Bar and Bench (www.barandbench.com) PDF

Preview Bar and Bench (www.barandbench.com)

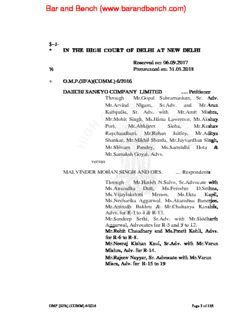

Bar and Bench (www.barandbench.com) $~J- * IN THE HIGH COURT OF DELHI AT NEW DELHI Reserved on: 06.09.2017 % Pronounced on: 31.01.2018 + O.M.P.(EFA)(COMM.) 6/2016 DAIICHI SANKYO COMPANY LIMITED ..... Petitioner Through Mr.Gopal Subramanium, Sr. Adv. Mr.Arvind Nigam, Sr.Adv. and Mr.Arun Kathpalia, Sr. Adv. with Mr.Amit Mishra, Mr.Mohit Singh, Ms.Hima Lawrence, Mr.Akshay Puri, Mr.Abhijeet Sinha, Mr.Keshav Raychaudhuri, Mr.Rohan Jaitley, Mr.Aditya Shankar, Mr.Mikhil Sharda, Mr.Jayvardhan Singh, Mr.Shivam Pandey, Ms.Samridhi Hota & Mr.Samaksh Goyal, Advs. versus MALVINDER MOHAN SINGH AND ORS. .... Respondents Through Mr.Harish N.Salve, Sr.Advocate with Ms.Anuradha Dutt, Ms.Fereshte D.Sethna, Ms.Vijaylakshmi Menon, Ms.Ekta Kapil, Ms.Neeharika Aggarwal, Ms.Akanshsa Banerjee, Mr.Anirudh Bakhru & Mr.Chaitanya Kaushik, Advs. for R-1 to 4 & R-13. Mr.Sandeep Sethi, Sr.Adv. with Mr.Siddharth Aggarwal, Advocates for R-5 and 9 to 12. Mr.Rohit Chaudhary and Ms.Preeti Kohli, Advs. for R-6 to R-8. Mr.Neeraj Kishan Kaul, Sr.Adv. with Mr.Varun Mishra, Adv. for R-14. Mr.Rajeev Nayyar, Sr. Advocate with Mr.Varun Misra, Adv. for R-15 to 19 OMP (EFA) (COMM) 6/2016 Page 1 of 115 Bar and Bench (www.barandbench.com) CORAM: HON'BLE MR. JUSTICE JAYANT NATH JAYANT NATH, J. 1. This petition has been filed under Part II of The Arbitration and Conciliation Act,1996 by the petitioner M/s.Daiichi Sankyo Company Limited seeking enforcement and execution of the Foreign Award dated 29th April 2016 passed by the Majority Arbitral Tribunal comprising of Mr.Karyl Nairn QC and Professor Lawrence G.Boo ( a dissenting award being given by Justice (Retd.) A.M.Ahmadi). By the present judgment, I will decide the objections under section 48 of The Arbitration and Conciliation Act, 1996 filed by the respective respondents to enforcement of the Award. Separate objections have been filed by Respondents No.1 to 3, Respondent No.4, Respondents No.6 and 7, Respondent No.8, Respondents No.5 and 9 to 12 (minors) and by Respondents No.14 to 19 and Respondent No.20 respectively. 2. The controversy revolves around a Share Purchase and Share Subscription Agreement (hereinafter referred to as SPSSA) dated 11.6.2008 whereby the petitioner agreed to purchase from the respondents their total stake in Ranbaxy Laboratories Limited (hereinafter referred to as „Ranbaxy‟) for a transaction valued at INR 198 billion (approximately 4.6 billion US dollars). 3. Disputes having arisen between the parties, in terms of SPSSA, the petitioner invoked the arbitration clause. In terms of the said arbitration agreement the disputes were to be resolved by Arbitration to be administered by the International Chamber of Commerce (hereinafter referred to as ICC). OMP (EFA) (COMM) 6/2016 Page 2 of 115 Bar and Bench (www.barandbench.com) The place of arbitration was to be Singapore. Each disputing side was to appoint one Arbitrator and the two Arbitrators so appointed were to consult and appoint a third Arbitrator. In case of failure to appoint respective Arbitrators or two party Arbitrators or even to appoint the Chairperson, the ICC was to appoint such Arbitrator or Chairperson, as the case may be. The arbitration proceedings were to be conducted in English. 4. The petitioner nominated Ms.Karyl Nairn QC. Respondents nominated Justice A.M.Ahmadi (Rtd.), former Chief Justice of India. ICC appointed Professor Lawrence, G.S.Boo of The Arbitration Chambers, Singapore as the President of the Arbitral Tribunal. The applicable procedural law of arbitration was to be the International Arbitration Act of Singapore. The governing law was to be the laws of Republic of India. 5. Some of the brief facts as urged by the claimant/petitioner are as follows:- 6. The petitioner by a Share Purchase and Share Subscription Agreement dated 11.6.2008 purchased the respondent‟s total stake in the company Ranbaxy Laboratories Limited (Ranbaxy) for a value of over INR 198 billion (approximately US Dollar 4.6 billion at the relevant exchange rates). In terms of the SPSSA the respondents received total amount of Rs.9,576.1 crores. In discharge of statutory duty under Security and Exchange Board of India Act the petitioner had to purchase shares from the public. Hence, it spent a total amount of Rs19,804/- crores approximately to complete the transaction. The first installment of the payment was received by the respondents on 20.10.2008 and the final payment was received on 7.11.2008. On 19.12.2008 Dr.Une and Mr.Takshi Shoda were nominated on the Board on behalf of the petitioners. Mr.Malvinder Singh/respondent No.1 continued OMP (EFA) (COMM) 6/2016 Page 3 of 115 Bar and Bench (www.barandbench.com) to be the CEO of Ranbaxy. Subsequently, on account of differences he resigned on 24.5.2009. The claim of the petitioner arises out of the said SPSSA. It is the case of the petitioner that during the acquisition process of the respondent‟s shares in Ranbaxy Mr. Malvinder (respondent No.1) and his business associates Mr. Vinay Kaul and Mr.Jay Deshmukh made false representations to the petitioner by concealing a document known as Self Assessment Report (hereinafter referred to as SAR) and also about the genesis, nature and severity of pending investigations by the US Food and Drug Administration (hereinafter referred to as FDA) and Department of Justice (hereinafter referred to as DOJ) against Ranbaxy thereby fraudulently inducing the petitioner to acquire the shares. 7. (a) It is stated that in 2004 Ranbaxy recruited Dr.Rajinder Kumar as the President of the R&D department. Just a few months into the job the said Dr.Kumar reported to the Company‟s Science Committee that Ranbaxy is engaged in data falsification to obtain regulatory approvals more quickly for hundreds of drug products in dozens of countries around the world. He is said to have prepared this document termed as SAR which had details of the stated falsification. Dr.Kumar is later said to have resigned from the company having complained that the matters addressed in SAR were not being given sufficient attention. It transpired that a former colleague of Dr.Kumar, Shri Dinesh Thakur provided a copy of the SAR to the US authorities, probably around 2005-06. Regulatory investigation is said to have commenced sometimes in February 2006 into the Ranbaxy‟s facilities. Warning letter is said to have been issued to Ranbaxy on 15.6.2006 which is said to have identified various violations of Good Manufacturing Practices and FDA Regulations. Various other steps are said to have been taken by OMP (EFA) (COMM) 6/2016 Page 4 of 115 Bar and Bench (www.barandbench.com) DOJ and FDA. It is the case of the petitioner that Mr.Malvinder Singh (Respondent No.1) and his close business and family associates were fully aware that SAR evidenced widespread fraudulent practices at Ranbaxy. The company and its senior management being aware of its practices failed to address its problems for years. It is further the case of the petitioner that Mr.Malvinder Singh acting for himself and agent for other respondents misrepresented and concealed from the petitioner the existence of SAR or any document of that nature reporting that Ranbaxy had intentionally fabricated data for regulatory submissions to various regulators or the fact that the US Government was in possession of such documents. It is pleaded that the respondents kept the SAR as a secret. The respondent misrepresented the ongoing investigation by the US Regulatory authorities as routine regulatory exercise and a meritless fishing expedition launched at the behest of a competitor. It is the case of the petitioner that but for the fraud it would not have acquired Ranbaxy shares at all and has thereby suffered loss and damages. (b) It is further stated by the petitioner that it first learnt in November 2009 that SAR was the true source of the US authorities concerns. On coming to know about this aspect the petitioner is said to have worked towards addressing the issues and an Agreement was entered into with the US Regulatory Authority. A consent decree was entered into with FDA in December 2011. The cost of complying with the terms of the consent decree was estimated to be US$35-50 million per year. It further entered into a Settlement Agreement with the Department of Justice, agreeing to pay a sum USD$500 million penalty to resolve all potential, civil and criminal liability. OMP (EFA) (COMM) 6/2016 Page 5 of 115 Bar and Bench (www.barandbench.com) (c) The petitioner claims to have suffered direct and indirect losses as a result of having entered into the SPSSA relying upon the false picture painted by the misrepresentation and active concealment of material facts by Mr.Malvinder Singh/his agents in the course of negotiations. (d) The petitioners invoked arbitration clause on 14.11.2008 seeking compensatory damages equivalent to US$ 1.4 billion or equivalent in such other currency, pre-Award interest of 10% annually running from 7th November 2008, post-Award interest of 18% annually running from date of Award till the amount is paid and costs. (e) In April 2014 the petitioner entered into a market transaction with Sun Pharma in which the petitioner agreed to sell all its Ranbaxy shares by means of an arrangement by which Sun Pharma and Ranbaxy would merge on a stock for stock basis with Sun Pharma as the surviving entity. The transaction was finally closed on 25.3.2015 with Sun Pharma. The petitioner is said to have received consideration of Rs.22,679 crores. The majority gave its Award on 29.4.2016. The minority Award came on 30.4.2016. (f) The respondent raised number of defences before the Arbitral Tribunal. It was the case of the respondent that the petitioner was unable to demonstrate any active concealment. It was the petitioner who had initiated negotiations and was keen to acquire majority stake in Ranbaxy despite the petitioner having knowledge of the ongoing FDA and DOJ investigations in Ranbaxy. While negotiations were going on, a warning letter dated 15.6.2006 was published by FDA on its website. (g) A DOJ search in the office of Ranbaxy in New Jersey took place on which Ranbaxy issued a Press Statement which was reported online and was publically available. The petitioner had raised queries on the ongoing FDA OMP (EFA) (COMM) 6/2016 Page 6 of 115 Bar and Bench (www.barandbench.com) and DOJ investigation during February 2008 to May 2008. It is hence pleaded that it is manifest that the petitioner was fully aware about the pending investigations and its ramifications. Further, it is stated by the respondent that the petitioner and his representatives were given access to a “data room” during the negotiations which contained all correspondence and other documents relating to the stated investigation by US Authorities. The claimants/petitioner also had access to publically available information such as announcements by Ranbaxy, relevant stock exchanges, press releases and other announcement made by FDA from time to time which was available on FDA‟s website. Despite knowledge of all these facts, the petitioner acquired the shareholding of the respondent in Ranbaxy on „as is where is basis‟. In fact the petitioner had specifically asked for representations, warranties and indemnities from the respondent relating to the investigation and it agreed to drop that requirement. Hence, under advice they accepted the risks attendant to and arising from the said investigations including the risk that FDA had the power to bar Ranbaxy‟s products from entering into the US market and other coercive steps. It is also the case of the respondent that there was no positive duty to inform the petitioner about the SAR inasmuch as SAR was not a material document. (h) It is also pleaded by the respondent that for the first time the petitioner made assertions of concealment of material information in its purported notice dated 12.9.2012, more than three years after closing of the share purchase transaction under SPSSA. Hence, it was pleaded by the respondent that the claim is time barred under the limitation laws of India. Alternatively, the claimant could have with reasonable diligence discovered the matters complained of after completion of the transaction or any rate, after 24th May OMP (EFA) (COMM) 6/2016 Page 7 of 115 Bar and Bench (www.barandbench.com) 2009 when Mr.Malvinder left Ranbaxy. It is further pleaded that elements of active concealment are not made out in terms of section 17 of the Indian Contract Act, 1872 (hereinafter referred to as The Contract Act). Further, the respondent has suffered no loss direct or indirect as a result of the alleged active concealment and wrong doing. In 2015 the petitioner sold the shares to Sun Pharma at a profit i.e. above the price paid to the respondent. 8. The majority Award in the present case was passed by the two Arbitrators, namely, Ms.Karyl Nairn and Professor Lawrence, G.S.Boo. Justice A.M.Ahmadi (Retired) gave a dissenting Award. The Majority Award grants the following relief to the petitioner:- I. The Respondents shall forthwith pay to the Claimant, damages in the sum of INR 25,627,847,918.31. II. The Respondents shall pay to the Claimants interest on the sum of INR 25,627,847,918.31 at the rate of 4.44% per annum on a simple basis as from 7 November 2008 to the date of the Award, amounting in aggregate to INR 8,510,692,333.80. III. The Respondents shall bear and pay the attorneys' fees and expenses incurred by the Claimant which we fixed at US$ 14,549,684.60. IV. The Respondents shall reimburse to the Claimant the sum of US$ 599,250.00 for its share of the costs of arbitration as fixed by the ICC Court. V. The Respondents shall bear and pay interest to the Claimant on all sums (including costs and interest accrued) awarded herein to the Claimant at the rate of 5.33% per annum on a simple basis from the date following the date of the Award until the same is fully and finally paid.” 9. The Arbitral Tribunal framed the issues for determination as follows:- a. Whether the Respondents have fraudulently misrepresented and/or concealed from the Claimant the source and severity of OMP (EFA) (COMM) 6/2016 Page 8 of 115 Bar and Bench (www.barandbench.com) the Company's regulatory problems in connection with the Respondents' sale of their interest In the Company to the Claimant pursuant to the SPSSA b. Whether the Claimant agreed to forego any express representation, warranty or indemnity in the SPSSA by the Respondents and if so, whether that precludes the Claimant from making a case of fraud. c. Whether the elements of section l7 of the Contract Act have been satisfied. d. Whether the Claimant's claim is time-barred under the Limitation Act? {If the Respondents be found liable] e. Whether the Claimant is entitled in law to recover the damages claimed and/or has standing to advance the claims for damages that have been made and if so, whether the Claimant has suffered any actionable loss, direct or indirect, as a result of the alleged fraud by the Respondents. f. Whether the Claimant has taken such steps as are necessary and/or appropriate and/or reasonable to mitigate any loss that it may have suffered. g. To ascertain such proper and appropriate reliefs and remedies to which each Party may be entitled; h. To ascertain who should bear the costs and expenses of Parties' legal representation and the costs of this arbitration. 10. Issue No.(a) framed by the Arbitral Tribunal is whether the respondents have fraudulently misrepresented and/or concealed from the claimant the source and severity of the Company‟s regulatory problems. The Majority Arbitral Tribunal (hereinafter referred to as Arbitral Tribunal) first noted the legal position regarding the standard of proof. Relying upon the judgment of the Privy Council in A.N.Narayanan Chettyar vs. Official Assignee, AIR 1941 P.C.93 the Arbitral Tribunal held that as per the legal position the claimant/petitioner was to discharge the higher burden of proving any element of actual dishonesty by the respondent or the agent OMP (EFA) (COMM) 6/2016 Page 9 of 115 Bar and Bench (www.barandbench.com) beyond reasonable doubt. Based on the evidence on record the Arbitral Tribunal concluded that at the time of due diligence meeting that took place on 26.5.2008 it was beyond reasonable doubt that Mr.Malvinder, Mr. Kaul and Mr.Deshmukh were aware about SAR and believed that it had triggered both the US investigations and that Ranbaxy was very seriously exposed. It noted that Mr.Kaul was a close family friend of the Singh family who had retired as an Executive but had been asked by Mr.Malvinder to provide guidance to Mr.Deshmukh in handling the US investigations. Similarly, Mr.Deshmukh was employed by Ranbaxy till March 2009 and was Ranbaxy‟s Director of Intellectual Property and Senior V.P. of Global I.Department. He later acted as General Counsel of Ranbaxy. The Arbitral Tribunal concluded that it is beyond reasonable doubt that Mr.Malvinder, Mr.Kaul and Mr.Deshmukh acted fraudulently and dishonestly misleading the petitioner/claimant about the genesis, nature and severity of the US Regulatory investigations and deliberately concealed SAR from the claimants. The Arbitral Tribunal concludes that the petitioner had established on a preponderance of probabilities that Mr.Malvinder and Mr.Kaul were aware that their representations would be relied upon by the petitioner and would induce it to make a decision to enter into the SPSSA. It also concluded that the petitioner did in fact reasonably rely upon these misrepresentations in making its decision to enter into the SPSSA and that but for those misrepresentations it would not have entered into it. 11. The next issue was issue No.(b) as to whether the claimant had agreed to forego any express representation, warranty or indemnity in the SPSSA by the respondent and if so, whether that precludes the claimant from making a claim of fraud. The Arbitral Tribunal noted the contention of the respondent, OMP (EFA) (COMM) 6/2016 Page 10 of 115

Description: