“equitable” relief under erisa: where the court's interpretation stands PDF

Preview “equitable” relief under erisa: where the court's interpretation stands

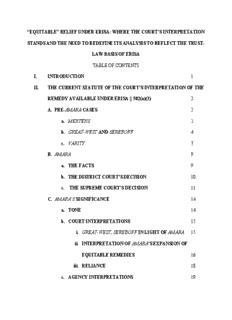

“EQUITABLE” RELIEF UNDER ERISA: WHERE THE COURT’S INTERPRETATION STANDS AND THE NEED TO REDEFINE ITS ANALYSIS TO REFLECT THE TRUST- LAW BASIS OF ERISA TABLE OF CONTENTS I. INTRODUCTION 1 II. THE CURRENT STATUTE OF THE COURT’S INTERPRETATION OF THE REMEDY AVAILABLE UNDER ERISA § 502(a)(3) 2 A. PRE-AMARA CASES 2 a. MERTENS 2 b. GREAT-WEST AND SEREBOFF 4 c. VARITY 7 B. AMARA 9 a. THE FACTS 9 b. THE DISTRICT COURT’S DECISION 10 c. THE SUPREME COURT’S DECISION 11 C. AMARA’S SIGNIFICANCE 14 a. TONE 14 b. COURT INTERPRETATIONS 15 i. GREAT-WEST, SEREBOFF IN LIGHT OF AMARA 15 ii. INTERPRETATION OF AMARA’S EXPANSION OF EQUITABLE REMEDIES 16 iii. RELIANCE 18 c. AGENCY INTERPRETATIONS 19 D. WHAT REMAINS? 21 III. SECTION § 502(a)(3) AND CONGRESSIONAL INTENT 21 A. CONGRESSIONAL INTENT AND THE TRUST LAW MODEL 22 B. JUSTICE SCALIA’S INTERPRETATION OF “APPROPRIATE EQUITABLE RELIEF” 25 C. AMARA’S EXAMPLES OF “APPROPRIATE EQUITABLE RELIEF” a. MONEY DAMAGES 27 b. REFORMATION OF THE TRUST INSTRUMENT 28 c. EQUITABLE ESTOPPEL 29 IV. CONCLUSION 30 I. Introduction Section 502(a)(3) of ERISA1 states that a civil action may be brought by a participant, beneficiary, or fiduciary “to enjoin any act or practice which violates any provision of [Title I of ERISA] or the terms of the plan, or to obtain other appropriate equitable relief to redress such violations or to enforce any provisions of [Title I] or the terms of the plan.”2 What constitutes “appropriate equitable relief” under this section has been an intense subject of debate in the Supreme Court for twenty years. According to the Court’s early jurisprudence on this question, “appropriate equitable relief” excluded the remedy of make-whole monetary relief. In Mertens v. Hewitt Associates, the Court held that money damages are “the classic form of legal relief” and are therefore not authorized under § 502(a)(3).3 Two other Supreme Court cases, Great- West Life & Annuity Ins., Co. v. Knudson,4 and Sereboff v. Mid Atlantic Medical Services, Inc.5 similarly restricted the scope of § 502(a)(3), interpreting it as authorizing restitution in only limited circumstances. 1 While the Court in Varity Corporation v. Howe6 merely implied the availability of a broader range of remedies under § 502(a)(3), the Court in CIGNA Corporation v. Amara expressly invited the District Court to consider an expanded repertoire of remedies, including money damages, reformation of the plan, and estoppel.7 Although the Department of Labor has interpreted this decision as authorizing these remedies under § 502(a)(3), the lower courts are divided, and only when the Supreme Court squarely addresses the issue can any definite conclusions be reached about what Amara did or did not accomplish. If Amara has indeed authorized the use of money damages against a breaching fiduciary, this result is consistent with congressional intent. In enacting its remedial provisions, Congress intended to replicate trust law. In order to determine whether a remedy is authorized under § 502(a)(3) against a fiduciary, the remedy must have been used by courts applying the law of trusts. Because courts routinely ordered money damages against a breaching trustee, that remedy is available under § 502(a)(3). Courts did not reform the terms of a trust instrument or order estoppel against a trustee, however; therefore, such remedies do not qualify as “appropriate equitable relief.” II. The Current Status of the Court’s Interpretation of the Remedy Available Under ERISA § 502(a)(3) A. Pre-Amara Cases a. Mertens The Court in Mertens interpreted “appropriate equitable relief” under § 502(a)(3) as excluding money damages. In Mertens, Plaintiffs were former employees of the Kaiser Steel Corporation (Kaiser) who participated in the company’s retirement plan, a qualified pension plan under ERISA.8 Defendant Hewitt Associates was the plan’s actuary when Kaiser began to 2 reduce its steelmaking operations, which led to early retirement by many plan participants. Kaiser failed to change the plan’s actuarial assumptions to reflect the additional costs imposed by the retirements. Consequently, Kaiser did not adequately fund the plan, and the plan’s assets became insufficient to satisfy its benefit obligations, leading the Pension Benefit Guaranty Corporation (PBGC) to terminate the plan. As a result, the plaintiffs received only the benefits guaranteed by ERISA, which were lower than the pensions owed to them under the plan.9 Plaintiffs sued Hewitt Associates, claiming that it had caused the losses to the plan by allowing Kaiser to choose the plan’s actuarial assumptions, by failing to reveal that Kaiser was one of its clients, and by failing to disclose the plan’s funding shortfall. They asserted that Hewitt Associates was liable as a nonfiduciary who knowingly participated in the plan fiduciaries’ breach of their fiduciary duties, for which they sought monetary relief.10 The Supreme Court granted certiorari on the question of whether ERISA § 502(a)(3) authorizes suits for money damages against nonfiduciaries who knowingly participate in a fiduciary’s breach of fiduciary duty.11 The Mertens Court seemed to answer more than simply this question, however; they seemingly answered the question of whether § 502(a)(3) authorizes suits for money damages, period. According to the Court, “what petitioners in fact seek is nothing other than compensatory damages . . . . Money damages are, of course, the classic form of legal relief.”12 The Court then explained why compensatory damages could not qualify as “appropriate equitable relief” under § 502(a)(3). The Solicitor General had argued that “equitable relief” should mean “whatever relief a court of equity is empowered to provide in the particular case at issue.”13 Because a beneficiary’s action to recover losses resulting from a breach of duty has traditionally been obtained in courts of equity, the Solicitor General argued that such relief “is, 3 by definition, equitable relief.”14 The Court rejected this reading, however, and instead articulated its now-familiar interpretation of the phrase “appropriate equitable relief”: those categories of relief that were “typically available in equity,” prior to the merger of law and equity courts.15 It reasoned that the Solicitor General’s reading of § 502(a)(3) would render the modifier “appropriate” superfluous, and would render Congress’s distinction elsewhere in ERISA between “equitable” and “legal” relief meaningless.16 Armed with its new interpretation of “appropriate equitable relief,” the Court turned to the relief requested in this case, money damages. It declared that injunction, mandamus, and restitution were typically available in equity, but not compensatory damages.17 Therefore, the Court denied plaintiffs’ claim for money damages.18 The procedural distinctions between legal and equitable relief and relevant here, particularly with regard to money. A plaintiff suing for damages, which are legal, is entitled to a jury.19 If the plaintiff is successful, he receives a judgment that he files. He then levies on the defendant’s property, or the sheriff seizes the property of the defendant and sells it at auction and transmits the property to the plaintiff.20 If there is no money and no assets of the defendant sufficient to satisfy the judgment, the defendant is not in contempt of court.21 A plaintiff suing in equity seeks a court order requiring the defendant to take some action, including paying money. While the order requires payment of money, the plaintiff does not have a right to a jury22 and the sheriff will not levy on property. However, if the defendant does not pay, the plaintiff receives an order to show cause why the defendant should not be held in civil contempt of court.23 b. Great-West and Sereboff Great-West and Sereboff similarly restricted the scope of relief available under § 502(a)(3). In Great-West, defendant Janette Knudson became a quadriplegic after a car accident. 4 She was covered by the Health and Welfare Plan for Employees and Dependents of Earth Systems, Inc. (Plan). The Plan covered $411,157.11 of Knudson’s medical expenses, $75,000 of which was paid by the plaintiff pursuant to a stop-loss insurance agreement with the Plan.24 The Plan included a reimbursement provision providing that the Plan would have “a first lien upon any recovery, whether by settlement, judgment, or otherwise” that a beneficiary receives from a third party. If the beneficiary recovers from a third party and does not reimburse the Plan, “then he will be personally liable to [the Plan] . . . up to the amount of the first lien.”25 Knudson received a $650,000 settlement in a tort action against the car manufacturer, which only allocated $13,828.70 to Great-West.26 Great-West sought injunctive and declaratory relief under § 502(a)(3) to enforce the reimbursement provisions of the Plan by requiring the Knudsons to pay the Plan $411,157.11 of any proceeds recovered from third parties.27 The Supreme Court granted certiorari on the question of whether judicially decreed reimbursement for payments made to a beneficiary of an insurance plan by a third party is equitable relief under § 502(a)(3).28 It held that § 502(a)(3) did not authorize such relief. It concluded that restitution was not available to Great-West because the type of restitution they sought was not a traditional form of equitable relief.29 This qualified Mertens, which had stated that restitution was typically available in equity.30 According to the Court, a plaintiff could seek restitution in equity as a constructive trust or an equitable lien “where money or property identified as belonging in good conscience to the plaintiff could clearly be traced to particular funds or property in the defendant’s possession.”31 But here, the money Great-West claimed it was entitled to – the proceeds from the tort settlement – were not in Knudson’s possession; rather, the proceeds were distributed to a trust that provided for Knudson’s medical care, and to Knudson’s attorney. Thus, according to the Court, “the basis for petitions’ claim is not that 5 respondents hold particular funds that, in good conscience, belong to petitioners, but that petitioners are contractually entitled to some funds for benefits that they conferred.” According to the Court, this type of claim was not equitable but legal.32 In Sereboff, the Court affirmed its holding in Great-West. The facts in Sereboff were similar to those in Great-West, with a few key differences. Marlene Sereboff and her husband were involved in an automobile accident in California and suffered injuries. Their health insurance plan, Mid Atlantic Medical Services, Inc., paid their medical benefits. The Sereboffs settled a tort suit, but failed to send any money to Mid Atlantic pursuant to the Plan’s reimbursement provision.33 The Court, in an opinion written by Chief Justice Roberts, held that Mid Atlantic’s suit to collect from the Sereboffs the medical expenses it had paid was properly one for equitable relief under § 502(a)(3).34 Unlike the plaintiffs in Great-West, Mid Atlantic sought specifically identifiable funds that were within the possession and control of the Sereboffs, because the funds had been set aside and preserved in the Sereboffs’ investment accounts.35 Thus, the “impediment to characterizing the relief in [Great-West] as equitable [was] not present here.”36 On the one hand, it is possible to characterize the holdings in both Great-West and Sereboff as limited. Much like the Court in Mertens, these Courts only needed to answer a specific question: whether judicially decreed reimbursement for payments made to a beneficiary of an insurance plan by a third party is equitable relief under § 502(a)(3). However, language in the opinions suggests that these cases stand for the broader proposition that money damages are generally not available under § 502(a)(3). According to the Court in Great-West, “[a]lmost invariably[,] suits seeking (whether by judgment, injunction, or declaration) to compel the defendant to pay a sum of money to the plaintiff are suits for 'money damages,' as that phrase has 6 traditionally been applied, since they seek no more than compensation for loss resulting from the defendant's breach of legal duty.”37 c. Varity Against this backdrop of Supreme Court cases that limited the scope of relief available under § 502(a)(3), the Court’s decision in Varity Corporation v. Howe suggests that there is a broader range of remedies that can be obtained in ERISA actions.38 In Varity, the petitioners were former employees of Massey-Ferguson, Inc., and a wholly owned subsidiary, Varity Corporation. The employees were all participants in Massey-Ferguson’s employee welfare benefit plan. In the mid-1980’s, Varity became worried that some of Massey-Ferguson’s divisions were losing money and concocted a business plan to address the problem. The business plan involved transferring Massey-Ferguson’s money-losing divisions and other debts to a newly created subsidiary called Massey Combines. Varity knew that Massey Combines might fail, but was not troubled by this possibility because its failure would mean the elimination of Varity’s poorly performing divisions and the eradication of various debts.39 Among other obligations, Varity hoped the reorganization would eliminate those arising from the Massey-Ferguson benefit plan’s promises to pay benefits to employees of Massey- Ferguson’s money-losing divisions. Instead of terminating those benefits directly, Varity induced the failing divisions’ employees to switch employers and thereby relieve Massey- Ferguson from its obligation to provide them benefits. To persuade these employees to accept the change of employer and benefit plans, Varity called them together at a special meeting to discuss Massey Combine’s business outlook, its likely financial viability, and the security of their employee benefits. At the meeting, Varity assured its employees that their employee benefits would remain secure if they transferred to Massey Combines, even though Varity knew 7 differently. After the presentation, 1,500 Massey-Ferguson employees agreed to the transfer. After two years, the Massey Combines employees lost their nonpension benefits. They sued, seeking the benefits they would have been owed under their old plan, had they not transferred to Massey Combines.40 The Court first held that Varity was acting in its capacity as an ERISA fiduciary when it misled the beneficiaries, and then found that Varity violated its fiduciary obligations under § 404 of ERISA. Turning to the all-important question of remedies, it next held that § 502(a)(3) authorizes ERISA plan beneficiaries to bring a lawsuit that seeks relief for individual beneficiaries harmed by an administrator’s breach of fiduciary duties.41 However, after deciding that § 502(a)(3) provided the plaintiffs with a remedy, the Court neglected to discuss the appropriate remedy; it simply affirmed the judgment of the court of appeals.42 Examining the relief the plaintiffs requested, and the judgment of the court of appeals, is instructive. As mentioned above, the employees sought “the benefits they would have been owed under their old, Massey-Ferguson plan, had they not transferred to Massey Combines”: in other words, money.43 The Court of Appeals agreed with their request, and awarded them money “to compensate them for benefits of which . . . they had been deprived” and thus to “restore[] [them] to the position they would have occupied if the misrepresentations . . . had never occurred.”44 In addition, the Court of Appeals ordered an injunction reinstating the employees as members of the Massey-Ferguson plan as it existed at the time of their retirement, in essence reforming the terms of the plan.45 Thus, while it did not say so explicitly, the Court of Appeals, in a decision affirmed by the Supreme Court, seemed to suggest that both monetary relief and reformation of the terms of the plan qualified as equitable relief under § 502(a)(3). 8 B. Amara While the Court in Varity merely implied that a broader range of remedies could be obtained under § 502(a)(3), the Court in Amara explicitly (albeit in dicta) invited the lower court to consider an expanded menu of remedies under § 502(a)(3), including money damages against a breaching fiduciary, reformation of the plan, and estoppel. a. The Facts Prior to 1998, CIGNA Corporation (CIGNA) had a defined-benefit retirement plan. The plan provided an employee with a defined benefit in the form of an annuity calculated on the basis of the employee’s preretirement salary and length of service.46 In November 1997, CIGNA sent a newsletter to its employees announcing its intent to create a new pension plan, which would substitute an account balance plan for the existing defined-benefit system. The newsletter said that the old plan would end on December 31, 1997, CIGNA would introduce the new plan sometime in 1998, and the new plan would apply retroactively to January 1, 1998.47 The new plan created an individual retirement account for each employee. Each year CIGNA would contribute an amount to each employee’s individual account, and the account balance would earn compound interest. Upon retirement, the employee would receive the amount then in his individual account.48 Because many employees had already earned some old-plan benefits prior to January 1, 1998, CIGNA promised to make an initial contribution to the individual’s account equal to the value of that employee’s already-earned benefits.49 The District Court found that CIGNA’s descriptions of its new plan were incomplete and misled its employees.50 In reality, the new plan saved the company money annually, the initial deposit was not the full value of the benefit that employees had earned for service before 1998, and the plan made a number of employees worse off.51 9

Description: