anubhav infrastructure limited PDF

Preview anubhav infrastructure limited

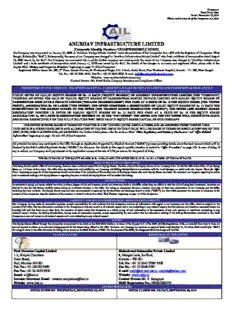

Prospectus Fixed Price Offer Dated: November 13, 2014 Please read Section 32 of the Companies Act, 2013 ANUBHAV INFRASTRUCTURE LIMITED (Corporate Identity Number: U51109WB2006PLC107433) Our Company was icorporated on January 20, 2006 as ‘Anubhav Vanijya Private Limited’ under the provisions of the Companies Act, 1956 with the Registrar of Companies, West Bengal, Kolkata (the “RoC”). Subsequently, the name of our Company was changed to ‘Anubhav Infrastructure Private Limited’ vide fresh certificate of incorporation dated August 13, 2007 issued by the RoC. Our Company was converted into a public limited company and consequently the name of our Company was changed to ‘Anubhav Infrastructure Limited’ and a fresh certificate of incorporation dated January 11, 2008 was issued by the RoC. For details of the changes in our name and registered office, please refer to the chapter titled ‘History and Corporate Structure’ beginning on page 77 of this Prospectus. Registered Office: Room No. 303, 3rd Floor, Ananta Bhavan, 94 Vivekanand Nagar, P.O. Podrah, Andul Road, Near Westbank Hospital, Howrah - 711 109, West Bengal. Tel. No.: +91 33 3261 3440, Fax No.: +91 33 2644 2626, E-mail: [email protected], Website: www.anubhavinfrastructure.com Contact Person: Ms. Swati Kedia, Company Secretary and Compliance Officer PROMOTERS OF OUR COMPANY: MR. DINESH AGARWAL, PARMESHWAR BARTER PRIVATE LIMITED AND PARMESHWAR MERCANTILE PRIVATE LIMITED PUBLIC OFFER OF 60,00,000 EQUITY SHARES OF Rs. 10 EACH (“EQUITY SHARES”) OF ANUBHAV INFRASTRUCTURE LIMITED (THE “COMPANY”) THROUGH AN OFFER FOR SALE OF 30,00,000 EQUITY SHARES BY PARMESHWAR BARTER PRIVATE LIMITED AND 30,00,000 EQUITY SHARES BY PARMESHWAR MERCANTILE PRIVATE LIMITED (“SELLING SHAREHOLDERS”) FOR CASH AT A PRICE OF Rs. 15 PER EQUITY SHARE (THE “OFFER PRICE”), AGGREGATING Rs. 900 LAKHS (“THE OFFER”). THE OFFER COMPRISES A RESERVATION OF 3,20,000 EQUITY SHARES OF Rs. 10 EACH FOR SUBSCRIPTION BY THE MARKET MAKER TO THE OFFER (THE “MARKET MAKER RESERVATION PORTION”). THE OFFER LESS MARKET MAKER RESERVATION PORTION I.E. OFFER OF 56,80,000 EQUITY SHARES OF Rs. 10 EACH FOR CASH AT A PRICE OF Rs. 15 PER EQUITY SHARE AGGREGATING Rs. 852 LAKHS IS HEREINAFTER REFERED TO AS THE “NET OFFER”. THE OFFER AND THE NET OFFER WILL CONSTITUTE 28.02% AND 26.52% RESPECTIVELY OF THE FULLY DILUTED POST ISSUE PAID UP EQUITY SHARE CAPITAL OF OUR COMPANY. THE OFFER IS BEING MADE IN TERMS OF CHAPTER X-B OF THE SEBI (ICDR) REGULATIONS, 2009 AS AMENDED FROM TIMETO TIME. THIS ISSUE IS A FIXED PRICE ISSUE AND ALLOCATION IN THE NET ISSUE TO THE PUBLIC WILL BE MADE IN TERMS OF REGULATION 43(4) OF THE SEBI (ICDR) REGULATIONS 2009, AS AMENDED. For further details please refer the sections titled ‘Other Regulatory and Statutory Disclosures’ and ‘Offer Related Information’ beginning on page 132 and 145 of this Prospectus. All potential investors may participate in the Offer through an Application Supported by Blocked Amount (“ASBA”) process providing details about the bank account which will be blocked by the Self Certified Syndicate Banks (“SCSBs”) for the same. For details in this regard, specific attention is invited to ‘Offer Procedure’ on page 152. In case of delay, if any in refund, our Company shall pay interest on the application money at the rate of 15% per annum for the period of delay. THE FACE VALUE OF THE EQUITY SHARES IS Rs. 10 EACH AND THE OFFER PRICE OF Rs. 15 I.E.1.5 TIMES OF THE FACE VALUE. RISKS IN RELATION TO FIRST OFFER This being the first public Offer of our Company, there has been no formal market for our Equity Shares. The face value of the Equity Shares of our Company is Rs. 10 and the Offer Price of Rs. 15 per Equity Share i.e. 1.5 times of face value. The Offer Price (as determined and justified by our Company and Selling Shareholders in consultation with the Lead Manager, as stated under the chapter ‘Basis for Offer Price’ beginning on page 50 of this Prospectus) should not be taken to be indicative of the market price of the Equity Shares after such Equity Shares are listed. No assurance can be given regarding an active and/ or sustained trading in the Equity Shares or regarding the price at which the Equity Shares will be traded after listing. GENERAL RISKS Investments in equity and equity-related securities involve a degree of risk and investors should not invest any funds in the Offer unless they can afford to take the risk of losing their investment. Investors are advised to read the risk factors carefully before taking an investment decision in the Offer. For taking an investment decision, investors must rely on their own examination of our Company and the Offer, including the risks involved. The Equity Shares have not been recommended or approved by the Securities and Exchange Board of India (“SEBI”), nor does SEBI guarantee the accuracy or adequacy of the contents of this Prospectus. Specific attention of the investors is invited to the section titled ‘Risk Factors’ beginning on page 12 of this Prospectus. COMPANY’S AND SELLING SHAREHOLDERS’ ABSOLUTE RESPONSIBILITY Our Company, having made all reasonable inquiries, accepts responsibility for and confirms that this Prospectus contains all information with regard to our Company and the Offer, which is material in the context of the Offer, that the information contained in this Prospectus is true and correct in all material aspects and is not misleading in any material respect, that the opinions and intentions expressed herein are honestly held and that there are no other facts, the omission of which makes this Prospectus as a whole or any of such information or the expression of any such opinions or intentions, misleading, in any material respect. Further, the Selling Shareholders, having made all reasonable inquiries, accept responsibility for and confirm that the information relating to the Selling Shareholders contained in this Draft Prospectus is true and correct in all material aspects and is not misleading in any material respect. LISTING The Equity Shares offered through this Prospectus are proposed to be listed on the BSE SME Platform. In terms of the Chapter X-B of the SEBI (ICDR) Regulations, 2009, as amended from time to time, we are not required to obtain an in-principal listing approval for the shares being offered in the Offer. However, our Company has received an approval letter dated October 22, 2014from BSE Limited (the ‘BSE’) for using its name in the offer document for listing of our shares on the SME Platform of BSE. For the purpose of the Offer, the designated Stock Exchange will be BSE. LEAD MANAGER REGISTRAR TO THE OFFER First Overseas Capital Limited Maheshwari Datamatics Private Limited 1-2, Bhupen Chambers 6, Mangoe Lane, 2nd Floor, Dalal Street, Kolkata – 700 001. Fort, Mumbai 400 001 Tel. No.: +91 33 2243 5029/ 5809 Tel. No.: +91 224050 9999 Fax No.: +91 33 2248 4787 Fax No.: +91 22 4050 9900 E-mail: [email protected], [email protected] Email: [email protected] Website: www.mdpl.in Investor Grievance Email: investor [email protected] Contact Person: Mr. S. Rajagopal Website: www.focl.in SEBI Registration No.: INR000000353 Contact Person: [●] OFFER PROGRAMME SEBI RegistOraFtFioEnR N OoP.:E [N●S] ON: WEDNESDAY, NOVEMBER 26, 2014 OFFER CLOSES ON: FRIDAY, NOVEMBER 28, 2014 TABLE OF CONTENTS TITLE PAGE SECTION I – DEFINITIONS AND ABBREVIATIONS 3 General Terms 3 Offer Related Terms 3 Company Related Terms 5 Technical Terms/ Industry Related Terms/ Abbreviations 6 SECTION II – GENERAL 9 Presentation of Financial, Industry and Market Data 9 Forward Looking Statements 11 SECTION III – RISK FACTORS 12 Internal Risks 12 External Risks 17 Prominent Notes 19 SECTION IV – INTRODUCTION 22 Summary of Industry 22 Summary of Business 24 Summary of Financial Information 25 The Offer 28 General Information 29 Capital Structure 36 SECTION V – PARTICULARS OF THE OFFER 47 Objects of the Offer 47 Basic Terms of the Offer 48 Basis for Offer Price 50 Statement of Tax Benefits 52 SECTION VI – ABOUT US 68 Industry Overview 68 Business Overview 72 Key Regulations and Policies 76 History and Corporate Structure 77 Our Management 81 Promoters and Group Companies 92 Dividend Policy 99 SECTION VII- FINANCIAL STATEMENTS 100 Financial Information 100 Management’s Discussion and Analysis of Financial Conditions and Results of Operations 116 SECTION VIII- LEGAL AND OTHER INFORMATION 124 Outstanding Litigations 124 Material Developments 128 Government and Other Approvals 129 SECTION IX- OTHER REGULATORY AND STATUTORY DISCLOSURES 132 Other Regulatory and Statutory Disclosures 132 SECTION X- OFFER RELATED INFORMATION 145 Terms of the Offer 145 Offer Structure 150 Offer Procedure 152 SECTION XI - RESTRICTIONS ON FOREIGN OWNERSHIP OF INDIAN SECURITIES 175 Restrictions on Foreign Ownership of Indian Securities 175 SECTION XII - MAIN PROVISIONS OF THE ARTICLES OF ASSOCIATION 176 SECTION XIII – OTHER INFORMATION 208 Material Contracts and Documents for Inspection 208 SECTION XIV – DECLARATION 210 2 SECTION I – DEFINITIONS AND ABBREVIATIONS In this Prospectus, unless the context otherwise requires, the terms defined and abbreviations stated hereunder shall have the meanings as assigned therewith as stated in this section. General Terms Term Description Act/ Companies Act The Companies Act, 2013 and Companies Act, 1956 to the extent applicable. Depositories Act The Depositories Act, 1996 and amendments thereto. Depository / Depositories A Depository registered with SEBI under the SEBI (Depositories and Participants) Regulations, 1996, as amended from time to time, in this case being Central Depository Services Limited (CDSL) and National Securities Depository Limited (NSDL) EPS Earnings per Share IT Act The Income Tax Act,1961 and amendments thereto Indian GAAP Generally Accepted Accounting Principles in India NAV Net Asset Value per Share PAT Profit after Tax RONW Return on Net Worth ROC / Registrar of The Registrar of Companies, West Bengal, Kolkata at Nizam Palace, 2nd MSO Companies Building, 2nd Floor, 234/4, A.J.C. Bose Road, Kolkata - 700020 SEBI Securities and Exchange Board of India constituted under the SEBI Act, 1992 SEBI Act Securities and Exchange Board of India Act, 1992 and amendments thereto SEBI Regulations/ SEBI SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 issued by ICDR Regulations SEBI on August 26, 2009, as amended, including instructions and clarifications issued by SEBI from time to time. SEBI Insider Trading Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations Regulations, 1992, as amended, including instructions and clarifications issued by SEBI from time to time SEBI Takeover Regulations / The SEBI (SAST) Regulations 2011 which came into effect from October 22, Takeover Code/ Takeover 2011 and subsequent amendments thereto. Regulations/ SEBI (SAST) Regulations Securities Act United States Securities Act of 1933, as amended. Wealth Tax Act The Wealth Tax Act, 1957 and amendments thereto. Offer Related Terms Terms Description Allotment Unless the context otherwise requires, the allocation and transfer of the Equity Shares pursuant to the Offer to successful Applicants Allottee The successful applicant to whom the Equity Shares are being/ have been allotted Applicant(s) Any prospective investor who makes an application for Equity Shares in terms of this Prospectus Application Amount The amount at which the Applicant makes an application for Equity Shares of our Company in terms of this Prospectus. Application Form The form in terms of which the Applicant shall apply for the Equity Shares of our Company Application Supported by An application, whether physical or electronic, used by Applicants, to make an Blocked Amount/ASBA Application authorising an SCSB to block the Application Amount in the ASBA Account maintained with the SCSB. ASBA is mandatory for QIBs and Non Institutional Applicants participating in the Offer ASBA Investor/ ASBA Any prospective investor (s) / applicant(s) in the Offer who apply(ies) through the Applicant ASBA Process Banker(s) to the Company HDFC Bank Limited Banker(s) to the Offer/ HDFC Bank Limited Escrow Collection Bank(s) Basis of Allotment The basis on which the Equity Shares will be Allotted to successful Applicants under the Offer in consultation with the Stock Exchange which is described in the 3 Chapter titled ‘Offer Procedure’ beginning on page 152 of this Prospectus BSE BSE Limited Demographic Details The demographic details of the Applicants such as their Address, PAN, Occupation and Bank Account details Depository Participant A Depository Participant as defined under the Depositories Act, 1996 Draft Prospectus Draft Prospectus dated September 27, 2014 filed with BSE Escrow Account Account opened/ to be opened with the Escrow Collection Bank(s) and in whose favour the Applicant (excluding the ASBA Applicant) will issue cheques or drafts in respect of the Application Amount when submitting an Application Escrow Agreement Agreement dated September 17, 2014 entered into amongst our Company, Lead Manager, the Registrar, the Banker(s) to the Offer/ Escrow Collection Bank(s) for collection of the Application Amounts and for remitting refunds (if any) of the amounts collected to the Applicants (excluding the ASBA Applicants) on the terms and condition thereof Escrow Collection Bank(s) The banks which are clearing members and registered with SEBI as Banker(s) to the Offer/ Escrow Collection Bank(s) at which bank(s) the Escrow Account of our Company will be opened Equity Shares Equity Shares of our Company of Face Value of Rs. 10 each being offered under the Offer unless otherwise specified in the context thereof IPO Initial Public Offering Listing Agreement Unless the context specifies otherwise, this means the SME Equity Listing Agreement to be signed between our Company and the SME Platform of BSE. LM / Lead Manager Lead Manager to the Offer, in this case being First Overseas Capital Limited Market Maker 4A Securities Limited Market Making Agreement The agreement entered into between the Lead Manager, Market Maker, and our Company dated September 17, 2014 Net Offer The Offer (excluding the Market Maker Reservation Portion) of 56,80,000 Equity Shares of Rs. 10 each of M/s. Anubhav Infrastructure Limited at Rs. 15 (including share premium of Rs. 5) per Equity Share aggregating to Rs. 852.00 Lakhs Non-Institutional Applicants All Applicants that are not Qualified Institutional Buyers or Individual Investors and who have applied for Equity Shares for an amount more than Rs. 2,00,000 (but not including NRIs other than Eligible NRSs) Offer / Offer Size / Public The Public Offer of 60,00,000 Equity Shares of Rs. 10 each at Rs. 15 (including Offer share premium of Rs. 5) per Equity Share aggregating to Rs. 900.00 Lakhs by Anubhav Infrastructure Limited Offer Price The price at which the Equity Shares will be transferred and Allotted in terms of this Prospectus being Rs. 15 Prospectus This Prospectus, filed with the RoC containing, inter alia, the Offer opening and closing dates and other information Qualified Institutional As defined under the SEBI ICDR Regulations, including public financial Buyers / QIBs institutions as specified in Section 2 (72) of the Companies Act, 2013 scheduled commercial banks, mutual fund registered with SEBI, Alternative Investment Funds, multilateral and bilateral development financial institution, venture capital fund registered with SEBI, foreign venture capital investor registered with SEBI, state industrial development corporation, insurance company registered with Insurance Regulatory and Development Authority, provident fund with minimum corpus of Rs. 2,500 Lakhs, pension fund with minimum corpus of Rs. 2,500 Lakhs, National Investment Fund set up by resolution No. F. No. 2/3/2005-DDII dated November 23, 2005 of the Government of India published in the Gazette of India and insurance funds set up and managed by army, navy or air force of the Union of India, Insurance funds set up and managed by the Department of Posts, India Refund Account Account opened / to be opened with a SEBI Registered Banker to the Offer from which the refunds of the whole or part of the Application Amount (excluding to the ASBA Applicants), if any, shall be made Refund Bank HDFC Bank Limited Refunds through electronic Refunds through electronic transfer of funds means refunds through ECS, Direct transfer of funds Credit or RTGS or NEFT or the ASBA process, as applicable Registrar/ Registrar to the Maheshwari Datamatics Private Limited Offer 4 Retail Individual Investors Individual investors (including HUFs, in the name of Karta and Eligible NRIs) who apply for the Equity Shares of a value of not more than Rs. 2,00,000 Revision Form The form used by the Applicants to modify the quantity of Equity Shares in any of their Application Forms or any previous Revision Form(s) SCSB A Self Certified Syndicate Bank registered with SEBI under the SEBI (Bankers to an Issue) Regulations, 1994 and offers the facility of ASBA, including blocking of bank account. A list of all SCSBs is available at http://www.sebi.gov.in/pmd/scsb.pdf Selling Shareholders Parmeshwar Barter Private Limited and Parmeshwar Mercantile Private Limited SME Platform of BSE The SME Platform of BSE for listing of equity shares offered under Chapter X- B of the SEBI (ICDR) Regulations which was approved by SEBI as an SME Exchange on September 27, 2011. Underwriters First Overseas Capital Limited and 4A Securities Limited Underwriting Agreement The Agreement entered into between the Underwriters, the Selling Shareholders and our Company dated this September 17, 2014. Working Days All days on which banks in Mumbai are open for business except Sunday and public holiday, provided however during the Offer period a working day means all days on which banks in Mumbai are open for business and shall not include a Saturday, Sunday or a public holiday. Company Related Terms Terms Description Anubhav Infrastructure Unless the context otherwise requires, refers to Anubhav Infrastructure Limited, a Limited / Anubhav / Company incorporated under the Companies Act, 1956 and having its registered Anubhav Infrastructure / office at Room No. 303, 3rd Floor, Ananta Bhavan, 94 Vivekanand Nagar, P.O. AIL / We / us / our Podrah, Andul Road, Near Westbank Hospital, Howrah - 711 109, West Bengal. Company / the Company / the Issuer Articles / Articles of Unless the context otherwise requires, requires, refers to the Articles of Association /AoA Association of Anubhav Infrastructure Limited, as amended from time to time. Auditors/ Statutory Auditors/ The Statutory Auditors to the Company (Peer Review Auditor), being M/s. Ghoshal Statutory Auditors of the & Co., Chartered Accountants. Company Audit Committee The committee of the Board of Directors constituted as the Company‘s Audit Committee in accordance with Section 177 of the Companies Act, 2013 and Clause 52 of the SME Listing Agreement to be entered into with the BSE. Board of Directors / Board The Board of Directors of our Company, including all duly constituted Committee(s) thereof. CIN Corporate Identity Number - U51109WB2006PLC107433 Director (s)/ Directors of our Directors of our Company unless otherwise specified Company Group Companies Includes those companies, firms and ventures promoted by our Promoters, irrespective of whether such entities are covered under Section 370(1)(B) of the Companies Act and disclosed in ‘Promoters and Group Companies’ beginning on page 92 of this Prospectus. Key Managerial Personnel / The personnel listed as Key Managerial Personnel in the chapter titled ‘Our KMP Management’ beginning on page 81 of this Prospectus MOA / Memorandum / Memorandum of Association of Anubhav Infrastructure Limited Memorandum of Association Promoter/ Promoters of our Mr. Dinesh Agarwal, Parmeshwar Barter Private Limited (PBPL) and Parmeshwar Company Mercantile Private Limited (PMPL) Promoter Companies Parmeshwar Barter Private Limited (PBPL) and Parmeshwar Mercantile Private Limited ( PMPL) Promoter Group Unless the context otherwise requires, refers to such persons and entities constituting the Promoter Group of our Company in terms of Regulation 2(1)(zb) of the SEBI (ICDR) Regulations, 2009 and as disclosed in ‘Promoters and Group Companies’ beginning on page 92 of this Prospectus. Registered Office The Registered Office of our Company which is located at Room No. 303, 3rd Floor, Ananta Bhavan, 94 Vivekanand Nagar, P.O. Podrah, Andul Road, Near Westbank Hospital, Howrah - 711 109, West Bengal. 5 Stock Exchange Unless the context requires otherwise, refers to, the BSE Limited Technical Terms/ Industry Related Terms/ Abbreviations Term Description AAI Airports Authority of India A/c Account ACS Associate Company Secretary AGM Annual General Meeting AS Accounting Standards as issued by the Institute of Chartered Accountants of India ASBA Applications Supported by Blocked Amount AY Assessment Year BG Bank Guarantee Bn Billion BOM Bill on Materials BOO Build, Own, Operate BOOT Build, Own, Operate and Transfer BOT Build, Operate and Transfer BSE BSE Limited (formerly known as The Bombay Stock Exchange Limited) CAGR Compounded Annual Growth Rate CDSL Central Depository Services (India) Limited CEA Central Electricity Authority CFO Chief Financial Officer CFT Cubic Feet CIN Company Identification Number CIT Commissioner of Income Tax CLRA Contract Labour ( Regulation and Abolition) Act, 1970 CPWD Central Public Works Department CSO Central Statistical Organisation DBFO Design Build Finance Operate DEPB Duty entitlement pass book scheme DIN Director Identification Number DP Depository Participant DWT Dead Weight Tonnage EASF Essential Air Services Fund EBR Extra-Budgetary Resources ECS Electronic Clearing System EGM Extraordinary General Meeting EOU Export Oriented Unit EPC Engineering Procurement and Commissioning EPCG Export Promotion Capital Goods Scheme EPS Earnings Per Share EPZ Export Processing Zone F&NG Father and Natural Guardian FDI Foreign Direct Investment Foreign Exchange Management Act, 1999, as amended from time to time, and the FEMA regulations framed there under Foreign Institutional Investor, as defined under the Securities and Exchange FIIs Board of India (Foreign Institutional Investors) Regulations, 1995, as amended from time to time and registered with the SEBI under applicable laws in India FIPB Foreign Investment Promotion Board FTWZ Free Trade and Warehousing Zone Period of twelve months ended March 31 of that particular year, unless FY/ Fiscal/ Financial Year otherwise stated GBS Gross Budgetary Support GDP Gross Domestic Product GoI/ Government Government of India GQ Golden Quadrilateral HUF Hindu Undivided Family 6 I.R. Internal resources I.T. Act Income Tax Act, 1961, as amended from time to time ICSI Institute of Company Secretaries Of India IEBR Internal resources and Extra-Budgetary Resources IT Information Technology Km Kilometres LC Letter of Credit LNG Liquefied Natural Gas LSTK Lump Sum Turnkey LT Low Tension MAPIN Market Participants and Investors’ Integrated Database Merchant Banker as defined under the Securities and Exchange Board of India Merchant Banker (Merchant Bankers) Regulations, 1992 MHUD Ministry of Housing and Urban Development MoF Ministry of Finance, Government of India MOU Memorandum of Understanding MT Metric Tonnes NA Not Applicable NAV Net Asset Value NHAI National Highway Authority of India NHDP National Highway Development Projects NPV Net Present Value NRE Account Non Resident External Account NRIs Non Resident Indians NRO Account Non Resident Ordinary Account NSDC National Skill Development Council NSDL National Securities Depository Limited NS-EW North, South, East, West O&M Operations and Maintenance OCB Overseas Corporate Bodies p.a. per annum P/E Ratio Price/ Earnings Ratio PAC Persons Acting in Concert PAN Permanent Account Number PAT Profit After Tax PE Private Equity PPP Public Private Partnership QIC Quarterly Income Certificate RACF Regional Air Connectivity Fund RBI The Reserve Bank of India REIT Real Estate Information Technology REMF Real Estate Mutual Fund ROE Return on Equity RONW Return on Net Worth Rs. Rupees, the official currency of the Republic of India RSOP Regional Scheduled Operator Permit RTGS Real Time Gross Settlement SCRA Securities Contract (Regulation) Act, 1956, as amended from time to time SCRR Securities Contracts (Regulation) Rules, 1957, as amended from time to time. Sec. Section SEZ Special Economic Zone SOP Standard Operating Procedure SPV Special Purpose Vehicle SSI Small Scale Industry STT Securities Transaction Tax US/ United States United States of America USD/ US$/ $ United States Dollar, the official currency of the Unites States of America Foreign Venture Capital Funds (as defined under the Securities and Exchange VCF / Venture Capital Fund Board of India (Venture Capital Funds) Regulations, 1996) registered with SEBI under applicable laws in India. 7 Working Days All days except Saturday, Sunday and any public holiday Notwithstanding the foregoing: 1. In the section titled ‘Main Provisions of the Articles of Association’ beginning on page 176 of this Prospectus, defined terms shall have the meaning given to such terms in that section; 2. In the chapters titled ‘Summary of Business’ and ‘Business Overview’ beginning on page 24 and 72 respectively, of this Prospectus, defined terms shall have the meaning given to such terms in that section; 3. In the section titled ‘Risk Factors’ beginning on page 12 of this Prospectus, defined terms shall have the meaning given to such terms in that section; 4. In the chapter titled ‘Statement of Tax Benefits’ beginning on page 52 of this Prospectus, defined terms shall have the meaning given to such terms in that section; 5. In the chapter titled ‘Management’s Discussion and Analysis of Financial Conditions and Results of Operations’ beginning on page 116 of this Prospectus, defined terms shall have the meaning given to such terms in that section. 8 SECTION II - GENERAL CERTAIN CONVENTIONS, USE OF FINANCIAL, CURRENCY, INDUSTRY AND MARKET DATA Certain Conventions All references in the Prospectus to “India” are to the Republic of India. All references in the Prospectus to the “U.S.”, “USA” or “United States” are to the United States of America. Financial Data Unless stated otherwise, the financial data in the Prospectus is derived from our audited financial statements as on and for the period ended June 30, 2014 and financial years ended March 31, 2014, 2013, 2012, 2011 and 2010 prepared in accordance with Indian GAAP, Accounting Standards, the Companies Act and restated in accordance with the SEBI ICDR Regulations and the Indian GAAP which are included in this Prospectus, and set out in the section titled ‘Financial Statements’ beginning on page 100 of this Prospectus. Our Financial Year commences on April 1 and ends on March 31 of the following year, so all references to a particular Financial Year are to the twelve-month period ended March 31 of that year. In this Prospectus, discrepancies in any table, graphs or charts between the total and the sums of the amounts listed are due to rounding-off. There are significant differences between Indian GAAP, IFRS and U.S. GAAP. Our Company has not attempted to explain those differences or quantify their impact on the financial data included herein, nor do we provide a reconciliation of our financial statements to those under U.S. GAAP or IFRS and the investors should consult their own advisors regarding such differences and their impact on the financial data. Accordingly, the degree to which the restated financial statements included in this Prospectus will provide meaningful information is entirely dependent on the reader's level of familiarity with Indian accounting practices Indian GAAP, the Companies Act and the SEBI Regulations. Any reliance by persons not familiar with Indian accounting practices on the financial disclosures presented in this Prospectus should accordingly be limited. In the Prospectus, any discrepancies in any table between total and the sum of the amounts listed are due to rounding-off. All decimals have been rounded off to two decimal points. Any percentage amounts, as set forth in the chapters titled ‘Risk Factors’, ‘Business Overview’ and ‘Management's Discussion and Analysis of Financial Conditions and Results of Operations’ beginning on page 12, 72 and 116, respectively, of this Prospectus and elsewhere in this Prospectus, unless otherwise indicated, have been calculated on the basis of our restated financial statements prepared in accordance with Indian GAAP, the Companies Act and restated in accordance with the SEBI ICDR Regulations and the Indian GAAP. Currency and units of presentation In the Prospectus, unless the context otherwise requires, all references to; • ‘Rupees’ or ‘Rs.’ or ‘INR’ are to Indian rupees, the official currency of the Republic of India. • ‘US Dollars’ or ‘US$’ or ‘USD’ or ‘$’ are to United States Dollars, the official currency of the United States of America. All references to the word ‘Lakh’ or ‘Lac’, means ‘One hundred thousand’ and the word ‘Million’ means ‘Ten Lakhs’ and the word ‘Crore’ means ‘Ten Million’ and the word ‘Billion’ means ‘One thousand Million’. Industry and Market Data Unless stated otherwise, industry data used throughout this Prospectus has been obtained or derived from industry and government publications, publicly available information and sources. Industry publications generally state that the information contained in those publications has been obtained from sources believed to be reliable but that their accuracy and completeness are not guaranteed and their reliability cannot be assured. Although our Company believes that industry data used in this Prospectus is reliable, it has not been independently verified. 9 Further, the extent to which the industry and market data presented in the Prospectus is meaningful depends on the reader's familiarity with and understanding of, the methodologies used in compiling such data. There are no standard data gathering methodologies in the industry in which we conduct our business, and methodologies and assumptions may vary widely among different industry sources. 10

Description: