Alibaba's F-1 PDF

Preview Alibaba's F-1

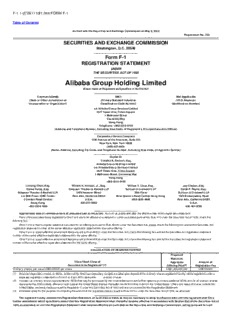

F-1 1 d709111df1.htm FORM F-1 Table of Contents As filed with the Securities and Exchange Commission on May 6, 2014 Registration No. 333- SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form F-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Alibaba Group Holding Limited (Exact name of Registrant as Specified in its Charter) Cayman Islands 5961 Not Applicable (State or Other Jurisdiction of (Primary Standard Industrial (I.R.S. Employer Incorporation or Organization) Classification Code Number) Identification Number) c/o Alibaba Group Services Limited 26/F Tower One, Times Square 1 Matheson Street Causeway Bay Hong Kong Telephone: +852-2215-5100 (Address and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) Corporation Service Company 1180 Avenue of the Americas, Suite 210 New York, New York 10036 (800) 927-9801 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) Copies to: Timothy A. Steinert, Esq. Alibaba Group Holding Limited c/o Alibaba Group Services Limited 26/F Tower One, Times Square 1 Matheson Street, Causeway Bay Hong Kong +852-2215-5100 Leiming Chen, Esq. William H. Hinman, Jr., Esq. William Y. Chua, Esq. Jay Clayton, Esq. Daniel Fertig, Esq. Simpson Thacher & Bartlett LLP Sullivan & Cromwell LLP Sarah P. Payne, Esq. Simpson Thacher & Bartlett LLP 2475 Hanover Street 28th Floor Sullivan & Cromwell LLP c/o 35th Floor, ICBC Tower Palo Alto, California 94304 Nine Queen’s Road Central Hong Kong 1870 Embarcadero Road 3 Garden Road Central U.S.A. +852-2826-8688 Palo Alto, California 94303 Hong Kong 650-251-5000 U.S.A. +852-2514-7600 650-461-5700 Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨ If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ CALCULATION OF REGISTRATION FEE Proposed Maximum Title of Each Class of Aggregate Amount of Securities to be Registered(1)(2) Offering Price(3) Registration Fee Ordinary shares, par value US$0.000025 per share US$1,000,000,000 US$128,800 (1) American depositary shares, or ADSs, evidenced by American depositary receipts issuable upon deposit of the ordinary shares registered hereby will be registered under a separate registration statement on Form F-6. Each ADS represents ordinary shares. (2) Includes (a) ordinary shares represented by ADSs that may be purchased by the underwriters pursuant to their option to purchase additional ADSs and (b) all ordinary shares represented by ADSs initially offered or sold outside the United States that are thereafter resold from time to time in the United States. Offers and sales of shares outside the United States are being made pursuant to Regulation S under the Securities Act of 1933 and are not covered by this Registration Statement. (3) Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine. Table of Contents The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the United States Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to Completion, Dated , 2014 American Depositary Shares Representing Ordinary Shares Alibaba Group Holding Limited This is the initial public offering of Alibaba Group Holding Limited, or Alibaba Group. We are offering American Depositary Shares, or ADSs, and the selling shareholders named in this prospectus are offering ADSs. Each ADS represents ordinary shares, par value US$0.000025 per share. We expect that the initial public offering price of the ADSs will be between US$ and US$ per ADS. We will not receive any proceeds from the ADSs sold by the selling shareholders. Pursuant to our memorandum and articles of association, a partnership, or the Alibaba Partnership, comprised of certain management members of our company and our related companies and affiliates, will have the exclusive right to nominate a simple majority of the board of directors of our company. See “Alibaba Partnership” and “Description of Share Capital — Ordinary Shares — Nomination, Election and Removal of Directors.” Prior to this offering, there has been no public market for our ADSs or ordinary shares. We will apply for listing of our ADSs on the New York Stock Exchange or the Nasdaq Global Market under the symbol “ .” Investing in our ADSs involves risk. See “Risk Factors” beginning on page 20. Per ADS Total Price to public US$ US$ Underwriting discounts and commissions US$ US$ Proceeds, before expenses, to us US$ US$ Proceeds, before expenses, to the selling shareholders US$ US$ We and certain selling shareholders have granted the underwriters the right to purchase up to an aggregate of additional ADSs. Neither the United States Securities and Exchange Commission nor any state securities commission or any other regulatory body has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The underwriters expect to deliver the ADSs against payment in U.S. dollars to purchasers on or about , 2014 Credit Suisse Deutsche Bank Goldman Sachs J.P. Morgan Morgan Stanley Citi , 2014. Table of Contents Table of Contents Table of Contents Table of Contents TABLE OF CONTENTS Page Prospectus Summary 1 Risk Factors 20 Special Note Regarding Forward-Looking Statements 58 Industry Data and User Metrics 59 Use of Proceeds 60 Dividend Policy 61 Capitalization 62 Dilution 64 Exchange Rate Information 66 Enforcement of Civil Liabilities 67 Our History and Corporate Structure 69 Selected Consolidated Financial and Operating Data 76 Management’s Discussion and Analysis of Financial Condition and Results of Operations 82 Business 122 Regulation 174 Alibaba Partnership 186 Our Directors 189 Our Executive Officers 193 Principal and Selling Shareholders 198 Related Party Transactions 200 Description of Share Capital 206 Description of American Depositary Shares 222 Shares Eligible for Future Sale 231 Taxation 233 Underwriting 240 Expenses Related to this Offering 246 Legal Matters 247 Experts 247 Where You Can Find More Information 248 Index to Financial Statements F-1 You should rely only on the information contained in this prospectus. We have not authorized anyone to provide information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, ADSs only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our ADSs. Until , 2014 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions. Table of Contents PROSPECTUS SUMMARY This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary may not contain all of the information that you should consider before investing in our ADSs. You should carefully read the entire prospectus, including “Risk Factors” and the financial statements, before making an investment decision. Our Mission Our mission is to make it easy to do business anywhere. Our founders started our company to champion small businesses, in the belief that the Internet would level the playing field by enabling small enterprises to leverage innovation and technology to grow and compete more effectively in the domestic and global economies. Our decisions are guided by how they serve our mission over the long-term, not by the pursuit of short-term gains. Our Business We are the largest online and mobile commerce company in the world in terms of gross merchandise volume in 2013, according to industry sources. We operate our ecosystem as a platform for third parties, and we do not engage in direct sales, compete with our merchants or hold inventory. We operate Taobao Marketplace, China’s largest online shopping destination, Tmall, China’s largest third-party platform for brands and retailers, in each case in terms of gross merchandise volume, and Juhuasuan, China’s most popular group buying marketplace by its monthly active users, in each case in 2013 according to iResearch. These three marketplaces, which comprise our China retail marketplaces, generated a combined GMV of RMB1,542 billion (US$248 billion) from 231 million active buyers and 8 million active sellers in the twelve months ended December 31, 2013. A significant portion of our customers have begun transacting on our mobile platform, and we are focused on capturing this opportunity. In the three months ended December 31, 2013, mobile GMV accounted for 19.7% of our GMV, up from 7.4% in the same period in the previous year. In addition to our three China retail marketplaces, which accounted for 82.7% of our revenues in the nine months ended December 31, 2013, we operate Alibaba.com, China’s largest global online wholesale marketplace in 2013 by revenue, according to iResearch, 1688.com, our China wholesale marketplace, and AliExpress, our global consumer marketplace, as well as provide cloud computing services. As a platform, we provide the fundamental technology infrastructure and marketing reach to help businesses leverage the power of the Internet to establish an online presence and conduct commerce with consumers and businesses. We have been a leader in developing online marketplace standards in China. Given the scale we have been able to achieve, an ecosystem has developed around our platform that consists of buyers, sellers, third-party service providers, strategic alliance partners, and investee companies. Our platform and the role we play in connecting buyers and sellers and making it possible for them to do business anytime and anywhere is at the nexus of this ecosystem. Much of our effort, our time and our energy is spent on initiatives that are for the greater good of the ecosystem and the various participants in it. We feel a strong responsibility for the continued development of the ecosystem and we take ownership for this development. Accordingly, we refer to this as “our ecosystem.” Our ecosystem has strong self-reinforcing network effects that benefit our marketplace participants, who are invested in our ecosystem’s growth and success. Through this ecosystem, we have transformed how commerce is conducted in China and built a reputation as a trusted partner for the participants in our ecosystem. We have made significant investments in proprietary technologies and infrastructure in order to support our growing ecosystem. Our technology and infrastructure allow us to harness the substantial volume of data generated from our marketplaces and to further develop and optimize the products and services offered on our platform. 1 Table of Contents Through, our related company, Alipay, we offer payment and escrow services for buyers and sellers, providing security, trust and convenience to our users. We take a platform approach to shipping and delivery by working with third-party logistics service providers through a central logistics information system operated by Zhejiang Cainiao Supply Chain Management Co., Ltd., or China Smart Logistics, our 48%-owned affiliate. Through our investment in UCWeb, we are able to leverage its expertise as a developer and operator of mobile web browsers to enhance our mobile offerings beyond e-commerce, such as general mobile search. Our revenue is primarily generated from merchants through online marketing services (via Alimama, our proprietary online marketing platform), commissions on transactions and fees for online services. We also generate revenues through fees from memberships, value-added services and cloud computing services. In the nine months ended December 31, 2013, we generated revenue of RMB40.5 billion (US$6.5 billion) and net income of RMB17.7 billion (US$2.9 billion). Our fiscal year ends on March 31. Our Key Metrics We have experienced significant growth across various key metrics for our China retail marketplaces: 2 Table of Contents Our business and our ecosystem as a whole have achieved significant scale and size: Our Scale and Size Scale and Size of Our Ecosystem Participants Unless otherwise indicated, all figures in the above charts are for the twelve months ended, or as of, December 31, 2013, and in the case of our scale and size, on our China retail marketplaces. (1) For the three months ended December 31, 2013. (2) According to iResearch. Excluding virtual items. (3) For the month ended December 31, 2013. Based on the aggregate mobile MAUs of apps that contribute to GMV on our China retail marketplaces. (4) Representing 54% of the 9.2 billion packages delivered in 2013 by delivery services in China meeting certain minimum revenue thresholds, according to the State Post Bureau of the PRC. (5) Alibaba Cloud Computing processing capability as of December 31, 2013. (6) The sum of merchants on our (i) China retail marketplaces who paid fees and/or commissions to us in 2013, plus (ii) wholesale marketplaces with current paid memberships as of December 31, 2013. A merchant may have more than one paying relationship with us. (7) Includes registered countries and territories of (i) buyers that sent at least one inquiry to a seller on Alibaba.com and (ii) buyers that settled at least one transaction on AliExpress through Alipay, in each case in 2013. (8) For the twelve months ended December 31, 2013. Approximately 37.6% of Alipay’s total payment volume in 2013 represented payments processed for our China retail marketplaces. (9) Marketing affiliates who received a revenue share from us in the three months ended December 31, 2013. (10) Based on data provided by our 14 strategic delivery partners companies as of March 2014. 3

Description: