Park District a portion of the City Increment in an amount not to exceed Four Hundred Thousand Dollars ($400,000) (the "T.I.F. Assistance") for the purpose of partially funding the acquisition of the Property (the "T.I.F.-Funded Improvements") in the Lawrence/Pulaski Redevelopment Area to the extent and in the manner provided in the agreement (as hereinafter defined). M. The City will agree and contract to exercise its Transfer Rights pursuant to the Act, the LawrencejKedzie Ordinance and the LawrencejKedzie Plan in order to pay for certain T.I.F.-Funded Improvements in the Lawrence/Pulaski Redevelopment Area, to the extent and in the manner provided in the agreement. N. The Plan contemplates that tax increment financing assistance would be provided for public improvements, such as the Project, within the boundaries of the Lawrence/ Pulaski Redevelopment Area. 95956 JOURNAL--CITY COUNCIL--CHICAGO 11/6/2002 0. The Park District is a taxing district under the Act. P. In accordance with the Act, the T.I.F.-Funded Improvements shall include such of the Park District's capital costs necessarily incurred or to be incurred in furtherance of the objectives of the Plan, and the City has found that the T.I.F. Funded Improvements consist of the cost of the Park District's capital improvements that are necessary and directly result from the redevelopment project constituting the Project and, therefore, constitute "taxing districts' capital costs" as defined in Section 5/ 11-74 .4-3(u) of the Act. Q. The City and the Park District wish to enter into this agreement whereby the City shall pay for or reimburse the Park District for a· portion of the T.I.F.-Funded Improvements. R. On , 2002, the City Council adopted an ordinance published in the Journal of Proceedings for said date at pages to _ , (the "Authorizing Ordinance"), among other things, authorizing the execution of this agreement. S. 0 n , the Park District's Board of Commissioners passed Ordinance Number expressing its desire to cooperate with the City in the construction of the Project and authorizing the execution of this agreement (the "Park District Ordinance"). Now, Therefore, In consideration of the mutual covenants and agreements contained herein, the above recitals which are made a contractual part of this agreement, and other good and valuable consideration the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows: Terms And Conditions. section 1. The Project. l.l Within days after execution of this agreement the Park District agrees to purchase the Property (the "Purchase") in compliance with all applicable federal, state and local laws, statutes, ordinances, rules, regulations, codes and executive orders, all as may be in etTect from time to time, pertaining· to or affecting the 11/6/2002 REPORTS OF COMMITTEES 95957 Purchase or the Park District as related thereto, including but not limited to 70 ILCS 1505/0.01, et seq. 1.2 No later than eighteen (18) months from the Closing date, or later as the Commissioner of D.P.D. (the "Commissioner") may agree in writing, the Park District shall let one (1) or more contracts for the construction of the Project in compliance with all applicable federal, state and local laws, statutes, ordinances, rules, regulations, codes and executive orders, all as may be in effect from time to time, pertaining to or affecting the Project or the Park District as related thereto. 1.3 The plans and specifications for the Project (the "Plans and Specifications") shall at a minimum meet the general requirements set forth in (Sub)Exhibit C hereof and shall be provided to the City by the Park District prior to the disbursement of the T.I.F. Assistance. No material devi~tion from the Plans and Specifi~ations may be made without the prior written approval of the City. The Park District shall comply with all applicable federal, state and local laws, statutes, ordinances, rules, regulations, codes and executive orders, all as may be in effect from time to time, pertaining to or affecting the Project or the Park District as related thereto. 1.4 At such time as the Park District lets a contract or contracts for the Project, the Park District shall also provide the City with copies of all governmental licenses and permits required to construct the Project and to use, occupy and operate the Property as a public park from all appropriate governmental authorities, including evidence that the Property is appropriately zoned to be used, occupied and operated as a public park. 1.5 The Park District shall include a certification of compliance with the requirements of Sections 1.1, 1.2, 1.3 and 1.4 hereof with each request for the T.I.F. Assistance hereunder and at the time the Project is completed. The City shall be entitled to rely on this certification without further inquiry, Upon the City's request, the Park District shall provide evidence satisfactory to the City of such compliance.

Description: