Chadwick Staff Report PDF

Preview Chadwick Staff Report

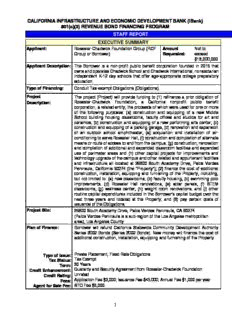

CALIFORNIA INFRASTRUCTURE AND ECONOMIC DEVELOPMENT BANK (IBank) 501(c)(3) REVENUE BOND FINANCING PROGRAM STAFF REPORT EXECUTIVE SUMMARY Applicant: Roessler-Chadwick Foundation Group (RCF Amount Not to Group or Borrower) Requested: exceed $18,000,000 Applicant Description: The Borrower is a non-profit public benefit corporation founded in 2015 that owns and operates Chadwick School and Chadwick International, nonsectarian independent K-12 day schools that offer age-appropriate college preparatory education. Type of Financing: Conduit Tax-exempt Obligations (Obligations) Project The project (Project) will provide funding to (1) refinance a prior obligation of Description: Roessler-Chadwick Foundation, a California nonprofit public benefit corporation, a related entity, the proceeds of which were used for one or more of the following purposes: (a) construction and equipping of a new Middle School building housing classrooms, faculty offices and studios for art and ceramics, (b) construction and equipping of a new performing arts center, (c) construction and equipping of a parking garage, (d) renovation and expansion of an outdoor school amphitheater, (e) acquisition and installation of air- conditioning to serve Roessler Hall, (f) construction and completion of alternate means or route of access to and from the campus, (g) construction, renovation and completion of additional and expanded classroom facilities and expanded use of perimeter areas and (h) other capital projects for improvements and technology upgrade of the campus and other related and appurtenant facilities and infrastructure all located at 26800 South Academy Drive, Palos Verdes Peninsula, California 90274 (the “Property”); (2) finance the cost of additional construction, installation, equipping and furnishing of the Property, including, but not limited to: (a) new classrooms, (b) faculty housing, (c) swimming pool improvements, (d) Roessler Hall renovations, (e) solar panels, (f) STEM classrooms, (g) wellness center, (h) weight room renovations, and (i) other routine capital expenditures included in the Borrower’s capital budget over the next three years and located at the Property; and (3) pay certain costs of issuance of the Obligations. Project Site: 26800 South Academy Drive, Palos Verdes Peninsula, CA 90274 (Palos Verdes Peninsula is a sub-region of the Los Angeles metropolitan area); Los Angeles County Plan of Finance: Borrower will refund California Statewide Community Development Authority Series 2002 Bonds (Series 2002 Bonds). New money will finance the cost of additional construction, installation, equipping and furnishing of the Property. Type of Issue: Private Placement, Fixed Rate Obligations Tax Status: Tax-Exempt 30 Years Term: Credit Enhancement: Guaranty and Security Agreement from Roessler-Chadwick Foundation Unrated Credit Rating: Fees: Application Fee $3,000; Issuance Fee $45,000; Annual Fee $1,000 per year Agent for Sale Fee: STO Fee $6,000 1 Estimated Sources of Funds: Estimated Uses of Funds: Tax-exempt Proceeds $18,000,000 Construction $13,200,000 Borrower Funds 6,550,000 Renovation/Retrofit 5,500,000 Series 2002 Refinancing 5,500,000 Cost of Issuance $350,000 TOTAL SOURCES $24,550,000 TOTAL USES $24,550,000 Financing Team: Bond Counsel: Kutak Rock LLP Underwriter: George K. Baum & Company Purchaser/Lender: First Republic Bank Public Benefits: Refunding the Series 2002 Bonds will significantly reduce the debt-related risk exposure by establishing a long-term fixed rate debt instrument. Additionally, new construction and renovation to include classrooms, buildings, parking garage, and faculty housing that provides college preparatory education to a diverse group of students. The Project is expected to provide 45 temporary construction jobs, and an energy cost savings from solar panels of $50,000 per year. Date of Board Meeting: Resolution Number: Prepared by: 11/28/2017 17-19 John Belmont Staff Recommendation: Staff recommends approval of Resolution No.17-19 authorizing the issuance of Conduit Tax-Exempt Obligations in an amount not to exceed $18,000,000 for the benefit of the Roessler-Chadwick Foundation Group. 2 BACKGROUND AND HISTORY Roessler-Chadwick Foundation (RCF) RCF is a California non-profit public benefit corporation which operates the Chadwick School (School) and Chadwick International (CI); two educational, independent day schools for children from pre-kindergarten (PK) through 12th grade. Organized in 1963, and governed by a Board of Trustees; RCF has evolved over the years to meet the educational mission of the growing School. In total, RCF enrolled nearly two thousand students for the 2016-17 school year. RCF is supported by the Chadwick Scholarship Foundation (CSF). CSF exists as a charitable trust, established in 1971. The sole purpose of CSF is to provide financial support to RCF, in the form of tuition assistance to students with demonstrated financial need. Roessler-Chadwick Foundation Group (RCF Group) RCF Group is a tax-exempt California nonprofit corporation that operates as a holding and operational entity supporting RCF. The RCF Group was established in July 2015 during a corporate reorganization of RCF. RCF Group is governed by a Board of Directors, a majority of whom concurrently serve on the RCF Board of Trustees. The reorganization established RCF Group as the sole corporate member of RCF and holder of certain real estate and endowment assets, and intellectual property. RCF Group’s endowment fund totaled $30.1 million as of June 30, 2017. Over the past 6 years the endowment has grown 58%. Chadwick School (School) The School was originally founded in 1935 in San Pedro, California. In 1938 the School moved to Palo Verdes, California. After the retirement of its founders, Commander Chadwick and Mrs. Chadwick in 1963, the School established the RCF and Board of Trustees. In 2016-17, the School enrolled 840 students in K-12 grade. The School offers a pre-preparatory and college preparatory program. The academic programs are divided into three divisions: The Village School (grades K-6), the Middle School (grades 7-8) and the Upper School (grades 9-12). The School maintains a student-to-teacher ratio of 8:1. Approximately 80% of faculty and staff hold an advanced degree, which currently consists of 104 full-time and six part-time educators. In addition to faculty, there are 66 employees in student support, administration, admissions and marketing, and maintenance. Financial aid in 2016-17 amounted to $3.78 million benefitting 17% of students. The School is accredited by the Association for Experiential Education and the Western Association of Schools and Colleges (WASC). The School’s stable student enrollment, annual fund support, and efficient expense management have contributed to its consistent financial results. The School’s total philanthropic support from all sources was $2,965,450 for 2016-17. The School is located on a 45-acre campus in Palos Verdes Peninsula, Los Angeles County. The campus includes 22 academic and administrative buildings, athletic fields 3 and facilities. The School’s mission is to “develop global citizens with keen minds, exemplary character, self-knowledge and the ability to lead.” Chadwick International (CI) RCF opened a second campus, Chadwick International (CI), an American school located in Songdo, South Korea. Opening in 2010, CI operates as a PK-12 school and serves the expatriate community and internationals comprised of 31 countries living in South Korea. The 2016-17 school year had enrollment of 1,156 students. CI is WASC accredited, and offers the International Baccalaureate program. Current leadership information is available in Appendix A. PROJECT DESCRIPTION The refunding will refinance a prior obligation of Roessler-Chadwick Foundation, a California nonprofit public benefit corporation, a related entity, the proceeds of which were used for one or more of the following: (a) construction and equipping of a new Middle School building housing classrooms, faculty offices and studios for art and ceramics, (b) construction and equipping of a new performing arts center, (c) construction and equipping of a parking garage, (d) renovation and expansion of an outdoor school amphitheater, (e) acquisition and installation of air-conditioning to serve Roessler Hall, (f) construction and completion of alternate means or route of access to and from the campus, (g) construction, renovation and completion of additional and expanded classroom facilities and expanded use of perimeter areas and (h) other capital projects for improvements and technology upgrade of the campus and other related and appurtenant facilities and infrastructure (collectively, the “2002 Facilities”) all located at 26800 South Academy Drive, Palos Verdes Peninsula, California 90274 (the “Property”). The new money will finance the cost of additional construction, installation, equipping and furnishing of the Property, including, but not limited to: (a) new classrooms, (b) faculty housing, (c) swimming pool improvements, (d) Roessler Hall renovations, (e) solar panels, (f) STEM classrooms, (g) wellness center, (h) weight room renovations, and (i) other routine capital expenditures included in the Borrower’s capital budget over the next three years and located at the Property and pay certain costs of issuance in connection with the issuance of the Obligations. The tax-exempt Obligations in an amount not to exceed $18 million will provide financial assistance for an eligible project for the benefit of the RCF Group. No loan funds will be used for CI. Borrower will contribute approximately $6,500,000 of its own equity to the Project. The Loan Agreement will specify that Borrower will use solely its own equity to finance the faculty housing portions of the Project. The School’s strategic plan includes a number of capital projects over the next several years. The School expects construction to begin the spring of 2018, which includes installation of solar panels, STEM (Science, Technology, Engineering and Math) classrooms, and five new faculty homes. In spring 2019, plans are to renovate Roessler Hall, several classrooms, and one new classroom. In spring 2020, plans are to construct a new wellness center, pool, and weight room. 4 The School is seeking refinancing of tis 2002 Series Bonds in order to eliminate certain ongoing risks related to the LOC structure, and secure a longer bank commitment period to reduce the frequency of renewal and repricing events. School’s Strategic Plan Project Construction Start Date Estimated Project Cost Faculty Housing 2018 $3,000,000 Solar Panels 2018 $1,200,000 STEM Classrooms 2018 $2,400,000 Classrooms 2019 $2,000,000 Roessler Hall 2019 $3,500,000 Swimming Pool 2020 $3,600,000 Wellness Center 2020 $2,000,000 Weight Room 2020 $1,000,000 Total Construction & Renovation $18,700,000 Existing Debt Structure This table displays the Borrower’s existing capital structure and the total annual debt service: Par Interest Final Issuer Outstanding Trustee Purpose Amount Rate Maturity CSCDA $8,000,000 $5,500,000 Variable 10/1/2029 BNY Tax-exempt variable Series Mellon bonds to finance 2002 construction of Middle School, performing Arts facility, parking garage, and expansion and improvement of various campus facilities. The Series 2002 Bonds were structured as variable rate demand bonds, remarketed at a weekly variable rate by the remarketing agent. The Series 2002 Bonds were secured by a letter of credit (LOC) provided by Allied Irish Bank and later JP Morgan, which has been renewed and extended over the past years. The LOC was recently extended for a two- year period expiring in December 2017. The Series 2002 Bonds mature in 2029, but may be redeemed at earlier dates. The Series 2002 Bonds are not secured by any campus real estate, as the RCF Group provided a guarantee for the debt. Further, the School has not entered into any interest rate swap or other derivative product to hedge against variable interest rates. See Appendix B--Project Renderings 5 FINANCING STRUCTURE Roessler-Chadwick Foundation Group Date: November 28, 2017 Par Amount: Not to exceed $18,000,000; Tax-Exempt and/or Taxable Obligations Type of Offering: Private Placement Lender: First Republic Bank Credit Enhancement: Guaranty and Security Agreement from Roessler-Chadwick Foundation Expected Credit Rating: None Interest*: 30 year fixed rate at 3.10% Maturity: December 1, 2047 Collateral: Borrower’s general revenues and personal property. Closing Date*: December 12, 2017 Transaction: The Obligations are special, limited obligations payable solely from payments made by the Borrower under the transaction documents and IBank shall not be directly or indirectly or contingently or morally obligated to use any other moneys or assets of IBank for all or any portion of payment to be made pursuant to the Obligations. *Please note that Interest Rate and Closing Date are subject to change. Financing Structure The Obligations will be privately placed to First Republic Bank, a California state-chartered banking corporation. The Obligations are subject to transfer restrictions to certain affiliates and Qualified Institutional Buyers. Obligation proceeds will be loaned to the Borrower pursuant to a Loan Agreement. The Obligations will be secured by a Security Agreement from the Borrower. The credit is enhanced by a Guarantee and Security Agreement from RCF. The terms are defined by 36 months of interest only payments, followed by monthly payments of principal and interest, with a 30 year maturity. Limited Obligations of IBank The Obligations are payable solely from and secured solely by the pledge of the Borrower’s payments under the transaction documents. Neither IBank, nor any of the members of its Board of Directors, nor any of its officers or employees, nor any person 6 executing the transaction documents on behalf of IBank shall be personally liable for the Obligations or subject to any personal liability or accountability by reason of the execution thereof. The Obligations are limited obligations of IBank and are not a pledge of the faith and credit of IBank or the State of California or any of its political subdivisions. PUBLIC BENEFITS The School, a K-12 school provides college preparatory education to a diverse student body. The School’s 45-acre campus includes 22 academic and administrative buildings, athletic fields and facilities, and state of the art facilities in the sciences and performing arts. Students have access to multiple science labs, dance and music studios, a swimming pool, computer labs, library and learning center staffed with three full-time librarians. The School also has a videoconference room that provides all K-12 students an opportunity to interact with peers at the CI campus. Specific public benefits to the Project are as follows: Construction and Renovation: The Project being funded from the proceeds of a tax-exempt financing will have a significant impact on the School’s finances and as well as educational program. The School has identified multiple sites for solar panels, which will decrease the School's carbon footprint and provide energy cost savings of approximately $50,000 per year. STEM classrooms will improve the School's curricular offerings and learning space in science, technology, engineering and mathematics. Thus keeping up to date in preparing students for success in these areas. The Wellness Center, including the weight room and pool upgrades, will provide beneficial upgrades to the School’s current physical education in addition to the emotional well-being of its students and employees. The Wellness Center, to be used by athletic teams, clubs, and physical education students is a key component to the well-being of students, as outlined in the mission statement. Faculty housing offers jobs and on-campus housing at below-market rates, which is rare in California. This added benefit to the compensation package allows the School to attract and retain high quality educators. Each of these upgrades will allow the School to continue to (1) deliver its mission of educating a diverse student population, (2) offer financial aid to highly qualified students with demonstrated financial need, and (3) deliver the highest quality academic program to its student body. Estimated Job Creation Temporary construction jobs is estimated to be 45 jobs on site at any given time. Project construction will span three years, and is expected to be completed in phases among various contractors and sub-contractors. The job total does not include architects or consultants hired by the School as part of the construction and planning process. 7 The proposed improvements are not expected to expand the School's enrollment or add any full-time positions, however certain cost savings from the project will free up cash flow to be dedicated to, among other areas, employee compensation and/or additional future hiring flexibility and facility improvements that will strengthen the School’s ability to remain financially sustainable. Outreach One of the significant public benefits the School offers to the community is its Community Service Program. Approximately 90% of the students participate in weekly, monthly and annual outreach opportunities, including volunteering to tutor local public school elementary students, interacting with developmentally challenged students and adults, retirement community activities, hospitals, foster children, and participating in beach clean- ups. The School also hosts free access to plays, concerts, art installations, athletic competitions, and other performances and events. In 2016-17, 18% of students received some form of School funded financial aid, representing nearly $25,000 per recipient, a total commitment of $3.8 million. Refunding 2002 Bonds: The School’s primary benefit of refunding the Series 2002 Bonds is to eliminate risks associated with the current debt structure, as costs savings are unable to be determined. The Series 2002 Bonds are backed by a one year Letter of Credit (LOC), and bear interest at a variable rate established weekly. The LOC has a one-year expiration and exposes the School to frequent repricing/renewal risk. Additionally, the School is subject to interest rate risk given the floating rate structure, exposing it to fluctuations in interest rate related to the creditworthiness of the LOC bank. Thus, refunding will establish a long-term, committed fixed rate structure at today’s favorable low interest rates. The School will no longer be exposed to repricing/renewal risk in the future because of First Republic Bank’s 30 year commitment. This new structure significantly reduces the debt-related risk exposure by establishing a long-term fixed rate debt instrument. 8 OTHER PROJECT DATA PERMITS AND APPROVAL Required? NO YES Describe: All approvals have been obtained. TEFRA Date of TEFRA November 7, 2017 Publications The Daily Recorder Los Angeles Daily Journal Oral/Written Comments NO YES, Explain: LEGAL QUESTIONNAIRE Completed? NO YES Issues? NO YES, Explain: ELIGIBILITY REVIEW Does Applicant meet all of the 1. Project is in the State of California. IBank eligibility criteria? 2. Chadwick is capable of meeting the obligations YES NO incurred under relevant agreements. 3. Payments to be made by Borrower to IBank under the proposed financing agreements are adequate to pay the current expenses of IBank in connection with the financing and to make all the scheduled payments. 4. The proposed financing is appropriate for the Project. INDUCEMENT CERTIFICATE Completed? NO YES Certificate No.: N/A Date: RECOMMENDATION Staff recommends approval of Resolution No.17-19 authorizing the issuance of Conduit Tax-Exempt Obligations in an amount not to exceed $18,000,000 for the benefit of the Roessler-Chadwick Foundation Group. 9 APPENDIX A GOVERNANCE AND MANAGEMENT CHADWICK SCHOOL OFFICERS Jack Creeden, Head of School Chief Executive Officer John Kjenner Chief Financial Officer RCF BOARD OF TRUTEES Ted Haile, Board Chair Retired Christine Bucklin, Vice Chair Private Equity Gryphon Investors Los Angeles, CA Jared Felt, Secretary Retired Lynn Hopton Davis, Treasurer Investment Management Columbia Management Investment Advisers, LLC El Segundo, CA Ken Baronsky Lawyer Milbank, Tweed, Hadley & McCloy LLP Los Angeles, CA Linda McLoughlin Figel Entrepreneur Pages: A Bookstore Manhattan Beach, CA Pam Freer Philanthropist John Fukunaga Lawyer Los Angeles, CA Kurt Gibbs Architect Gibbs Architects/Southerly Group, LLC Long Beach, CA Ted Hill President, RCF Group Ruth MacFarlane Retired Lisa Petrie Financial Advisor The Petrie Group Long Beach, CA Nick Richardson CEO Solartis Los Angeles, CA Jennie Nash Robertson Author and Writing Coach Los Angeles, CA Lynne Rosenberg Insurance Agent Innovative Solutions Insurance Services El Segundo, CA Velveth Schmitz City Council Rolling Hills Estates, CA Wayne Song Lawyer Los Angeles, CA Dr. Saskia Subramanian Research Sociologist Los Angeles, CA Brian Sweeney Real Estate Los Angeles, CA Gregg Tenser Investment Management NWQ Investment Management Co. Inc. Los Angeles, CA Charles Toups Project Management Boeing Seal Beach, CA Matt Wilson Investment Management Oaktree Capital Management Los Angeles, CA 10

Description: