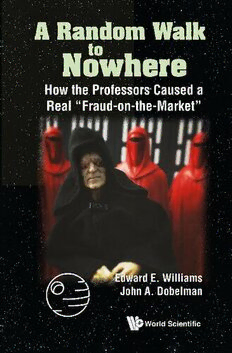

A Random Walk to Nowhere: How the Professors Caused a Real "Fraud-on-the-Market" PDF

Preview A Random Walk to Nowhere: How the Professors Caused a Real "Fraud-on-the-Market"

A Random Walk to Nowhere How the Professors Caused a Real “Fraud-on-the-Market” 11484_9789811207785_tp.indd 1 18/6/19 9:26 AM b2530 International Strategic Relations and China’s National Security: World at the Crossroads TTTThhhhiiiissss ppppaaaaggggeeee iiiinnnntttteeeennnnttttiiiioooonnnnaaaallllllllyyyy lllleeeefffftttt bbbbllllaaaannnnkkkk b2530_FM.indd 6 A Random Walk to Nowhere How the Professors Caused a Real “Fraud-on-the-Market” Edward E. Williams John A. Dobelman Rice University, USA World Scientific NEW JERSEY • LONDON • SINGAPORE • BEIJING • SHANGHAI • HONG KONG • TAIPEI • CHENNAI • TOKYO 11484_9789811207785_tp.indd 2 18/6/19 9:26 AM Published by World Scientific Publishing Co. Pte. Ltd. 5 Toh Tuck Link, Singapore 596224 USA office: 27 Warren Street, Suite 401-402, Hackensack, NJ 07601 UK office: 57 Shelton Street, Covent Garden, London WC2H 9HE Library of Congress Cataloging-in-Publication Data Names: Williams, Edward E, author. | Dobelman, John A, author. Title: A random walk to nowhere : how the professors caused a real “fraud-on-the-market” / Edward E Williams, John A Dobelman, Rice University USA. Description: Singapore ; Hackensack, NJ : World Scientific Publishing, [2020] | Includes bibliographical references and index. Identifiers: LCCN 2019042755 | ISBN 9789811207785 (hardcover) | ISBN 9789811208355 (paperback) Subjects: LCSH: Efficient market theory--Statistical methods. | Efficient market theory--Mathematical models. | Random walks (Mathematics) Classification: LCC HG4915 .W55 2020 | DDC 332.01/5195--dc23 LC record available at https://lccn.loc.gov/2019042755 British Library Cataloguing-in-Publication Data A catalogue record for this book is available from the British Library. Copyright © 2020 by World Scientific Publishing Co. Pte. Ltd. All rights reserved. This book, or parts thereof, may not be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval system now known or to be invented, without written permission from the publisher. For photocopying of material in this volume, please pay a copying fee through the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA. In this case permission to photocopy is not required from the publisher. For any available supplementary material, please visit https://www.worldscientific.com/worldscibooks/10.1142/11484#t=suppl Desk Editor: Shreya Gopi Typeset by Stallion Press Email: [email protected] Printed in Singapore Shreya - 11484 - A Random Walk to Nowhere.indd 1 26-09-19 11:39:06 AM 129mmx198mm b3705 A Random Walk to Nowhere This book is dedicated to the everlasting memory of M. C. Findlay, III, Ph.D. 1944–2008 and Edward E. Williams, Ph.D. 1945–2018 v b3705_FM.indd 5 3-1-2020 1:58:29 PM b3705 A Random Walk to Nowhere 129mmx198mm TTTThhhhiiiissss ppppaaaaggggeeee iiiinnnntttteeeennnnttttiiiioooonnnnaaaallllllllyyyy lllleeeefffftttt bbbbllllaaaannnnkkkk b3705_FM.indd 6 3-1-2020 1:58:29 PM 129mmx198mm b3705 A Random Walk to Nowhere Contents Preface ix About the Authors xvii Chapter 1 Fraud, Lies, and Statistics 1 Chapter 2 The Early History of Modern Financial Economics 17 Chapter 3 The Birth of the Efficient Market Hypothesis 39 Chapter 4 Earlier Views of Market Efficiency 53 Chapter 5 The Impact of Information and Regulation on Market Efficiency 73 Chapter 6 Tests of the EMH 95 Chapter 7 Anomalies 115 Chapter 8 The Capital Asset Pricing Model 131 vii b3705_FM.indd 7 3-1-2020 1:58:29 PM b3705 A Random Walk to Nowhere 129mmx198mm viii A Random Walk to Nowhere Chapter 9 Beyond the CAPM 137 Chapter 10 Conclusions 161 Bibliography 165 b3705_FM.indd 8 3-1-2020 1:58:29 PM 129mmx198mm b3705 A Random Walk to Nowhere Preface This book is about an intellectual fraud. The fraud started out as an honest attempt to improve our insights on how financial markets work, but it eventu- ally became almost a religion that every financial econ- omist had to buy into or risk professional crucifixion. More importantly, the fraud has become a part of the legal opinion that has greatly influenced decisions all the way up to the United States Supreme Court. These decisions have real consequences and it is almost a cer- tainty that the judges and justices who have relied on this “fraud” have no idea that their opinions have little basis in economic fact. The fraud we are describing goes by the name “the efficient market hypothesis” (or EMH). The origins of the EMH began over 50 years ago and it came to dominate research in the academic financial community for decades. In addition to the courts, the hypothesis has been widely read and considered by professional portfolio managers and every day investors. It has even been claimed to be the intellectual foundation of the development of the ix b3705_FM.indd 9 3-1-2020 1:58:29 PM