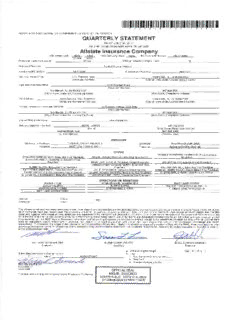

2017 2nd Quarter AIC Quarterly Statutory Statement. PDF

Preview 2017 2nd Quarter AIC Quarterly Statutory Statement.

STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY ASSETS Current Statement Date 4 1 2 3 December 31 Net Admitted Assets Prior Year Net Assets Nonadmitted Assets (Cols. 1 - 2) Admitted Assets 1. Bonds 26,810,815,538 26,810,815,538 25,376,295,554 2. Stocks: 2.1 Preferred stocks 74,831,502 74,831,502 63,865,604 2.2 Common stocks 8,861,923,245 5,674,697 8,856,248,548 8,398,570,589 3. Mortgage loans on real estate: 3.1 First liens 297,134,441 297,134,441 280,368,275 3.2 Other than first liens 4. Real estate: 4.1 Properties occupied by the company (less $ encumbrances) 241,421,638 241,421,638 252,633,337 4.2 Properties held for the production of income (less $ encumbrances) 93,207,701 93,207,701 93,569,519 4.3 Properties held for sale (less $ encumbrances) 5. Cash ($ (849,430,435)), cash equivalents ($ 255,716,901 ) and short-term investments ($ 1,074,730,790 ) 481,017,256 481,017,256 1,114,219,919 6. Contract loans (including $ premium notes) 7. Derivatives 26,446,242 26,446,242 19,438,210 8. Other invested assets 3,916,248,882 26,145,672 3,890,103,210 3,636,477,209 9. Receivables for securities 138,303,105 138,303,105 6,934,716 10. Securities lending reinvested collateral assets 20,506,766 20,506,766 1,431,993 11. Aggregate write-ins for invested assets 12. Subtotals, cash and invested assets (Lines 1 to 11) 40,961,856,316 31,820,369 40,930,035,947 39,243,804,926 13. Title plants less $ charged off (for Title insurers only) 14. Investment income due and accrued 222,668,437 222,668,437 217,557,263 15. Premiums and considerations: 15.1 Uncollected premiums and agents' balances in the course of collection 1,226,273,035 43,604,584 1,182,668,451 1,271,736,833 15.2 Deferred premiums, agents' balances and installments booked but deferred and not yet due (including $ earned but unbilled premiums) 3,445,139,566 3,445,139,566 3,304,252,657 15.3 Accrued retrospective premiums ($ ) and contracts subject to redetermination ($ ) 16. Reinsurance: 16.1 Amounts recoverable from reinsurers 54,542,277 54,542,277 64,137,815 16.2 Funds held by or deposited with reinsured companies 98,429 662 97,767 78,446 16.3 Other amounts receivable under reinsurance contracts 200,127 200,127 518,833 17. Amounts receivable relating to uninsured plans 18.1 Current federal and foreign income tax recoverable and interest thereon 18.2 Net deferred tax asset 1,169,119,641 1,169,119,641 1,188,442,553 19. Guaranty funds receivable or on deposit 20. Electronic data processing equipment and software 344,980,943 271,916,027 73,064,916 70,080,378 21. Furniture and equipment, including health care delivery assets ($ ) 291,733,840 291,733,840 22. Net adjustment in assets and liabilities due to foreign exchange rates 23. Receivables from parent, subsidiaries and affiliates 191,876,600 191,876,600 199,855,869 24. Health care ($ ) and other amounts receivable 25. Aggregate write-ins for other than invested assets 294,955,730 218,934,577 76,021,153 63,765,367 26. Total assets excluding Separate Accounts, Segregated Accounts and Protected Cell Accounts (Lines 12 to 25) 48,203,444,941 858,010,059 47,345,434,882 45,624,230,940 27. From Separate Accounts, Segregated Accounts and Protected Cell Accounts 28. Total (Lines 26 and 27) 48,203,444,941 858,010,059 47,345,434,882 45,624,230,940 DETAILS OF WRITE-INS 1101. 1102. 1103. 1198. Summary of remaining write-ins for Line 11 from overflow page 1199. Totals (Lines 1101 through 1103 plus 1198)(Line 11 above) 2501. Accounts receivable 66,316,398 34,187 66,282,211 61,026,092 2502. Prepaid assessments 117,573,607 111,362,410 6,211,197 2,203,620 2503. Collateral 2,347,900 2,347,900 70,285 2598. Summary of remaining write-ins for Line 25 from overflow page 108,717,825 107,537,980 1,179,845 465,370 2599. Totals (Lines 2501 through 2503 plus 2598)(Line 25 above) 294,955,730 218,934,577 76,021,153 63,765,367 2 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY LIABILITIES, SURPLUS AND OTHER FUNDS 1 2 Current December 31, Statement Date Prior Year 1. Losses (current accident year $ 3,957,058,792 ) 13,258,089,585 12,868,748,709 2. Reinsurance payable on paid losses and loss adjustment expenses 1,224,906 1,216,552 3. Loss adjustment expenses 3,696,457,499 3,557,060,649 4. Commissions payable, contingent commissions and other similar charges 191,781,119 182,330,634 5. Other expenses (excluding taxes, licenses and fees) 937,946,687 997,405,650 6. Taxes, licenses and fees (excluding federal and foreign income taxes) 80,428,643 104,710,719 7.1 Current federal and foreign income taxes (including $ on realized capital gains (losses)) 216,694,239 338,748,504 7.2 Net deferred tax liability 8. Borrowed money $ and interest thereon $ 9. Unearned premiums (after deducting unearned premiums for ceded reinsurance of $ 155,855,510 and including warranty reserves of $ and accrued accident and health experience rating refunds including $ for medical loss ratio rebate per the Public Health Service Act) 9,858,960,790 9,903,638,512 10. Advance premium 451,119,973 296,683,758 11. Dividends declared and unpaid: 11.1 Stockholders 11.2 Policyholders 12. Ceded reinsurance premiums payable (net of ceding commissions) 5,180,158 5,830,881 13. Funds held by company under reinsurance treaties 2,424,618 2,331,433 14. Amounts withheld or retained by company for account of others 38,866,985 32,454,591 15. Remittances and items not allocated 28,323,270 20,466,698 16. Provision for reinsurance (including $ certified) 45,863,235 39,285,477 17. Net adjustments in assets and liabilities due to foreign exchange rates 7,787 10,808 18. Drafts outstanding 19. Payable to parent, subsidiaries and affiliates 214,207,383 214,366,073 20. Derivatives 14,270,840 5,476,013 21. Payable for securities 451,151,279 503,026,559 22. Payable for securities lending 593,886,211 578,135,741 23. Liability for amounts held under uninsured plans 24. Capital notes $ and interest thereon $ 25. Aggregate write-ins for liabilities 380,335,092 412,355,355 26. Total liabilities excluding protected cell liabilities (Lines 1 through 25) 30,467,220,299 30,064,283,316 27. Protected cell liabilities 28. Total liabilities (Lines 26 and 27) 30,467,220,299 30,064,283,316 29. Aggregate write-ins for special surplus funds 35,595,678 37,724,657 30. Common capital stock 3,903,300 3,903,300 31. Preferred capital stock 32. Aggregate write-ins for other than special surplus funds 33. Surplus notes 34. Gross paid in and contributed surplus 3,428,713,602 3,398,126,117 35. Unassigned funds (surplus) 13,410,002,003 12,120,193,550 36. Less treasury stock, at cost: 36.1 shares common (value included in Line 30 $ ) 36.2 shares preferred (value included in Line 31 $ ) 37. Surplus as regards policyholders (Lines 29 to 35, less 36) 16,878,214,583 15,559,947,624 38. Totals (Page 2, Line 28, Col. 3) 47,345,434,882 45,624,230,940 DETAILS OF WRITE-INS 2501. Accounts payable 228,985,469 236,338,679 2502. Reserve for uncashed checks 112,131,598 114,848,757 2503. Deferred gain on intercompany asset transfers 24,507,925 26,328,139 2598. Summary of remaining write-ins for Line 25 from overflow page 14,710,100 34,839,780 2599. Totals (Lines 2501 through 2503 plus 2598)(Line 25 above) 380,335,092 412,355,355 2901. Deferred gain on sale/leaseback 30,554,314 32,515,917 2902. SCOR retroactive reinsurance account 5,041,364 5,208,740 2903. 2998. Summary of remaining write-ins for Line 29 from overflow page 2999. Totals (Lines 2901 through 2903 plus 2998)(Line 29 above) 35,595,678 37,724,657 3201. 3202. 3203. 3298. Summary of remaining write-ins for Line 32 from overflow page 3299. Totals (Lines 3201 through 3203 plus 3298)(Line 32 above) 3 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY STATEMENT OF INCOME 1 2 3 Current Prior Year Prior Year Ended Year to Date to Date December 31 UNDERWRITING INCOME 1. Premiums earned: 1.1 Direct (written $ 2,981,315,881 ) 3,094,141,417 3,291,036,365 6,476,002,692 1.2 Assumed (written $ 11,530,159,861 ) 11,472,847,534 10,986,876,968 22,275,681,533 1.3 Ceded (written $ 177,211,940 ) 188,047,427 197,105,429 384,365,097 1.4 Net (written $ 14,334,263,802 ) 14,378,941,524 14,080,807,904 28,367,319,128 DEDUCTIONS: 2. Losses incurred (current accident year $ 8,678,730,897 ): 2.1 Direct 1,560,668,037 1,725,112,638 3,721,737,866 2.2 Assumed 7,000,198,629 7,419,219,967 14,043,011,309 2.3 Ceded 33,199,371 146,408,607 593,203,915 2.4 Net 8,527,667,295 8,997,923,998 17,171,545,260 3. Loss adjustment expenses incurred 1,697,682,532 1,656,671,959 3,219,436,151 4. Other underwriting expenses incurred 3,635,070,871 3,537,237,480 7,159,729,268 5. Aggregate write-ins for underwriting deductions 6. Total underwriting deductions (Lines 2 through 5) 13,860,420,698 14,191,833,437 27,550,710,679 7. Net income of protected cells 8. Net underwriting gain or (loss) (Line 1 minus Line 6 + Line 7) 518,520,827 (111,025,533) 816,608,449 INVESTMENT INCOME 9. Net investment income earned 1,044,969,943 524,352,786 1,136,738,212 10. Net realized capital gains (losses) less capital gains tax of $ 63,308,243 77,574,614 (69,199,797) (199,748,270) 11. Net investment gain (loss) (Lines 9 + 10) 1,122,544,557 455,152,989 936,989,942 OTHER INCOME 12. Net gain or (loss) from agents’ or premium balances charged off (amount recovered $ amount charged off $ 47,678,151 ) (47,678,151) (52,376,620) (103,601,635) 13. Finance and service charges not included in premiums 118,307,363 116,658,812 220,043,443 14. Aggregate write-ins for miscellaneous income (42,229) (4,342,765) (4,611,174) 15. Total other income (Lines 12 through 14) 70,586,983 59,939,427 111,830,634 16. Net income before dividends to policyholders, after capital gains tax and before all other federal and foreign income taxes (Lines 8 + 11 + 15) 1,711,652,366 404,066,883 1,865,429,024 17. Dividends to policyholders 18. Net income, after dividends to policyholders, after capital gains tax and before all other federal and foreign income taxes (Line 16 minus Line 17) 1,711,652,366 404,066,883 1,865,429,024 19. Federal and foreign income taxes incurred 335,585,878 132,253,389 485,599,011 20. Net income (Line 18 minus Line 19)(to Line 22) 1,376,066,488 271,813,494 1,379,830,013 CAPITAL AND SURPLUS ACCOUNT 21. Surplus as regards policyholders, December 31 prior year 15,559,947,624 15,318,272,241 15,318,272,241 22. Net income (from Line 20) 1,376,066,488 271,813,494 1,379,830,013 23. Net transfers (to) from Protected Cell accounts 24. Change in net unrealized capital gains (losses) less capital gains tax of $ 115,154,708 525,232,759 276,443,441 605,591,454 25. Change in net unrealized foreign exchange capital gain (loss) 33,067,941 35,852,210 9,007,121 26. Change in net deferred income tax (7,925,132) 7,301,044 19,362,959 27. Change in nonadmitted assets 70,553,177 23,875,272 76,178,235 28. Change in provision for reinsurance (6,577,759) (6,017,684) 3,523,792 29. Change in surplus notes 30. Surplus (contributed to) withdrawn from protected cells 31. Cumulative effect of changes in accounting principles 32. Capital changes: 32.1 Paid in 32.2 Transferred from surplus (Stock Dividend) 32.3 Transferred to surplus 33. Surplus adjustments: 33.1 Paid in 30,587,485 18,837,588 28,676,808 33.2 Transferred to capital (Stock Dividend) 33.3 Transferred from capital 34. Net remittances from or (to) Home Office 35. Dividends to stockholders (701,437,000) (1,089,797,000) (1,904,797,000) 36. Change in treasury stock 37. Aggregate write-ins for gains and losses in surplus (1,301,000) (616,000) 24,302,000 38. Change in surplus as regards policyholders (Lines 22 through 37) 1,318,266,959 (462,307,635) 241,675,382 39. Surplus as regards policyholders, as of statement date (Lines 21 plus 38) 16,878,214,583 14,855,964,606 15,559,947,624 DETAILS OF WRITE-INS 0501. 0502. 0503. 0598. Summary of remaining write-ins for Line 5 from overflow page 0599. Totals (Lines 0501 through 0503 plus 0598)(Line 5 above) 1401. Fines and penalties (122,651) 892,842 873,911 1402. Retroactive reinsurance gain (12,099) (4,008,523) (3,338,050) 1403. Allocated share of gain (loss) on sale of fixed assets 92,521 (1,227,084) (2,147,035) 1498. Summary of remaining write-ins for Line 14 from overflow page 1499. Totals (Lines 1401 through 1403 plus 1498)(Line 14 above) (42,229) (4,342,765) (4,611,174) 3701. Transition obligation for postretirement benefits (1,301,000) (616,000) 24,302,000 3702. 3703. 3798. Summary of remaining write-ins for Line 37 from overflow page 3799. Totals (Lines 3701 through 3703 plus 3798)(Line 37 above) (1,301,000) (616,000) 24,302,000 4 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY CASH FLOW 1 2 3 Current Year Prior Year Prior Year Ended To Date To Date December 31 Cash from Operations 1. Premiums collected net of reinsurance 14,433,017,309 14,101,814,345 28,445,460,210 2. Net investment income 1,109,619,388 597,853,069 1,272,612,024 3. Miscellaneous income 70,586,983 59,939,427 111,830,634 4. Total (Lines 1 to 3) 15,613,223,680 14,759,606,841 29,829,902,868 5. Benefit and loss related payments 8,128,730,881 8,420,070,278 16,416,024,803 6. Net transfers to Separate Accounts, Segregated Accounts and Protected Cell Accounts 7. Commissions, expenses paid and aggregate write-ins for deductions 5,253,270,816 5,177,236,671 10,073,272,333 8. Dividends paid to policyholders 9. Federal and foreign income taxes paid (recovered) net of $ 63,308,243 tax on capital gains (losses) 520,948,386 305,598,822 387,959,979 10. Total (Lines 5 through 9) 13,902,950,082 13,902,905,770 26,877,257,114 11. Net cash from operations (Line 4 minus Line 10) 1,710,273,598 856,701,070 2,952,645,754 Cash from Investments 12. Proceeds from investments sold, matured or repaid: 12.1 Bonds 10,646,313,056 8,211,484,240 18,505,708,745 12.2 Stocks 2,509,355,439 1,866,818,650 3,752,143,377 12.3 Mortgage loans 2,023,834 2,878,785 124,164,690 12.4 Real estate 33,022 1,358,389 12.5 Other invested assets 244,430,487 153,506,443 380,674,242 12.6 Net gains or (losses) on cash, cash equivalents and short-term investments 128,676 179,770 (956,201) 12.7 Miscellaneous proceeds 3,514,748 13,072,019 12.8 Total investment proceeds (Lines 12.1 to 12.7) 13,402,284,515 10,238,382,636 22,776,165,260 13. Cost of investments acquired (long-term only): 13.1 Bonds 12,260,765,784 7,268,311,855 18,511,174,342 13.2 Stocks 2,362,609,457 1,959,553,035 4,076,042,939 13.3 Mortgage loans 18,790,000 20,000,000 108,786,079 13.4 Real estate 983,516 1,992,037 32,363,103 13.5 Other invested assets 362,172,100 373,602,380 782,338,948 13.6 Miscellaneous applications 39,817,265 23,765,462 1,762,197 13.7 Total investments acquired (Lines 13.1 to 13.6) 15,045,138,122 9,647,224,769 23,512,467,609 14. Net increase (or decrease) in contract loans and premium notes 15. Net cash from investments (Line 12.8 minus Line 13.7 and Line 14) (1,642,853,607) 591,157,867 (736,302,349) Cash from Financing and Miscellaneous Sources 16. Cash provided (applied): 16.1 Surplus notes, capital notes 16.2 Capital and paid in surplus, less treasury stock 30,587,485 18,837,588 28,676,808 16.3 Borrowed funds 16.4 Net deposits on deposit-type contracts and other insurance liabilities 16.5 Dividends to stockholders 701,437,000 850,568,254 1,665,568,254 16.6 Other cash provided (applied) (29,773,139) 72,609,642 292,091,538 17. Net cash from financing and miscellaneous sources (Line 16.1 through Line 16.4 minus Line 16.5 plus Line 16.6) (700,622,654) (759,121,024) (1,344,799,907) RECONCILIATION OF CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS 18. Net change in cash, cash equivalents and short-term investments (Line 11, plus Lines 15 and 17) (633,202,663) 688,737,913 871,543,498 19. Cash, cash equivalents and short-term investments: 19.1 Beginning of year 1,114,219,919 242,676,421 242,676,421 19.2 End of period (Line 18 plus Line 19.1) 481,017,256 931,414,335 1,114,219,919 Note: Supplemental disclosures of cash flow information for non-cash transactions: 20.0001. Portfolio investments exchanged 581,570,424 410,367,763 1,094,534,270 20.0002. Change in receivable from securities sold 131,415,585 371,272,640 60,645,718 20.0003. Change in payable for securities acquired 51,875,280 507,700,194 385,028,781 20.0004. Reinvestment of non-cash distribution from other invested assets 36,590,722 20.0005. Decrease in commitment on low income housing investments 16,092,630 17,116 9,982,884 20.0006. Donations 14,367,937 16,074,286 29,120,602 20.0007. Stock dividends received 5,479,517 14,651,009 26,965,020 20.0008. Real estate capital expenditure 1,675,710 19,338 257,748 20.0009. Dividends to parent in the form of non-cash invested assets 239,228,746 239,228,746 20.0010. Exchange traded funds portfolio exchanged 155,375,167 157,019,074 5 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY Note: Supplemental disclosures of cash flow information for non-cash transactions: 20.0011. Other invested assets sold 19,813,143 53,585,788 20.0012. Transfer of assets/liabilities related to commutation 18,073,587 18,073,587 20.0013. Capital contribution to subsidiaries in the form of non-cash invested assets 1,967,802 1,954,323 20.0014. Dividends received on limited partnerships 8,780,759 20.0015. Contribution to limited partnership 13,479 5.1 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS Notes required on a quarterly basis have been updated in their entirety. There have been no material changes to the following December 31, 2016 Annual Statement notes: 1(B), 2-4, 5(A-C, F-H, K, L), 6-8, 9(B, E-G), 10(D-N), 11(A), 12(B-I), 13(1-3, 5-9, 11-13), 14(A-F), 15, 16(Derivative financial instruments 2-4, Off-balance sheet financial instruments 1-4), 17(A), 18, 19, 21, 23, 24(A-E) and 26-35. Only material or significant changes from the Annual Statement have been updated for all other notes, or portions thereof. 1. Summary of Significant Accounting Policies A. Allstate Insurance Company (the “Company” or “Allstate”) prepares its financial statements in conformity with accounting practices prescribed or permitted by the Illinois Department of Insurance (“IL DOI”). Prescribed statutory accounting practices include a variety of publications of the National Association of Insurance Commissioners (“NAIC”), as well as state laws, regulations and general administrative rules. Permitted statutory accounting practices encompass all accounting practices not so prescribed. The State of Illinois requires its domestic insurance companies to prepare financial statements in conformity with the NAIC Accounting Practices and Procedures Manual, which includes all Statements of Statutory Accounting Principles (“SSAPs”), subject to any deviations prescribed or permitted by the IL DOI. The Company’s net income and capital and surplus did not include any accounting practices prescribed or permitted by the IL DOI during 2017 and 2016. (in millions) F/S F/S June 30, December 31, SSAP # Page # Line # 2017 2016 Net Income (1) The Company’s state basis (Page 4, Line 20, Columns 1 & 2) xxx xxx xxx $ 1,376 $ 1,380 (2) State prescribed practices that increase/(decrease) NAIC statutory accounting principles (“SAP”): - - (3) State permitted practices that increase/(decrease) NAIC SAP: - - (4) NAIC SAP (1-2-3=4) xxx xxx xxx $ 1,376 $ 1,380 Surplus (5) The Company’s state basis (Page 3, Line 37, Columns 1 & 2) xxx xxx xxx $ 16,878 $ 15,560 (6) State prescribed practices that increase/(decrease) NAIC SAP: - - (7) State permitted practices that increase/(decrease) NAIC SAP: - - (8) NAIC SAP (5-6-7=8) xxx xxx xxx $ 16,878 $ 15,560 C. Investments Loan-backed and structured securities (“LBASS”) with an NAIC designation of 1 or 2 are reported at amortized cost using the effective yield method. LBASS with an NAIC designation of 3 through 6 are reported at the lower of amortized cost or fair value, with the difference reflected in unassigned surplus as unrealized capital loss. In general, LBASS utilize a multi-step process for determining carrying value and NAIC designation in accordance with SSAP No. 43R, Loan-backed and Structured Securities. For LBASS that are purchased with high credit quality and fixed interest rates, the effective yield is recalculated on a retrospective basis. For all other LBASS, the effective yield is recalculated on a prospective basis. D. Based upon its evaluation of relevant conditions and events, management did not have substantial doubt about the Company’s ability to continue as a going concern as of June 30, 2017 or December 31, 2016. 5. Investments D. Loan-Backed Securities 1. Prepayment assumptions for LBASS were obtained from external sources and internal estimates. 6 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS 2. The following table presents the aggregate amortized cost of LBASS before recognized other-than-temporary-impairment (“OTTI”) adjustments, the amount of OTTI adjustments recognized and the fair value of those securities. (in millions) 2017 2016 (1) (2) (3) (1) (2) (3) Amortized Amortized Cost Basis Other-than- Cost Basis Other-than- Before Temporary Before Temporary Other-than- Impairment Other-than- Impairment Temporary Recognized Temporary Recognized Impairment in Loss Fair Value Impairment in Loss Fair Value OTTI recognized 1st Quarter a. Intent to sell $ - $ - $ - $ - $ - $ - b. Inability or lack of intent to retain the investment in the security for a period of time sufficient to recover the amortized cost basis 20 - 20 275 3 272 c. Present value of cash flows expected to be collected is less than the amortized cost basis 36 2 45 18 1 17 d. Total 1st Quarter $ 56 $ 2 $ 65 $ 293 $ 4 $ 289 OTTI recognized 2nd Quarter e. Intent to sell $ - $ - $ - $ - $ - $ - f. Inability or lack of intent to retain the investment in the security for a period of time sufficient to recover the amortized cost basis 43 1 42 155 1 154 g. Present value of cash flows expected to be collected is less than the amortized cost basis 11 - 11 12 - 12 h. Total 2nd Quarter $ 54 $ 1 $ 53 $ 167 $ 1 $ 166 OTTI recognized 3rd Quarter i. Intent to sell $ - $ - $ - j. Inability or lack of intent to retain the investment in the security for a period of time sufficient to recover the amortized cost basis 11 - 11 k. Present value of cash flows expected to be collected is less than the amortized cost basis 11 - 12 l. Total 3rd Quarter $ 22 $ - $ 23 OTTI recognized 4th Quarter m. Intent to sell $ - $ - $ - n. Inability or lack of intent to retain the investment in the security for a period of time sufficient to recover the amortized cost basis 53 1 52 o. Present value of cash flows expected to be collected is less than the amortized cost basis 9 - 9 p. Total 4th Quarter $ 62 $ 1 $ 61 q. Annual Aggregate Total $ 3 $ 6 6.1 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS 3. The following LBASS were other-than-temporarily impaired at the end of each quarter presented, as a result of the discounted present value of the cash flows expected to be collected being less than amortized cost. This includes any such impaired LBASS where there was also the intent to sell or the inability or lack of intent to retain the security for a period of time sufficient to recover the amortized cost basis. For these impaired LBASS, the amortized cost after OTTI will be equal to the fair value at the time of the OTTI and not the present value of the projected cash flows. ($ in millions) 1 2 3 4 5 6 7 Book/Adjusted Amortized Cost Date of Carrying Value Recognized After Other- Financial Amortized Cost Present Value Other-Than- Than- Fair Value Statement Before Current of Projected Temporary Temporary At Time of Where CUSIP Period OTTI Cash Flows Impairment Impairment OTTI Reported 007036PC4 $ - $ - $ - $ - $ - 03/31/2017 05953YBJ9 $ 9 $ 9 - $ 9 $ 9 03/31/2017 12543PAK9 $ 1 $ 1 - $ 1 $ 2 03/31/2017 126673DR0 $ 4 $ 3 1 $ 3 $ 8 03/31/2017 225470M42 $ 3 $ 2 1 $ 2 $ 4 03/31/2017 25151EAA1 $ 1 $ 1 - $ 1 $ 1 03/31/2017 32052JAA6 $ 3 $ 3 - $ 3 $ 3 03/31/2017 61750YAA7 $ - $ - - $ - $ - 03/31/2017 64129VAC7 $ - $ - - $ - $ - 03/31/2017 73316PBT6 $ 1 $ 1 - $ 1 $ 1 03/31/2017 73316PCK4 $ 3 $ 3 - $ 3 $ 3 03/31/2017 749581AH7 $ 3 $ 3 - $ 3 $ 4 03/31/2017 749581AJ3 $ 2 $ 2 - $ 2 $ 2 03/31/2017 86359DSR9 $ 4 $ 4 - $ 4 $ 5 03/31/2017 93362YAE2 $ - $ - - $ - $ - 03/31/2017 93363DAE7 $ - $ - - $ - $ - 03/31/2017 93363TAH5 $ - $ - - $ - $ - 03/31/2017 94985WDZ1 $ 2 $ 2 - $ 2 $ 3 03/31/2017 007036PC4 $ - $ - - $ - $ - 06/30/2017 64129VAC7 $ - $ - - $ - $ - 06/30/2017 73316PCK4 $ 3 $ 3 - $ 3 $ 3 06/30/2017 759950FX1 $ 3 $ 3 - $ 3 $ 3 06/30/2017 759950GV4 $ 5 $ 5 - $ 5 $ 5 06/30/2017 $ 2 143108AA6 $ 2 $ 2 $ - $ 2 $ 2 03/31/2016 32052JAA6 $ 3 $ 3 - $ 3 $ 4 03/31/2016 59020UH32 $ 2 $ 2 - $ 2 $ 2 03/31/2016 64015@AB3 $ - $ - - $ - $ - 03/31/2016 64015@AD9 $ 1 $ 1 - $ 1 $ 1 03/31/2016 749581AJ3 $ 2 $ 2 - $ 2 $ 2 03/31/2016 759950FX1 $ 5 $ 5 - $ 5 $ 5 03/31/2016 82842RAJ9 $ 3 $ 2 1 $ 2 $ 1 03/31/2016 93363DAE7 $ - $ - - $ - $ - 03/31/2016 007036PC4 $ - $ - - $ - $ - 06/30/2016 59020UH32 $ 2 $ 2 - $ 2 $ 3 06/30/2016 64015@AB3 $ - $ - - $ - $ - 06/30/2016 64015@AD9 $ - $ - - $ - $ - 06/30/2016 73316PCK4 $ 3 $ 3 - $ 3 $ 3 06/30/2016 759950FX1 $ 5 $ 5 - $ 5 $ 5 06/30/2016 82842RAJ9 $ 2 $ 2 - $ 2 $ 1 06/30/2016 225470M42 $ 3 $ 3 - $ 3 $ 3 09/30/2016 61750YAA7 $ - $ - - $ - $ - 09/30/2016 61751JAF8 $ 1 $ 1 - $ 1 $ 1 09/30/2016 64015@AD9 $ 1 $ 1 - $ 1 $ 1 09/30/2016 64129VAB9 $ 5 $ 5 - $ 5 $ 6 09/30/2016 759950FX1 $ 4 $ 4 - $ 4 $ 4 09/30/2016 93363DAE7 $ - $ - - $ - $ - 09/30/2016 93363TAH5 $ - $ - - $ - $ - 09/30/2016 007036PC4 $ - $ - - $ - $ - 12/31/2016 32052JAA6 $ 3 $ 3 - $ 3 $ 3 12/31/2016 64015@AD9 $ 1 $ 1 - $ 1 $ 1 12/31/2016 64129VAC7 $ - $ - - $ - $ - 12/31/2016 73316PBT6 $ 1 $ 1 - $ 1 $ 1 12/31/2016 759950FX1 $ 4 $ 4 - $ 4 $ 4 12/31/2016 93363TAH5 $ - $ - - $ - $ - 12/31/2016 $ 1 4. Unrealized losses are calculated as the difference between amortized cost and fair value. They result from declines in fair value below amortized cost and are evaluated for OTTI adjustments. Every LBASS with unrealized losses was included in the portfolio monitoring process. The following table summarizes gross unrealized losses and the fair value of LBASS by the length of time these individual securities have been in a continuous unrealized loss position. (in millions) June 30, December 31, 2017 2016 a. The aggregate amount of unrealized losses: 1. Less than 12 months $ (2) $ (5) 2. 12 months or longer $ (1) $ (2) b. The aggregate related fair value of securities with unrealized losses: 1. Less than 12 months $ 168 $ 292 2. 12 months or longer $ 54 $ 86 5. As of June 30, 2017, substantially all of the unrealized losses related to LBASS with an unrealized loss position less than 20% of amortized cost and were primarily investment grade, the degree which suggests these securities did not pose a high risk of being other-than- temporarily impaired. Investment grade is defined as a security having an NAIC designation of 1 or 2, a rating of Aaa, Aa, A or Baa from Moody’s, a rating of AAA, AA, A or BBB from S&P Global Ratings, a comparable rating from another nationally recognized rating agency or a comparable internal rating if an externally provided rating is not available. Market prices for certain securities may have credit spreads 6.2 STATEMENT AS OF JUNE 30, 2017 OF THE ALLSTATE INSURANCE COMPANY NOTES TO FINANCIAL STATEMENTS which imply higher or lower credit quality than the current third party rating. Unrealized losses on investment grade securities were principally related to an increase in market yields which may include increased risk-free interest rates and/or wider credit spreads since the time of initial purchase. LBASS in an unrealized loss position were evaluated based on actual and projected collateral losses relative to the securities’ positions in the respective securitization trusts, security specific expectations of cash flows and credit ratings. This evaluation also takes into consideration credit enhancement, measured in terms of: (1) subordination from other classes of securities in the trust that are contractually obligated to absorb losses before the class of security the Company owns, and (2) the expected impact of other structural features embedded in the securitization trust beneficial to the class of securities the Company owns, such as overcollateralization and excess spread. As of June 30, 2017, the Company had not made a decision to sell and it was not more likely than not the Company would be required to sell these securities with unrealized losses before recovery of the amortized cost basis. As of June 30, 2017, the Company had the intent and ability to hold LBASS with unrealized losses for a period of time sufficient for them to recover. E. Repurchase Agreements and/or Securities Lending Transactions 3. Collateral Received b. (in millions) June 30, December 31, 2017 2016 The fair value of that collateral and of the portion of that collateral that it has sold or repledged $ 607 $ 576 I. Working Capital Finance Investments The Company did not hold working capital finance investments as of June 30, 2017 or December 31, 2016. J. Offsetting and Netting of Assets and Liabilities None of the Company’s derivative or securities lending transactions contain a valid right to offset assets and liabilities per the requirements of SSAP No. 64, Offsetting and Netting of Assets and Liabilities. The Company did not enter into repurchase agreements, reverse repurchase agreements or securities borrowing transactions. M. Short Sales The Company did not have short sale transactions as of June 30, 2017. N. Prepayment Penalty and Acceleration Fees The following table provides the number of CUSIPs sold, disposed of or otherwise redeemed, and the aggregate amount of investment income generated for bonds, including LBASS, sold, redeemed or otherwise disposed of as a result of a callable feature for the six months ended June 30, 2017: ($ in millions) General Protected Account Cell (1) Number of CUSIPs 117 - (2) Aggregate amount of investment income $ 12 $ - 9. Income Taxes A. 1. The components of the net deferred tax assets DTA/deferred tax liabilities (DTL) were as follows: 6/30/2017 12/31/2016 Change (in millions) (1) (2) (3) (4) (5) (6) (7) (8) (9) (Col 1+2) (Col 4+5) (Col 1-4) (Col 2-5) (Col 7+8) Ordinary Capital Total Ordinary Capital Total Ordinary Capital Total (a) Gross DTAs $ 1,541 $ 247 $ 1,788 $ 1,533 $ 281 $ 1,814 $ 8 $ (34) $ (26) (b) Valuation allowance - - - - - - - - - (c) Adjusted gross DTAs (1a-1b) $ 1,541 $ 247 $ 1,788 $ 1,533 $ 281 $ 1,814 $ 8 $ (34) $ (26) (d) DTAs nonadmitted - - - 104 - 104 (104) - (104) (e) Subtotal – net admitted DTA (1c-1d) $ 1,541 $ 247 $ 1,788 $ 1,429 $ 281 $ 1,710 $ 112 $ (34) $ 78 (f) DTLs 454 165 619 334 188 522 120 (23) 97 (g) Net admitted DTA/(net DTL) (1e-1f) $ 1,087 $ 82 $ 1,169 $ 1,095 $ 93 $ 1,188 $ (8) $ (11) $ (19) 6.3

Description: