LEX AFRICA Guide to Doing Business in Africa PDF

Preview LEX AFRICA Guide to Doing Business in Africa

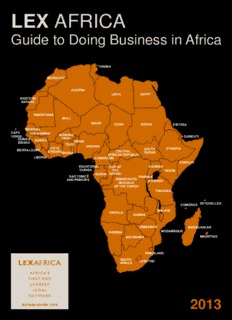

LEX AFRICA Guide to Doing Business in Africa TUNISIA MOROCCO ALGERIA LIBYA EGYPT WESTERN SAHARA MAURITANIA MALI NIGER CHAD SUDAN ERITREA SENEGAL CAPE THE GAMIBIA BURKINA VERDE DJIBOUTI GUINEA FASO GUINEA BENIN BISSAU TOGO NIGERIA CÔTE SOUTH ETHIOPIA SIERRA LEONE D'IVOIREG HANA CENTRAL SUDAN AFRICAN REPUBLIC LIBERIA CAMEROON SOMALIA EQUATORIAL REP. OF UGANDA GUINEA THE KENYA GABON CONGO SAO TOME RWANDA AND PRINCIPE DEMOCRATIC BURUNDI REPUBLIC OF THE CONGO TANZANIA SEYCHELLES COMOROS MALAWI ANGOLA ZAMBIA ZIMBABWE MADAGASCAR NAMIBIA MOZAMBIQUE BOTSWANA MAURITIUS SWAZILAND SOUTH LESOTHO AFRICA 2013 LEX AFRICA Guide to Doing Business in Africa 2013 LEX AFRICA AFRICA’S FIRST AND LARGEST LEGAL NETWORK Doing business in Africa is associated with diverse challenges and risks and must accordingly be founded on a strong legal base. The need for effective legal services was the reason for the formation in 1993 of LEX AFRICA, the first and largest network of law firms in Africa. LEX AFRICA has members in 29 African countries with over 500 lawyers and is rated by Chambers & Partners as a leading law firm network. Lex Africa's members focus on general corporate and commercial law as well as dispute resolution. Each LEX AFRICA member is an independent law firm but members often work together on cross border and other matters to provide comprehensive legal services to clients. LEX AFRICA member firms have a full understanding of the local laws, customs, business practices, cultures and languages in their respective countries and must comply with strict service standards to provide world class legal services. LEX AFRICA does not charge referral or other fees to clients. With LEX AFRICA effectively covering the entire African continent, the network and its members form an important and useful resource for advising and assisting business in Africa. LEX AFRICA website: www.lexafrica.com LEX AFRICA Management Office contact details: Tel: +27 (0) 11 535 8188 Fax: +27 (0) 11 535 8600 Email: [email protected] Editors: Pieter Steyn and Roger Wakefield of Werksmans Inc in South Africa ©LEX AFRICA All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, whether electronic, mechanical, photocopying, recording or otherwise, without fully and clearly acknowledging the LEX AFRICA Guide to Doing Business in Africa, as the source. The contents of this publication are intended for general information only and are not intended to serve as legal, financial or any other advice. While all steps have been taken to ensure the accuracy of information, LEX AFRICA shall not be liable to any person for any inaccurate information contained in this publication. TTAABBLLEE OOFF CCOONNTTEENNTTSS ANGOLA ... ... ... ... ... ... 4 BOTSWANA ... ... ... ... ... ... 7 BURKINA FASO ... ... ... ... ... ... 11 CAMEROON ... ... ... ... ... ... 14 CENTRAL AFRICAN REPUBLIC ... ... ... ... ... ... 19 CHAD ... ... ... ... ... ... 22 COTE D'IVOIRE ... ... ... ... ... ... 25 DEMOCRATIC REPUBLIC OF CONGO ... ... ... ... ... ... 28 EGYPT ... ... ... ... ... ... 31 GHANA ... ... ... ... ... ... 34 GUINEA ... ... ... ... ... ... 38 KENYA ... ... ... ... ... ... 40 LESOTHO ... ... ... ... ... ... 42 MADAGASCAR ... ... ... ... ... ... 44 MALAWI ... ... ... ... ... ... 47 MALI ... ... ... ... ... ... 49 MAURITIUS ... ... ... ... ... ... 52 MOZAMBIQUE ... ... ... ... ... ... 57 NAMIBIA ... ... ... ... ... ... 60 NIGER ... ... ... ... ... ... 63 NIGERIA ... ... ... ... ... ... 66 RWANDA ... ... ... ... ... ... 71 SENEGAL ... ... ... ... ... ... 72 SOUTH AFRICA ... ... ... ... ... ... 74 SWAZILAND ... ... ... ... ... ... 80 TANZANIA ... ... ... ... ... ... 78 TUNISIA ... ... ... ... ... ... 85 UGANDA ... ... ... ... ... ... 84 ZAMBIA ... ... ... ... ... ... 93 ZIMBABWE ... ... ... ... ... ... 96 repayments of its significant international debt. Despite the world economic crisis, Angola is seen as a high- ANGOLA growth economy and one which offers attractive investment opportunities. Investment Climate Private investment by national and foreign investors is being FBL ADVOGADOS promoted by the Government in the following sectors deemed strategic for the development of the country's economy: Firm Information Agriculture and livestock Website address: www.fbladvogados.com Construction and related services Languages spoken: Portuguese; English, French and Spanish Energy and water Address: Rua dos Enganos, no. 1, 7th floor, Luanda, Angola Infrastructure development and management Telephone: + 244 222 397 073 / 222 339 396 / 222 393 263 Hotel, catering and tourism Fax: + 244 222 393 273 Manufacturing Transport Contacts: Health and education. Paulette Lopes Email: [email protected] The following activities are exclusively reserved to the State: Djamila Pinto de Andrade Military equipment distribution and sales Email: [email protected] Angolan National Bank related activities Issuance of currency Country Information Airports and ports ownership and management. Angola has a population of approximately 19.1 million people (2011). The average annual growth of the population is 2.8 % and The following activities are partly reserved to the State and may the life expectancy is 50 years. The population is mainly only be carried out by private entities by way of a concession concentrated in Luanda (the capital city), Benguela, Huambo, agreement: sanitation, production and distribution of electricity Lubango, Lobito and Malange. The official language is for public consumption, water treatment and distribution, port Portuguese, although some national languages such as and airport transport services, additional postal and Umbundu, Kimbundu, Kikongo and Tchokwé are also spoken. telecommunication services and infrastructures outside the The official currency is Kwanza (Kz). basic network. Political System Oil, gold and diamond exploration by private entities is subject to Angola is a constitutional democracy. Parliament comprises 220 specific legislation. members, elected by direct universal suffrage and secret ballot. The first two candidates on the list of the party with the most The Angolan Agency for Private Investment (known as ANIP) is a votes are elected president and vice-president, respectively. government agency that assists and promotes private Following the last elections held in August 2012, the Popular investment projects. Regardless of their nationality, investors Movement for the Liberation of Angola (MPLA) got the majority who wish to undertake investment projects in Angola using of the seats in the parliament. foreign financial resources, materials and equipments need to submit an investment project to ANIP. Economic Indicators The sources of the indicators include Angola's National Bank, the Following the approval of the new Private Investment Law Ministry of Finance of the Republic of Angola, the International (2011), foreign investors who invest a minimum amount of Monetary Fund and the World Bank. USD 1 million are entitled to remit the profits generated in Angola to their countries of origin. The conditions for such GPD growth for 2012 ranges between 8% (World Bank) and remittance will be negotiated on a case by case basis with ANIP 10.8% (International Monetary Fund). Angola's economic and require the Angolan National bank to issue an authorization. growth for the period 2013 – 2015 is expected to remain above 6%. The Angolan government is deeply committed to the promotion of Angolan companies and entrepreneurs. This Angolanisation Inflation in 2011 reached 15% according to the IMF. Price growth policy entails the preferential treatment of Angolan companies was led by increases in basic foodstuffs and drinks, the supply of in public tender processes and companies operating in Angola which to much of the country being hampered by the poor are required to maintain a work force ratio of 30% foreign transport and distribution network. Inflation has been workers and 70% Angolan workers. decreasing during 2012 and is estimated to fall to 10%. Foreigners wishing to carry out industrial or commercial Standard & Poor, Moodys and Fitch all operations in Angola may: upgraded Angolan government debt during establish a branch of the foreign company 2011, reflecting not only the continuing establish a representation office of the foreign company political stability and modernization of the incorporate a new Angolan company economy, but also Angola's capacity to acquire shares in an existing Angolan company maintain growth and reform and its execute a consortium or an association agreement with an 4 Angolan company. Angola has not concluded any double taxation agreements with other countries. A representation office: may not conclude contracts in its own name but can rent In 2010, a program for the revision of the tax system (known as facilities and establish a single office PERT) was initiated and has led to changes to stamp duties, may hire a maximum of 6 workers (or 8, in exceptional consumption tax and real estate taxes. circumstances) must deposit a fee of USD 60 000, which will be returned Import/Export once the representation office closes. In 2006, Angola approved a Customs Code and, in 2008, a This procedure requires the approval of the Angolan National Customs Tariff of Import and Export Duties. The import of most Bank. goods into Angola is generally permitted without restriction. Certain products such as explosives, weapons, roulette tables, A branch, a new company, the acquisition of shares in an existing playing cards and ammunition require prior authorisation. company and the execution of a consortium/association Customs duties range between 2% to 30% of the cost, insurance agreement each require: and freight (CIF) price of the imported product and depend on a minimum investment amount of USD 1 million whether it is an essential, useful or luxury item. an approval by ANIP (for investment projects up to USD 10 million) or by the President of the Republic (for investment Exemptions may be granted to investors by the Ministry of projects over USD 10 million). Such approval is usually Finance and by the Customs General Directorate if the imported granted within 4 months after submission of the application. materials and equipment are used for private investment projects approved by ANIP or the President of the Republic. Incorporation of an Angolan company In order to incorporate a company, it is necessary to execute a Legal System public deed of incorporation, to publish the articles of Angola has a codified legal system which guarantees equal association in the official gazette and to arrange its commercial, treatment of Angolan and foreign individuals and companies. tax and statistic registration. The Guiche Único de Empresa is the The Angolan judicial system comprises the Supreme Court and public entity which deals with all matters regarding the Municipal Courts established through Angolan provinces. The incorporation of a company. Constitutional Court has been established in 2008, and has been active. After recognition by the Supreme Court, foreign If the company has a non-resident foreign shareholder, the prior judgments and arbitral awards may be enforced in Angola. approval of ANIP is required. Angola has an Arbitration Law, which is strongly influenced by Exchange Control the United Nations Commission on International Trade Law Foreign exchange regulations distinguish between goods, (UNCITRAL) model law. In 2011 two institutionalized arbitration current accounts and capital transactions, and apply to all centers in Angola were approved. Angola is not yet a party to the payments and transfers made between residents and non- New York Convention on the recognition of foreign arbitral resident entities. awards. An Agreement of Legal and Judicial Cooperation has been concluded with Portugal. Taxation Resident companies are taxed on their worldwide income at a Intellectual Property rate of 35%. As a member of the World Intellectual Property Organization (WIPO), Angola is committed to the protection of intellectual The branch of a non-resident company is taxed only on its property and has adopted the Paris Convention for the Angolan revenues at 35%. Protection of Intellectual Property. In order to promote more extensive protection, the Intellectual Property Law is currently Companies conducting agricultural or similar activities are taxed under review. at 20% of their income. The Angolan Industrial Property Institute promotes the Tax with regard to certain technical and construction services is registration of patents, trademarks, names, badges, industrial paid through withholding 5.25% and 3.5%, respectively. designs, utility models, rewards and provenance indications. A special tax regime applies to companies in the petroleum and Financial Services/ Insurance mining sectors. The Financial Institutions Law regulates banking and non- banking activities (including insurance activities). The Angolan Dividends paid by an Angolan resident company are subject to a National Bank supervises banking institutions. Other financial tax rate of 10% and interest paid by a resident company is subject institutions are supervised by the Capital Markets Commission to a rate of 15%. Royalties paid by an Angolan resident company or the Insurance Supervision Institute. are taxed at a rate of 10%. In some cases, the rate can be reduced to 5%. A stock exchange is expected to open in 2016. Personal income tax is paid by individuals regardless of their Angola has a significant number of insurance residence or nationality on their Angolan income on a sliding companies and banks. scale with a maximum rate of 17%. 5 Key Strategic Growth Initiatives by Government/Private Sector Recourse to the courts to defend and enforce rights is also Angola is investing in the rehabilitation and construction of its assured. transport infrastructure and in the development of railways. Foreign citizens travelling to Angola must obtain a valid visa Water and electricity production and distribution projects are which enables them to enter and remain in the country. part of the Government's policy to improve the wellbeing of the Different types of visas are available at Angola's Consular population. Services depending on the purpose of the entry. Angola has signed a treaty with Portugal in September 2011, aimed at The Government supports and incentivizes private projects in facilitating the issue of visas for the nationals of both countries. the agriculture, cattle raising and forestry sectors, as well as associated industrial projects. Treaties and Bilateral Agreements Angola is a member of the Multilateral Investment Guarantee Agency (MIGA), which provides dispute settlement assistance and guarantees for private investors. Angola has signed bilateral investment treaties with Portugal, South Africa, the United Kingdom, Italy and Germany, which have not yet been ratified. A bilateral investment treaty with Cape Verde has been executed and ratified. Angola has adopted the Southern African Development Community (SADC) Free Trade Protocol, which harmonizes trade and customs regimes and reduces tariffs among SADC countries. Angola has also signed customs cooperation agreements with Portugal and São Tomé and Principe. Discussions are currently under way on treaties with South Africa, the Community of Portuguese language Countries (CPLP), Namibia and the Democratic Republic of Congo. Membership of International and Regional Organizations Angola is a member of the United Nations (UN), the Southern Africa Development Community (SADC), the Community of Portuguese language Countries (CPLP), the International Monetary Fund (IMF) and the African Union (AU). Labor Relations The most common employment contracts have an indefinite duration. The average working week is 44 hours. In special circumstances, working hours may be extended to 54 hours per week. Workers may not work more than 5 consecutive hours. In each calendar year, workers are entitled to 22 working days of paid vacation leave. After disciplinary proceedings have been initiated by the employer, Angolan law allows dismissal for just cause without compensation. In the case of unfair dismissal, the worker has the right to receive compensation. Foreigners who wish to work in Angola need to execute an employment contract (or a promissory employment contract) in order to obtain a valid working visa. Significant country issues for investors to consider Private investors are ensured protection under Angolan law: In the case of expropriation, the investor will be entitled to an effective and fair compensation If there is a change in the economic or political system which results in nationalisation of private assets, investors will receive immediate monetary compensation Protection of intellectual property rights, licenses, banking, commercial and trade secrets is assured 6 to accommodate investors in such industries. Forms of Business BOTSWANA Private or public limited liability company External company (branch of foreign company) Company limited by guarantee Partnership Common law trust ARMSTRONGS ATTORNEYS Sole proprietorship Societies being associations of persons. Firm Information Website address: www.armstrongs.bw The Companies Act provides a simplified framework for the Languages spoken: English incorporation of companies and other legal entities (like close corporations) and imposes strict obligations on corporate Contacts: John Carr-Hartley, Mark McKee and Sipho Ziga governance. Telephone: +267 395 3481 Fax: +267 395 2757 Formation of a Company Email: [email protected], [email protected] and Non-residents may hold shares in a Botswana company. Two [email protected] shareholders are required and one may be a nominee for the other. One resident director is required for a private company Country Information and two resident directors for a public company. The registered Botswana is a landlocked country with a population of about office must be in Botswana. Auditors are required and must be 2 million. The urban population accounts for about 50% of the certified public accountants practising in Botswana. Company total population. secretarial duties are performed by secretarial services companies, most of which are attached to accounting firms. Type of Government Companies are usually registered within 4 weeks. Botswana is a stable multiparty democracy. Exchange Controls Latest GDP Figures Botswana has abolished all exchange control regulations and Real gross domestic product (GDP) current forecasts is 3.5% foreign investment is welcomed. Dividends and capital gains on growth in 2012 and 5% in 2013. The slower growth is primarily equity investments received from a foreign source are, subject due to a decline in mining sector output. to tax being paid, freely remittable out of Botswana in foreign currency. Interest on and the capital of foreign loans is freely Inflation Rate remittable in foreign currency. Upon disinvestment, a non- Inflation has declined, averaging 7% during July-September resident may remit capital in foreign currency. Foreign currency 2012, down from the previous year's average rate of 8.5%. can be held and earn interest with a bank in Botswana. Investment Climate Botswana securities denominated in a foreign currency may be Botswana is a stable democracy with an open economy. purchased using a foreign currency without converting that Implementation of the Southern African Customs Union (SACU) foreign currency into Botswana Pula and the proceeds of such Agreement and the Southern African Development Community Botswana securities may be received in foreign currency and (SADC) Free Trade Area (launched in 2008) will continue to be freely remitted anywhere in the world without notification to pursued, including the establishment of the necessary the Central Bank. institutions and harmonization of industrial and trade policies. The SADC Free Trade Area involves zero tariff levels for 85% of all Taxation goods traded among member states. Liberalisation of tariffs on Tax is levied on income that is actually derived or deemed to be the remaining 15% of goods (considered to be sensitive derived from Botswana sources. products) is expected to be completed in 2013. The Government is making substantial efforts to create a favourable climate for Foreign source dividends and interest are deemed to be from a private and foreign investment by imposing minimal restrictions Botswana source and are taxable on accrual. A long awaited on foreign investors and the privatisation of state entities. simplification of the tax system (involving the abolition of the two-tier corporate tax system) came into effect on 1 July 2011 The Botswana Export Development and Investment Authority and introduced a single corporate tax system with a flat tax rate (BEDIA) was established to operate a one-stop investor service of 22%, effective from the 2012 tax year. centre to assist investors with permits, licences, utilities connections and land and to provide assistance with other The 2011 tax year will be the last year that companies may regulatory issues. generate any Additional Company Tax (ACT). The single corporate tax rate of 22% (with no set off of withholding tax on BEDIA continues to seek export markets for locally produced dividends against corporate tax) will apply in goods and to promote investment opportunities in Botswana. respect of the 2012 tax year and all future tax BEDIA has selected niche industries such as manufacturing of years. All ACT must be utilised before 30 June textiles and garments, jewellery, tannery and leather products, 2011, after which any unutilised ACT will fall glass and IT products, as these can be undertaken using locally away. available raw materials. BEDIA procures factory shells and land 7 The corporate tax rate for non resident companies has been Import/Export Incentives/Support increased from 25% to 30%. This means that it will now be more The Botswana Export Development and Investment Authority tax efficient for foreign investors to operate in Botswana through (BEDIA) facilitates the establishment of export-oriented a subsidiary as opposed to a branch or external company. enterprises and selected services. The tax rate for manufacturing and International Financial Monetary Policy Services Centre (IFSC) companies is 15% in respect of approved Implementation of monetary policy is entrusted to the Central activities. These rates do not apply automatically and must be Bank of Botswana. Price stability is the main goal of monetary applied for and approved by the relevant authorities. policy using indirect policy instruments and a framework for forecasting inflation. Withholding Tax Withholding tax has been reduced from 15% to 7.5% on all Legal System dividends paid from 1 July 2011. The legal system of Botswana is a mixture of Roman-Dutch and English common law principles. There are also local systems of Payments of rent to a resident or non-resident for the use of any tribal law and custom in rural districts, which govern everyday land or building or both are subject to withholding tax at the rate disputes and property relations but are subordinate to statutory of 5% unless: law. The superior courts in Botswana are the Court of Appeal, the rent is paid by an individual and such rent is not claimed the High Court and the Industrial Court. or will not be claimed as a business expense by such person the payment of rent is less than P36 000 during any tax year Intellectual Property the rent is paid in respect of accommodation in a hotel, Intellectual property is protected by the Industrial Property Act motel, guest house or lodge which gives effect to various international conventions, treaties the recipient of such rent is a person exempt from taxation. and protocols to which Botswana is a party. The amount of any surplus amount paid by a mine rehabilitation Financial Services/Insurance fund to a person who contributed to such fund is subject to Banking services are regulated by the Banking Act, the Bank of withholding tax at 10%. Such withholding tax will represent a Botswana Act and the National Clearing and Settlement Systems final charge to tax and the amount paid by the mine Act with the Central Bank as the regulatory authority. rehabilitation fund will not form part of the recipient's assessable income. Legislation has been introduced which renders the writing of cheques against insufficient funds an offence. Arrangements Payment of commission or brokerage for or in connection with have been made to link all ATMs in the country via the VISA the procurement of goods or services is subject to withholding switching network. tax at the rate of 10%. Such withholding tax will only apply to payments in excess of 36 000 Pula in any tax year. The Financial Intelligence Act was adopted in 2007 in terms of which every financial organisation is required to effect anti- The exemption from withholding tax on commercial royalty money laundering measures. Non-bank financial services are payments made to non-residents in respect of the leasing of regulated by the Non-Bank Financial Institutions Regulatory aircraft has now been withdrawn. Authority. Capital Gains Tax Key Strategic Growth Initiatives by Government/Private Tax is payable on capital gains at the income tax rate of the Sectors particular tax payer in respect of: The Government accepts that growth will depend largely on the immovable property as to 100% of the gain, which is country's success in enhancing the performance of the non- calculated by deducting from the sale price the cost of mining sectors. Key to this goal is investment in technical skills acquisition and the cost of any improvements. A prescribed and resources. Botswana has substantial funds ready for such escalation factor is applied to such costs investments. other movable property, including shares in a company, as to 75% of the gain which is calculated by deducting from the The Government realises that sustainable employment creation sale price the cost of acquisition of the property sold. will require local and foreign investment, concentrating on Southern Africa and development in key niche areas where Capital gains tax is however not payable on the sale of shares in a Botswana has a natural advantage (for example tourism). public company as defined in the Income Tax Act. The Government remains committed to privatisation and the Double Taxation Agreements Privatisation Policy adopted in 2002 has been reinforced by the Botswana has double taxation agreements with South Africa, approval of a Privatisation Master Plan. The overriding goal of United Kingdom, Zimbabwe, Seychelles, Sweden, Mauritius, the policy is to improve effectiveness in the delivery of services, France, Lesotho, Swaziland, Barbados, India, Mozambique and raise Botswana's growth potential and competitiveness while Russia. increasing entrepreneurship and citizen participation in the economy. VAT Value Added Tax (VAT) is levied at 12% and The Government continues to implement programmes that came into effect on 1 April 2010. enhance citizen participation in economic activities and business ventures. A large share of Government expenditure 8 goes towards education, training and health. Area is on-going and is expected to be completed by the end of this financial year. Construction of the P543 million Thune dam The Botswana Development Corporation (BDC) continues to be is expected to be completed in April 2013. Negotiations have a leading investor and lender. The BDC has a diverse portfolio been concluded with the seven Zambezi Commission member covering industry, agribusiness, services, property development states to draw about 495million cubic metres of water per and management. Through its subsidiaries, affiliates and annum from the Chobe/Zambezi Rivers system. associate companies, the BDC has been active in the local production of products which were previously imported. Energy The country continues to meet its energy demands through Botswana's Industrial Development Policy aims to promote imports of electricity, of which more than 70% is from South highly productive and efficient export industries integrated with Africa. In order to improve the supply situation and energy foreign markets and technology, develop competitive security, a project to expand the existing Morupule Power manufacturing and service sectors able to compete Station by 600 MW (Phase I) is still under construction and is internationally, grow supporting services and component expected to be completed in 2013. Since the amendment of the manufacturers, create links between small and medium Electricity Supply Act, there has been increased interest from enterprises with foreign firms and develop small and medium private investors in power generation. A 1.3 MW Photovoltaic enterprises for the domestic market. power station was commissioned in August 2012. A special purpose vehicle to establish a National Oil Company, Botswana Treaties and Bilateral Agreements Oil (Pty) Ltd, has been approved and its mandate is to ensure Botswana is a signatory to the Lome Convention with the security of fuel supplies and citizen economic empowerment in European Union and has duty free or preferential access to the the petroleum sector as well as manage the Government's US market under the General System of Preferences with no strategic petroleum stocks. quota restrictions. Telecommunications The African Growth and Opportunity Act (AGOA) of the United A fixed line service is provided by Botswana Telecommunications States Government provides duty-free and quota-free entry of Corporation (BTC) which is implementing an international garments produced in Botswana from yarn or fabric of African or connectivity project accessing submarine fibre systems and American origin (to be increased to yarn of any origin). building national transmission rings to facilitate the promotion of Botswana as a telecommunications hub in the region to satisfy There are bilateral agreements with China and regional demand for information based services, web hosting, data countries (through SACU and SADC) allowing preferential or centres, call centres, global financial services and software limited duty free trade. research and development. The Botswana Telecommunications Authority (BTA) has adopted a very liberal licensing strategy. Membership of International and Regional Organisations Botswana is a member of the World Bank, the United Nations Botswana Stock Exchange (UN), SACU, SADC, the International Monetary Fund (IMF), the The Botswana Stock Exchange (BSE) has introduced an African Union (AU) and the AU's New Partnership for Africa's automated trading system in an effort to improve its trading Development (NEPAD). Botswana is a member of the World system. The BSE continues to be one of the best performing Trade Organization (WTO) and a signatory to the Multilateral exchanges in the world. Investment Guarantee Agency (MIGA), which protects investments from nationalisation or expropriation. Trade and Industry A review of the Industrial Development Policy and the Industrial Road and Transport Development Act is expected to provide a simplified and Major road projects are continuing. The Government has signed efficient business licensing process and the registration of micro a bilateral Road Transport Agreement with Zimbabwe. A businesses. In addition, implementation of the Directive on the Corridor Planning Committee involving Botswana, Namibia and use of Locally Manufactured Goods and Services will be South Africa promotes the utilisation of the Trans-Kalahari reviewed with a view to evaluating previous performance and Highway and the Walvis Bay port in Namibia. Botswana has now suggesting appropriate measures that will assist both local sourced the necessary finance from the African Development manufacturers and service providers to increase their output for Bank and Japanese International Cooperation Agency and the domestic and export markets. construction of the Kazungula Bridge with Zambia should commence in January 2014. Botswana has negotiated 21 and The Local Enterprise Authority (LEA) embraces business signed 8 bilateral air service agreements. ”incubation” as a tool for enhancing the development of entrepreneurship. In October 2006, the Botswana Export Water Development and Investment Authority (BEDIA) embarked on While water has constantly met the quality standards of the an export development programme with a view to building the World Health Organization (WHO) and Botswana Bureau of capacity of local firms to export to world markets. Standards (BOBS), it is an expensive and scarce resource. Both Dikgatlhong and Lotsane Dams were completed in February The Citizen Entrepreneurial Development 2012 and March 2012 respectively. Construction of a 75 Agency (CEDA) was incorporated as a kilometre pipeline from Dikgatlong Dam to Moralane is on-going company limited by guarantee on 12 April with 35 kilometres already constructed and the pipeline is 2001 and commenced operations in June expected to be completed in October 2013. The pipeline 2001. It was established to introduce the connecting Lotsane Dam to 22 villages in the Tswapong North professional management of Government 9

Description: